READ ALL OF THE LATEST UPDATES FROM ASCEND CONSULTANCY EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS. MEET THE ASCEND CONSULTANCY TEAM.

By Joanna Lu, Head of Consultancy – Asia at Cirium Ascend Consultancy

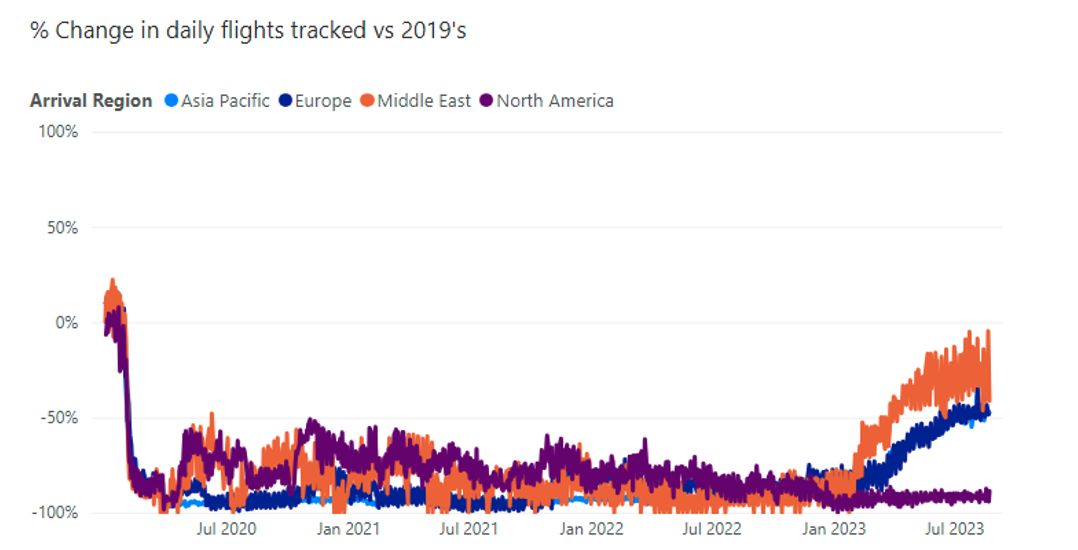

After three long years, Chinese travelers are finally able to travel in and out of the country without facing draconian restrictions. Although these restrictions were largely lifted in January, we haven’t seen the long-waited outbound recovery as expected. China’s International capacity still lags, being around 50% down in seat terms compared to pre-pandemic levels at the end of August. The US, as one of the largest long-haul markets, is still much behind; currently 90% down compared to 2019 equivalent. Europe and Asia-Pacific are both 50% down.

The top destinations from China are currently mainly short hauls, including Hong Kong, Japan, South Korea, Taiwan and Thailand. But none of these markets has recovered to 2019 levels.

China outbound flights tracked vs. 2019’s (by region)

Could we see a quick rebound after the lift of the group travel ban?

The recent removal of the group travel ban to key markets is obviously a positive message to the market. Group travel is a major influence channel across all age groups and types of consumers as travelers may experience language barriers and culture difference when travelling abroad. However, we may not see an immediate impact just yet. There remains a couple of issues on the supply side .

Tourism travel agencies have experienced major disruptions over the last couple of years, so it will take time to reestablish their supply chain, including building up manpower, looking for new partners in the destination markets and packaging products. These all take time.

The biggest bottleneck is the passport and visa process – many Chinese travelers have had passports expire during the COVID-19 period. Renewals are now possible, but the backlog will take a few months to be absorbed. Travel visas for destination countries can also take some time to be processed and issued due to capacity shortage. From an airline capacity perspective, it is perhaps easier for Chinese airlines as their widebody fleets are mostly in service (on domestic networks) or ready to be redeployed but it takes time for foreign carriers as they need to replot their network and fleet plan for China while dealing with the simultaneous or maybe faster (and more lucrative) recovery of other markets.

