READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM ANALYSTS AND CONSULTANTS, EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS.

MEET THE ASCEND BY CIRIUM TEAM

By Chris Seymour, Head of Market Analysis at Ascend by Cirium

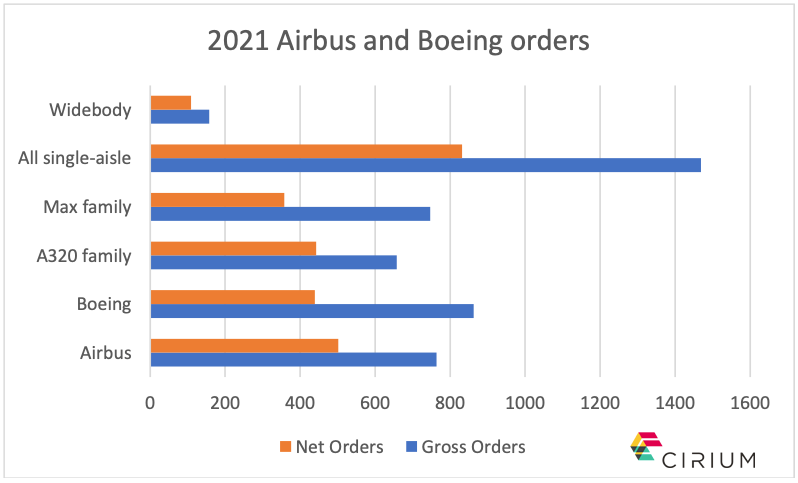

2021 was a much better year for orders placed with Airbus and Boeing, as commercial customers signed up for 1,627 new aircraft. Boeing took a 53% share, which was only the third time in the past 10 years it has outsold Airbus, although the European rival has a 53% share over the whole period.

The order tally for 2021 compares with just 536 new orders placed in 2020 when the Covid pandemic began; and is actually some 300 orders better than 2019. The order intake is always offset by cancellations of previous orders, and the net orders swung from a net loss of 230 in 2020 to a gain of 941 last year.

These are valued at $56 billion (based on 2021 Base Full-Life Value) and Airbus was just ahead with a 53% share of net orders and 55% in order value. For Boeing, their 439 net orders almost wiped out the loss of 467 in the previous two years.

Airlines placed 74% of the new orders in 2021, with 18% by the lessors and finance market and 6% by unannounced customers. The lessor share over the past 10 years was 21%.

Of the airlines, US Majors were an important subset, placing 590 orders, notably United with 328 737 Maxes and A321neos, and Southwest with 150 Maxes. The next largest subset was the low cost/leisure carriers sector with 40%, led by Indigo Partners with 257 A320neo family for its airlines Wizz, Volaris, Frontier and JetSMART.

Nine different lessors and financiers placed 294 orders, headed by Air Lease with 119 in December, followed by investment firm 777 Partners with 68. Other first-time customers for new jets were Griffin Global Asset Management and Carlyle Aviation Partners.

Looking at order cancellations, the 686 recorded in 2021 was a reduction from the 766 in 2020, but still well ahead of the previous 10-year average of 270. Around 100 cancellations were from airlines in bankruptcy or reorganising, and 143 from lessors. The Max saw the highest number for a family with 389, although at least 50 were then re-ordered by the customer. There is probably some element of price reset as customers who placed pre-grounding orders are now seeking lower pricing or a reset of escalation for future deliveries which are of course now taking place in a very different market.

In addition, 241 existing orders were swapped to another aircraft type or variant in the same family, with 125 upsized and 116 downsized. Two thirds were done by airlines, mainly by Asia-Pacific and US customers.

With a gross-order total of 747, the 737 Max outsold the A320neo family by 53% to 47%, but after cancellations, the neo ended up with a 55% share net. The Max received 70% of its orders from US operators, including a good end-year deal for 50 with Airbus operator Allegiant.

The A321neo was the year’s best-seller, with 581 new orders; and a net total of 614. This included 120 order swaps, upsized mainly from the A320neo, although it wasn’t all one way, as 30 orders were changed to the smaller type. However, after swaps, the A320neo ended the year with 161 fewer on order; continuing a trend towards the largest member of the family, the A321neo. The A220 took 64 new orders (net 38).

For the Max, 119 of the new orders are yet to have a series announced. Of the remainder, the 737 Max 8 (including the higher capacity 8-200) led with 241 (so outselling the A320neo), followed by 180 for the Max 7, from Southwest (which also changed 70 orders from -8s) and new customer Allegiant. United ordered 150 more Max 10s and Alaska 57 more Max 9s.

Twin-aisle passenger programmes saw a very quiet year, with just 63 new orders, reduced to a net gain of 17 after cancellations. Given the slow recovery of long-haul capacity, this was unsurprising. The A330neo fared best with a gain of 26, while the rival 787, suffering the delivery hiatus, had a net loss of 11. The A350 also ended with a net loss, of nine orders, while Singapore Airlines’ order for 11 was the only one for the 777X.

Good news for the widebody types came from the freight market, which had a strong year with 95 orders, including 42 for the 777F, making it the top seller for the year. 2021 was notable for new players CMA CGM and Maersk placing their first orders and the A350F being launched with 11 orders, as Airbus re-entered the large-capacity freight market.

With 2021 deliveries totalling 904, the two OEMs had a book-to-bill ratio of just over one and maintained a stable firm order backlog, which stands at just over 12,100 aircraft. This was a positive outcome after two difficult years for the aviation market.

See more Ascend by Cirium posts.