READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS. MEET THE ASCEND BY CIRIUM TEAM.

By Lalitya Dhavala, Valuations Consultant, Ascend by Cirium

When the Cirium team attended the inaugural Airline Economics Growth Frontiers India conference early this month, there was strong positivity, ambition and faith displayed by most of the attendees. The re-privatization of Air India is seen as very welcome news, coupled with the attention-grabbing announcement of the large number of aircraft commitments, the overall theme that came out was that India is moving to be a serious player in not just the aviation industry, but the global landscape, competing with China.

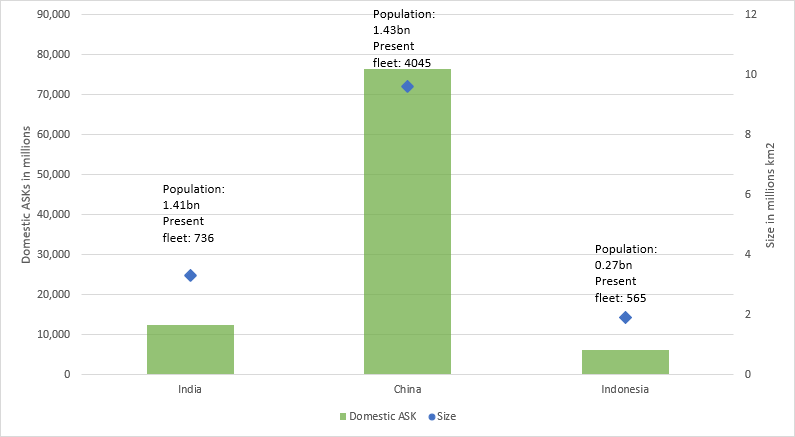

China and India are the world’s second and third largest domestic markets respectively, however the delta between these has been significant, with Indian domestic ASKs as of end- February 2023 being in the range of 11bn compared to around 75bn for China. Before the pandemic, although India was considered to be a top emerging market, the question of whether it would overtake China to become second largest domestic market was not really considered, as Chinese airlines had a larger population, stronger economic conditions and better connectivity with newer and efficient aircraft.

This is changing- India’s population and economy are already poised to overtake China’s, heavy investment in the fleet and infrastructure is on the way, and the average age of the aircraft operated by Indian carriers is now just 6 years.

Today, Cirium Fleets Analyzer data shows that Indian carriers operate a total of around 736 passenger aircraft, compared to more than 4,000 by Chinese carriers. With India’s population set to close in on China’s at 1.45bn+, there is a difference of almost five times in the fleet size between the two markets. It is also important to observe the demographics- India’s population has a larger share of younger adults, 40% of the population is under 25, and this generation is on a rising economic trajectory. The gender balance of the population is also improving, allowing a dual-income household to become the norm rather than the exception, ultimately this will translate to more disposable income to spend on travel.

Another aspect to consider is the size of the countries. For a comparable population, China is a much larger country with 320 operational airports, however, most of its domestic traffic is concentrated on the connection between just 6 major cities. In comparison, India currently has 159 airports, with regional connectivity improvement a key focus of the current government, with a target published to reach 220 airports by 2026. During the initial phases of recovery from lockdown when international flights were still restricted, there was a massive push to promote domestic tourism- particularly through social media, this appears to have taken hold, with forward-bookings showing a strong positive trend.

Cirium data shows that there is indeed room for significant growth opportunity in India’s airline industry as the major carriers expand their fleet, routes and customer base.

