By Mike Malik

Chief Marketing Officer at Cirium

Like everywhere else in the world, Portugal suffered an epic collapse of its airline market during the Covid pandemic. Coming out of the pandemic, however, it’s been one of the fastest airline markets to recover.

As data from Cirium’s Diio airline planning system shows, airports in Portugal offered 11% more seats in this year’s third quarter than they did in the third quarter of 2019. Of the 50 largest country markets in the world, only four have grown faster since then (Kazakhstan, Egypt, Mexico, and Greece). Like Egypt, Mexico, and Greece, Portugal is a popular tourist destination, offering beaches, sunshine, and relatively affordable prices. Portugal has also become a popular place for Americans, Brazilians, and other Europeans to work remotely, and the government even offered “digital nomad visas.” According to Statistics Portugal, the number of foreign tourists visiting the country exceeded 22 million during 2022. That still fell short of 2019’s total, but this year’s figure is on pace to reach a record high.

Cirium is also hosting a round table discussion at the Keynote Theatre on September 27th at 11.20am, titled: Stop guessing, start knowing – ending flight CO2 approximations and embracing true precision – why it matters!

Lisbon is therefore a market of great interest to many airlines, as they gather at the World Aviation Festival (WAF) in Lisbon this week. Cirium is at WAF showcasing its industry-leading analytical tools including Diio, which offers a wealth of data for a detailed look at Portugal’s dynamic airline market.

Portugal’s market leader is TAP Air Portugal, the national airline that’s again looking for a buyer. Almost a decade ago, TAP was sold to a group of investors that included JetBlue and Azul founder David Neeleman. Before that, it was partly owned by the old Swissair. The government, however, reasserted full control during the Covid pandemic, when TAP, like many airlines around the world, needed heavy government aid to survive. With the pandemic now past, TAP is earning some of its best profits ever, including a 7% operating margin in 2022. It again earned 7% during the first half of 2023 and it’s now flying more capacity than it was before the crisis.

Who might buy TAP this time around? IAG, the Lufthansa Group, and especially Air France/KLM all seem interested. They’re attracted to the Portuguese market not just for its big tourism sector but also its economic links to Portuguese-speaking markets in South America and Africa. In Brazil alone, as Diio shows, TAP serves no fewer than ten different airports! It now flies to ten airports in North America too. TAP likes to say that Lisbon, thanks to its geography and history, is a four-continent hub, linking Europe, South America, North America, and Africa. Its many long-haul routes, importantly, aren’t subject to low-cost competition from tough-to-beat carriers like Ryanair and EasyJet.

Shorthaul routes to and from Portugal, however, do feature heavy low-cost competition.

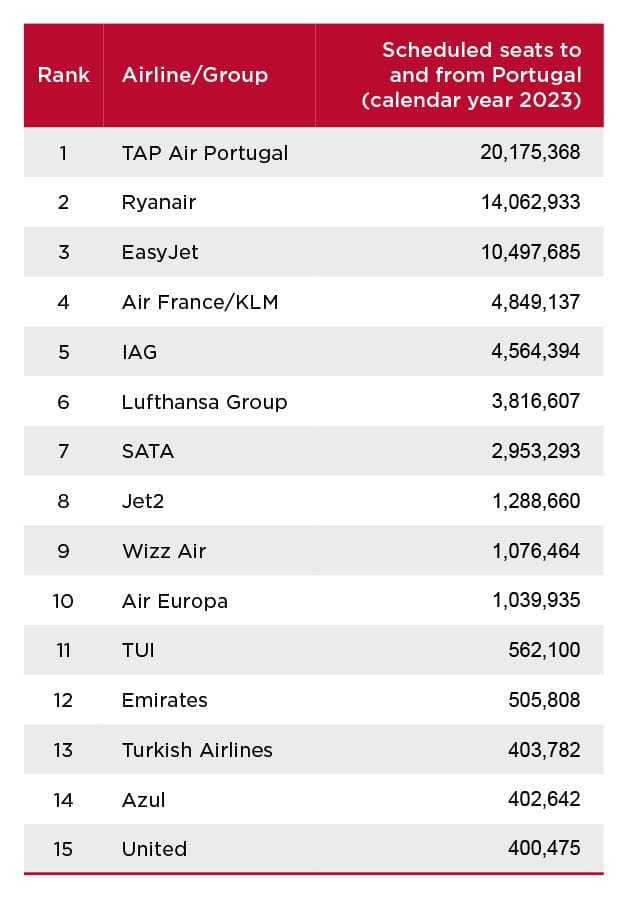

Our Diio analysis shows Ryanair as the clear number two in the country by total seat capacity. EasyJet is number three, accompanied by other low-cost carriers like Jet2, Wizz Air, Air France/KLM’s Transavia subsidiary, and IAG’s Vueling, to name a few. Also among the leaders by capacity is Azores Airlines, another Portuguese carrier named after the Atlantic Ocean archipelago where it’s based.

United, Delta, American, Air Canada, and Air Transat all fly to Portugal from North America, in some cases to secondary cities as well as Lisbon (namely Porto, Faro, and even Ponta Delgado in the Azores). LATAM and Azul compete in the Brazil-to-Portugal market. Two leisure carriers associated with tour operators, Orbest and World2Fly, offer some nonstops from Lisbon to the Caribbean.

New developments like the arrival of longer-range narrowbody planes should amplify Portugal’s geographic advantages and drive additional future traffic growth.

On the other hand, growth could be restrained by lack of airport capacity. Portugal faces a big question about how to expand Lisbon’s aviation infrastructure, given insufficient space at the existing Humberto Delgado Airport. Some relief could come from converting a nearby air force base to a commercial facility. Plans exist for an all-new airport as well. Airlines will be watching closely!

Learn more about Cirium Diio