VALUE TRENDS

Monitor and benchmark key value and liquidity metrics by different aircraft asset classes

The market for commercial aircraft is more dynamic than ever. Values and Lease Rates are being driven by a rapid recovery in passenger demand with further complexities added by supply chain disruptions, labour shortages and a higher inflationary environment.

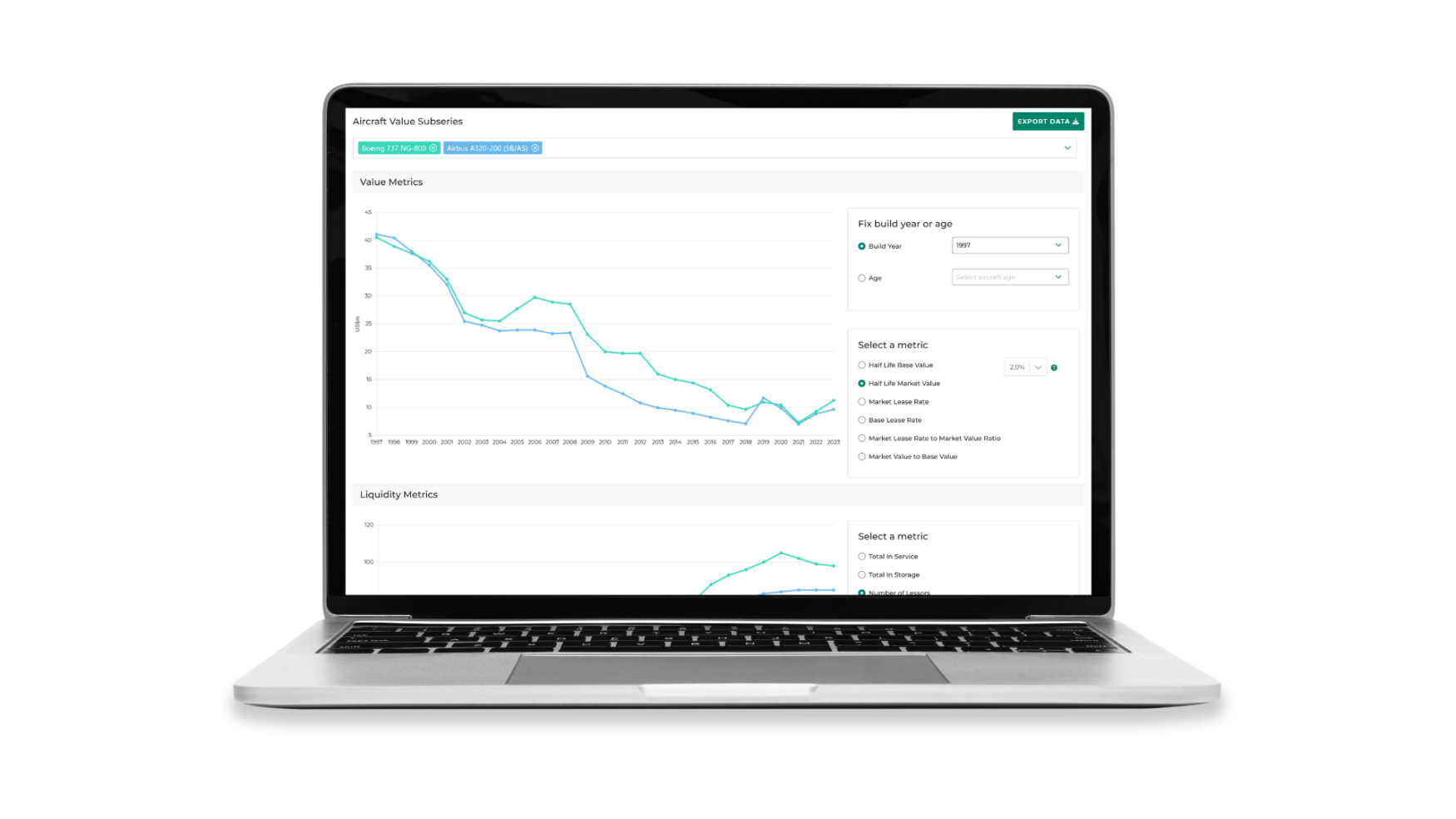

Monitoring and benchmarking aircraft value movements and resilience by aircraft type and variant by key value and liquidity metrics is therefore critical for both internal and external monitoring and reporting. Cirium Ascend Value Trends enables banks, lessors, and non-banking financial institutions to access historical, current and future values along with additional insightful liquidity metrics.