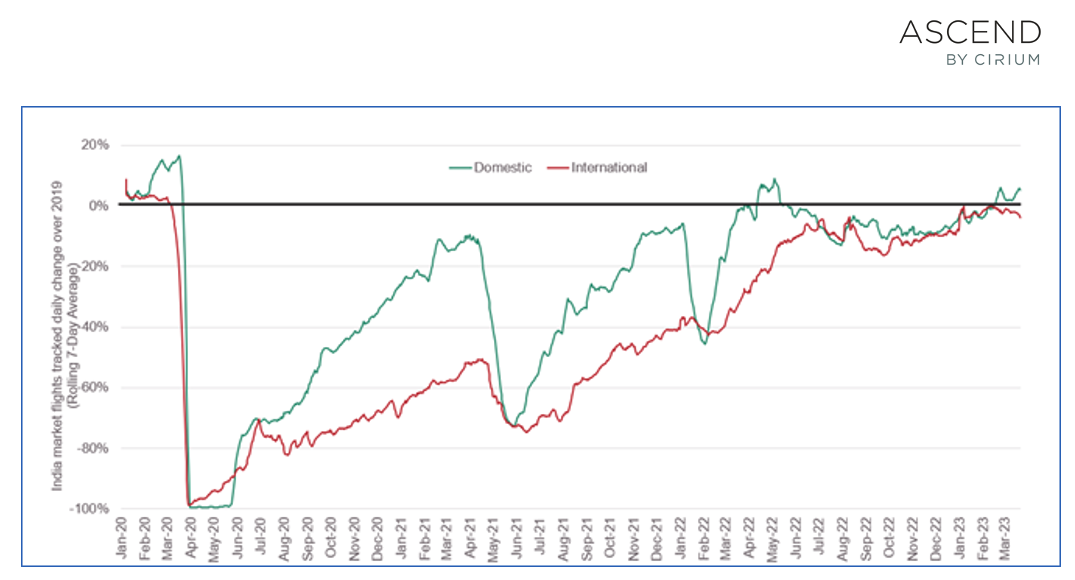

Both domestic and international traffic measured by Cirium Tracked Utilization data is showing that it has recovered to or even risen above the 2019 levels. The government’s commitment to developing the aviation industry in the country and its support of infrastructure initiatives such as the development of regional airports, reduction of taxes and facilitation of Special Economic Zones may provide the impetus needed to allow the growth of Indian traffic.

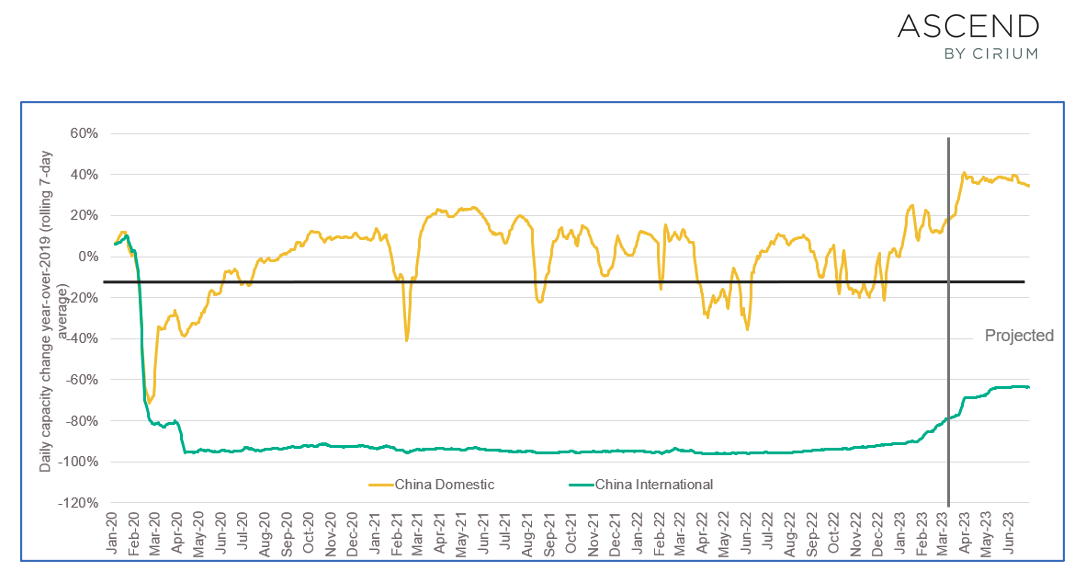

However, China’s domestic traffic recovered much more quickly during the pandemic, and although it experienced significant volatility, growth has been achieved already with traffic almost 20% better than pre-pandemic levels, and projected to continue.

Therefore, although the outlook is very positive, and India’s aviation sector is set to take-off, it remains to be seen how long the rewards of India’s investment in the aviation industry may take to get closer to narrowing the gap between the country and China.

SEE MORE ASCEND BY CIRIUM POSTS.