READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS. MEET THE ASCEND BY CIRIUM TEAM.

Pricing Power across the aviation sector

By Michael Graham, Valuations manager at Ascend by Cirium

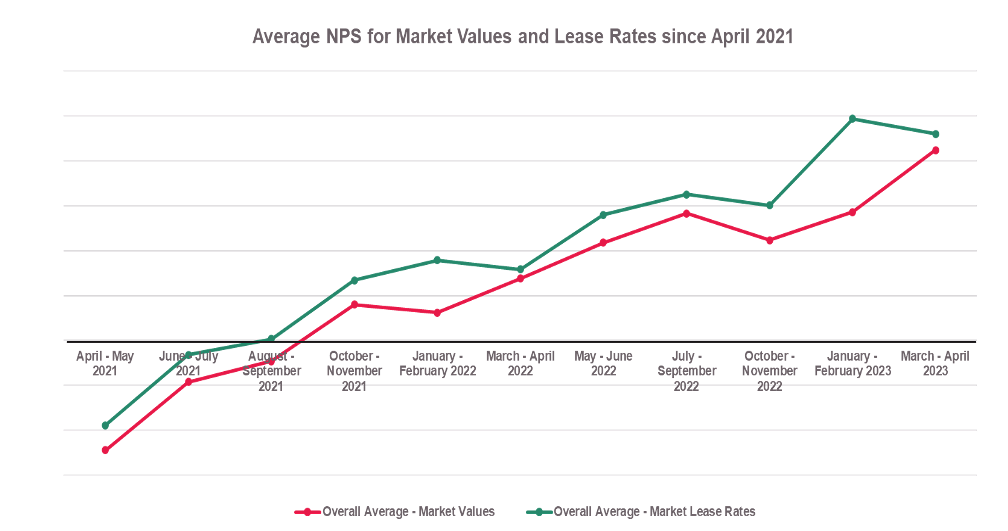

In April 2021, Ascend by Cirium launched the Commercial Aircraft Market Sentiment Index (CAMSI). The monthly Index tracks market sentiment and trends of values and lease rates through a survey of key market stakeholders, including lessors, banks, OEMs, part-out shops, airlines and brokers.

Within CAMSI, we utilise a NPS Index methodology – calculated as the number of respondents replying ’too high’ or ‘trending up’ minus those replying ‘too low’ or ‘trending down’, divided by the total sample response to that question. Scores in the 40% to -40% range broadly indicate stability, those below -40% can be considered to indicate a negative sentiment and those above 40% indicate a positive sentiment.

“Everything is costing more!” In a world of supply chain disruptions, labour shortages and generally high inflation, anecdotal evidence would suggest that this phrase is seeing more and more usage recently. Much has been written about how the ‘Cost of Living Crisis’ is hitting consumers hard, with fingers being pointed in multiple directions at “greedy” culprits, including supermarkets, energy suppliers and even airlines. However, rising prices are also a function of businesses’ rapidly increasing costs and their varying ability to reflect this in what they charge their customers. How much cost they can pass on is fundamentally a test of their pricing power, which in turn is dependent on the supply and demand for their services, how much competition they face and critically how much customers are willing and able to pay.

The question of who holds pricing power is a key theme across the commercial aviation sector; whether it is airlines’ ability to set fares, OEM escalation rates or lessors’ capacity to reflect their increasing cost of capital through higher lease rates. During the depths of the Covid-19 Pandemic, both lessors and OEMs lost nearly all pricing power, as travel restrictions forced airlines to park the majority of their fleets. They were unable or unwilling to continue existing lease payments, let alone lease in or take delivery of additional aircraft. In the face of this wholesale collapse in demand, many lessors were forced to reprice and accept “zero minimum” PBH deals, fixed rent reductions and even payment holidays to either keep aircraft in place or place aircraft from their idle inventories.

Fast-forward three years and looking at average NPS for Lease Rate trends from CAMSI, the tables would appear to have turned for lessors.

A resurgence in passenger demand, coupled with constrained supply of new aircraft would appear to have shifted pricing power for aircraft leases away from airlines and back towards lessors. Recent datapoint-driven Lease Rate reviews undertaken by the Ascend by Cirium Values would also support this hypothesis.

For example in the last 12 months, on a fleet weighted and constant age basis, we have increased Lease Rates for the Airbus A320-200 Sharklets and Boeing 737-800NG by 21% and 32% respectively. For buyers of used aircraft these data also suggest that for many types it is increasingly becoming a seller’s market, even for some twin-aisle types which are traditionally less liquid than single aisles. Boeing 787-9 and Airbus A330-300 (HGW) have been increased by a respective 16% and 17% over the past 12 months. It is worth noting however, that for many types both Market Values and Lease Rates still have some way to go to recover to pre-pandemic levels.

All of which should give some comfort to lessors who are now facing more expensive borrowing rates, as central banks aggressively increase interest rates to manage the aforementioned inflationary forces. However, April’s CAMSI NPS also suggests that lessors’ pricing power is far from absolute and that airlines are not always willing or able to simply “pay more” to lease aircraft. Compared to our last Lease Rate survey in February, the overall average Lease Rate Trend NPS declined by three percentage points in April. This is in stark contrast to the average NPS for Market Value Trends, which rose by 13 percentage points between January and March.

Whether or not April’s decline will be reflected in May’s survey on Market Values remains to be seen, and it is worth remembering that the NPS for both Market Values and Lease Rates remain firmly in positive territory. That said, this ‘correction’ illustrates that, while interest rate increases and reducing supply are slowly filtering through to lease rates, aircraft operating leasing remains a cut-throat business and intense competition between lessors to place aircraft continues to have a moderating effect on Lease Rates and Lease Rate Factors. A reminder that when it comes to pricing power, the market is always king.

We are always looking for further respondents to reflect all aspects of the market, who can then benefit from receiving the full set of results (above is only a top line summary). The CAMSI survey takes only 3 minutes to complete, yet provides respondents with the most comprehensive picture of the aircraft value market trends available. If you would like to participate, please contact michael.graham@cirium.com. Participants will receive a complete and detailed analysis of the survey results, with ten or more graphics included.

SEE MORE ASCEND BY CIRIUM POSTS.

READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM ANALYSTS AND CONSULTANTS, EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS.