READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS. MEET THE ASCEND BY CIRIUM TEAM.

Airbus and Boeing narrow-bodies in China – how have both been doing with the Max return uncertainty?

By Yuanfei Zhao (Scott), Senior aviation analyst at Ascend by Cirium

Much has been discussed recently about the return to service of the Boeing 737Max in China. The fate of this aircraft model in the country swings like a pendulum, as favorable and then unfavorable news emerges about its return. This potentially raises the question to Chinese airlines as to what they should do in terms of fleet planning given the uncertainty. Should they prepare for more Airbus neos, or rather just sit tight and be hopeful for Max’s soonest return. There remains no clear answer, but we may seek some direction by examining recent fleet dynamics in China.

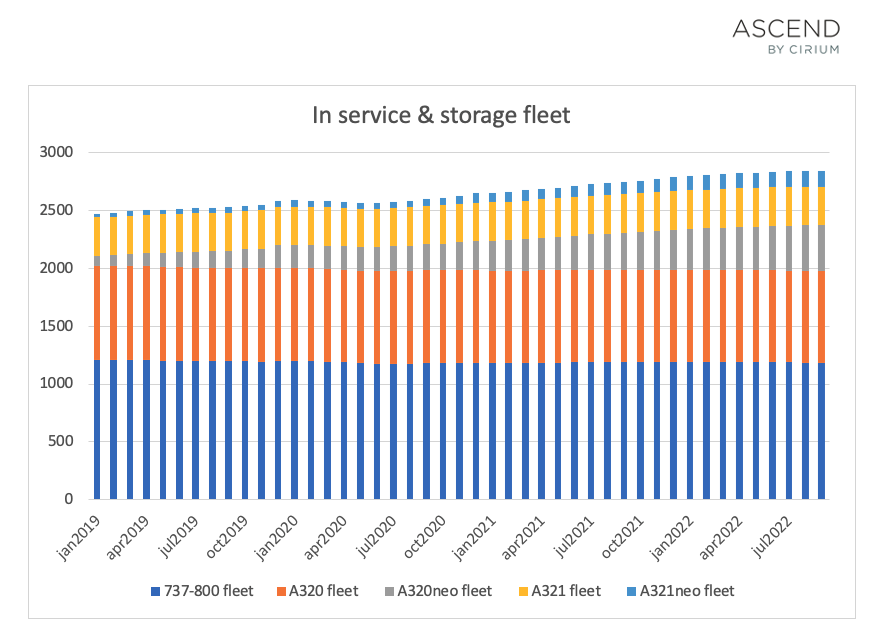

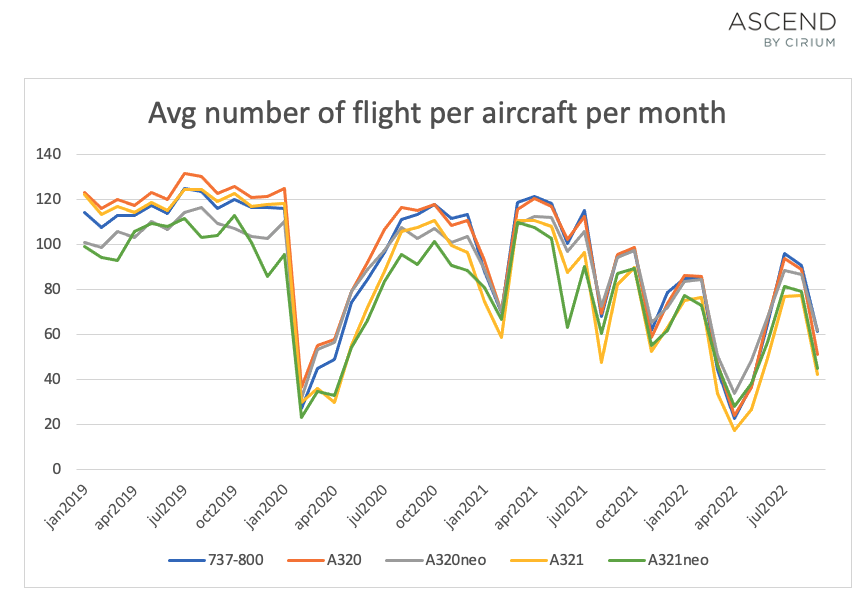

As indicated below by both Cirium’s Fleets Analyzer and Tracked Utilization data, the 737-800 remains the single largest commercial aircraft type in China. However, counterintuitively the A320 (second largest in fleet size) fleet has flown the most number of flights on a per aircraft per month basis during most of the time both pre and post COVID-19.

Given that average utilization of the 737-800 fleet in 2022 to date is only slightly more than half of the average utilization of 2019 level, the implication here is that whilst China continues with a zero-Covid policy, it is unlikely that there will be significant and sustained demand recovery, so that there will be no imminent capacity shortage for the 737 family aircraft.

In addition, as of the end of September, there were 104 737NGs (including 77 737-800), and 196 A320 family (including 109 A320ceo and 5 A320neo) aircraft managed by operating lessors available for leasing globally. These aircraft can serve as an alternative solution for airlines that need extra capacity, at least for the short term demand (although it must be noted that airlines in China have not typically favored the lease of used aircraft, so perhaps this is not an option).

The most notable trend lies with the A320neo. The fleet utilization by number of flights per aircraft per month was in the fourth place pre COVID-19, but has increased rapidly post COVID-19, along with the type’s fast growing fleet size.

In the foreseeable future, it is expected that fleet size of the A320neo will continue to grow following those large A320neo family orders placed by the likes of China’s big three airlines and Xiamen Airlines. It can also be expected that the fleet utilization for the type will also maintain growth at the same or even higher pace, especially considering resources invested in areas such as maintenance and flight by Chinese airlines will lean more towards the A320neo family aircraft, in preparation for the upcoming wave of neo deliveries.

Although we cannot conclude that Airbus is heading to dominance in the Chinese market, it does seem that the Max situation is turning their head towards Airbus. There are many other factors in play such as OEM slot issues, induction of C919 to commercial service, Max’s final return and operation capability of airlines for Airbus and Boeing aircraft. Cirium will continuously monitor the market dynamics following every milestone event.