Value Trends™ is part of Cirium Ascend®, providing aircraft analytics to empower businesses around the world to make informed portfolio investments that correlate to managing financial risk, investment growth strategy and portfolio diversification decisions.

Understand aircraft supply and demand dynamics

Access Cirium’s historical, current and future aircraft values data which is renowned for its reliability and trusted by all global top lessors. Cirium Ascend’s Values data is supported by the company’s award-winning team of Consultants, who use the data in their own well-respected Value Opinions. Use the tool to track the asset value and liquidity metrics historically.

Inform and improve decision making around your aircraft investments

Have confidence using Cirium’s Values data, which is based on a robust methodology, Cirium Ascend’s Inside track on Value (ITOV) is shared with clients and details, by market sector, the rationale and drivers for value adjustments. With Value Trends, insights can show how asset value and liquidity levels of different aviation asset types have trended historically and how they evolve across market shocks, recovery and in relation to one another.

Identify asset types which will improve resilience and Lease Rate yield

Value Trends enables lessors and banks to understand how Lease Rates have tracked across varying asset types. The tool incorporates Cirium’s proprietary “Ascend Value Sub-Series” groupings so users can analyze more deeply the characteristics of value drivers by aircraft type.

Improve return on investment of assets and manage value risk

Understand how the values and liquidity of different aircraft types have trended. The data in Value Tends derives from the industry’s most comprehensive database with over 50 years of historical and present market data on valuations, fleet and aircraft helping inform and shape future value developments, retention and depreciation.

Contextual intelligence on aircraft values and liquidity

Lessors and banks

Identify the key factors impacting aircraft, and understanding the supply and demand dynamic for aircraft and how it is evolving across the global aviation market. Assess the Value and Lease Rate performance of different aircraft types.

Non-banking financial institutions

Assess historical aircraft value performance with average market values. Benchmark the price volatility of different asset types and accordingly apply risk premiums to your pricing models. Identify the assets with the best risk/return profile for your risk appetite.

What’s included in Ascend Value Trends?

| Trusted values data Historical, current and future aircraft values data, trusted by all the top lessors globally. The data is supported by our award-winning team of aircraft Appraisers. | Comprehensive data Value Trends pulls data from Cirium’s core data which contains over 50 years of historical and present market data on valuations, fleet and aircraft. | Expansive fleet data Taps into Cirium’s fleet database with over 450k unique aircraft records across over 770 aircraft types. |

| Robust methodology Values are based on a robust methodology which is documented publicly through Cirium Ascend’s Inside Track on Values (ITOV) by market sector. | Sub-series groupings Access Cirium’s proprietary Ascend Value Sub-Series groupings to dig deeper into various aircraft types. | Dynamic interface Customize and quickly visualize key value and liquidity metric trends at speed, generated by Cirium’s advanced analytics. |

| Complementary to other tools Value Trends offers historical values and liquidity metrics which adds extra insights to other tools such as Cirium Ascend Fleets Analyzer, Values Analyzer and Profiles. | Unified Cirium Access Available via a modern web-app on desktop or tablet. Accessible anytime, anywhere with easy navigation between Cirium Ascend modules. | 24/5 customer support 15-person customer support team with a consistent 90%+ satisfaction score. |

Explore the Cirium Ascend suite

Learn more about the aircraft analytics at the core of Cirium Ascend

Tracked Utilization

Fleets and Values