Travel patterns shift

Considering all of these challenges, a more realistic expectation is to see a meaningful recovery of the Chinese outbound market starting from 2024. But the pandemic has changed people’s mindset and travel behaviour. Known for the shopping inclination, there’s a rising trend of Chinese travelers toward investing in experiences over possessions, post pandemic.

Over the past three years, while international travel remained limited, domestic exploration thrived.

This period allowed the domestic market to mature, and travelers became more sophisticated in their pursuits. It is noticeable that airlines are closely monitoring the potential market and started to explore island destinations, or some deemed as niche market for Chinese travelers before, such as the Maldives and Tahiti. However, there remain many uncertainties around China’s macroeconomic environment including slowing foreign trade, reducing investment and increasing unemployment. There are also signs of softening domestic consumption.

Japan will grow as a destination market from China but may encounter a potential risk

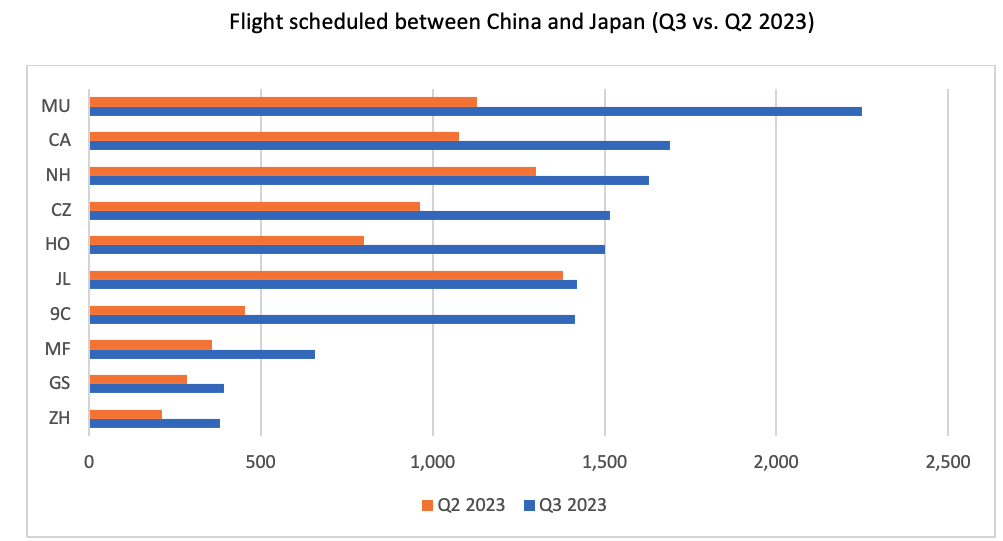

Cirium’s Schedule data for the third quarter of 2023 does show the positivity of Japan as a destination market for China, with a 65% increase in total seats between the two countries compared to the second quarter. Note however that the Japan-China market currently remains nearly 60% down in seat capacity compared to the 2019 equivalent. The growth we are seeing is led by Chinese carriers. Shanghai is the city driving the growth and we can see that China Eastern Airlines, Juneyao Airlines and Spring Airlines double or triple their capacity in the third quarter

Like China, Japan’s outbound travel from Japan is also not recovered, and is currently 30% down. But its connection to US has recovered to 95% of the 2019 level and overall, this is a market more reliant on inbound traffic.

With currency, the Yen is weakening so it is perhaps one of the reasons to attract Chinese travelers, those who are determined to travel. However, the new conflict on Japan’s release of processed nuclear water might create risks in the tourism sector.

Flight scheduled between China and Japan (Q3 vs. Q2 2023)

Overall, we may see evolving interests, changing attitudes, and a gradual shift toward experiential spending in China. These all point to a growing and adaptive outbound tourism sector. But, there is a risk that the uncertainty in geopolitics and macroeconomics might stand in the way.

SEE MORE ASCEND CONSULTANCY POSTS.