READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM ANALYSTS AND CONSULTANTS, EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS.

MEET THE ASCEND BY CIRIUM TEAM

By Michael Graham, Valuations manager at Ascend by Cirium

Ascend by Cirium recently launched the Commercial Aircraft Market Sentiment Index (CAMSI). The monthly Index tracks market sentiment and trends of values and lease rates through a survey of key market stakeholders, including lessors, banks, OEMs, part-out shops, airlines and brokers.

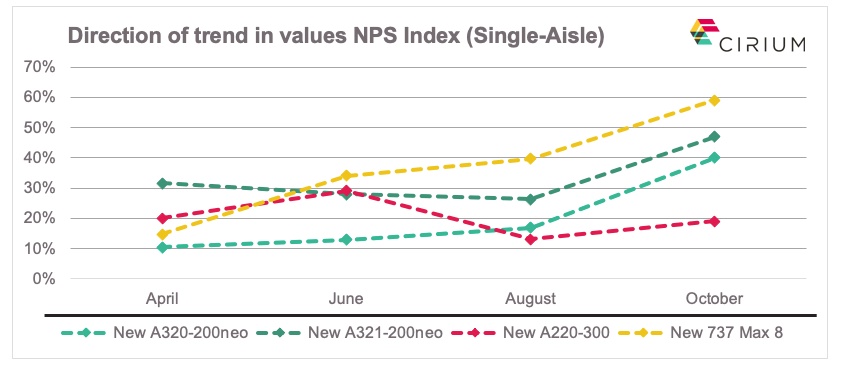

Within CAMSI, we utilize a NPS Index methodology – estimated as the number of respondents replying ’too high’ or ‘trending up’ minus those replying ‘too low’ or ‘trending down’, divided by the total sample response to that question. Scores in the 40% to -40% range broadly indicate stability, those below -40% can be considered to indicate a negative sentiment and those above 40% indicate the opposite positive sentiment.

In September, data from survey respondents indicated a generally positive picture regarding aircraft lease rates, particularly for narrowbodies, with all four new-build single-aisle aircraft types showing positive NPS trends. In other words, more people were of the view that lease rates are improving, compared to those who were not. This month, we turned back to market values and as with lease rates, feedback from respondents indicates the recovery is accelerating, at least for new single-aisle types.

Indeed, after a somewhat mixed picture in August, sentiment appears to be much more positive in October with an increase of around 20 percentage points in the NPS index for new-build Airbus A320 and A321neo aircraft, as well as the Boeing 737 Max 8.

While the smaller Airbus A220 has not witnessed quite the same increase, sentiment remains firmly in positive territory, indicating that most respondents see market values trending upwards.

By comparison, the market for twin-aisle aircraft remains challenged with all four widebody types which we measure; new-build Airbus A350-1000 and Boeing 787-9, as well as 10-year-old vintages of the Airbus A330-300 and Boeing 777-300ER, still seeing negative NPS scores. However, we have observed a steady increase in NPS scores for all four types over the past six months, which would indicate that sentiment regarding the direction of market values is slowly becoming less negative.

For the “bonus question” in October’s survey, we returned to a topic which we explored in our inaugural CAMSI survey, when respondents were asked when global passenger traffic might return to 2019 levels. In April, the majority of respondents thought that this would happen in 2023. However, over the past six months the mood appears to have become more pessimistic, with the majority now seeing 2024 as the mostly likely year when we’ll see a return to 2019 traffic levels, a sign perhaps that a smooth recovery from the pandemic cannot be taken for granted.

We are always looking for further respondents to reflect all aspects of the market, who can then benefit from receiving the full set of results (above is only a top line summary). The CAMSI survey takes only 3 minutes to complete, yet provides respondents with the most comprehensive picture of the aircraft value market trends available. If you would like to participate, please contact michael.graham@cirium.com. Participants will receive a complete and detailed analysis of the survey results, with ten or more graphics included.