In with the old

By Michael Graham, Valuations manager at Ascend by Cirium

In April 2021, Ascend by Cirium launched the Commercial Aircraft Market Sentiment Index (CAMSI). The monthly Index tracks market sentiment and trends of values and lease rates through a survey of key market stakeholders, including lessors, banks, OEMs, part-out shops, airlines and brokers.

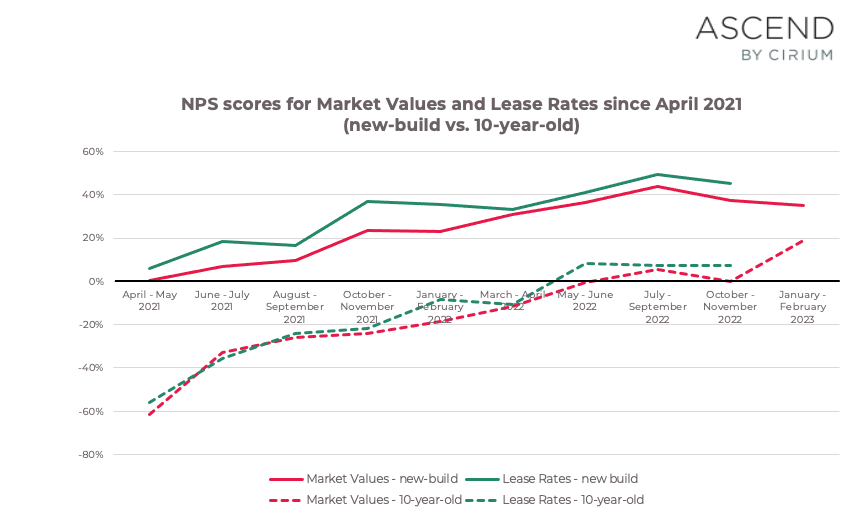

Within CAMSI, we utilize a NPS Index methodology – calculated as the number of respondents replying ’too high’ or ‘trending up’ minus those replying ‘too low’ or ‘trending down’, divided by the total sample response to that question. Scores in the 40% to -40% range broadly indicate stability, those below -40% can be considered to indicate a negative sentiment and those above 40% indicate a positive sentiment.

Knowing which asset class to invest in for positive long-term returns is a tricky business. In the UK, most people (who can afford it) have long put their faith in the property market, in which the price of the average house has quintupled over the past 70 years in real terms*. Others have chosen to invest in equities, where returns have been even higher at almost 12% per year1 from the S&P500 since 1957. However, both of these asset classes have been blown out of the water over the past 10 years by something with a little more horsepower – classic cars. For example, if one had bought an Aston Martin DB5 in 2005 for £80,000, today it would be worth almost 10 times as much, according to Classic Car Weekly. Similarly desirable vintage models also seen stratospheric price rises. As we kick off 2023 it seems that classics are very much in vogue in the commercial aircraft world as well.

In November last year it appeared that after 18 months of a steady climb, NPS scores within CAMSI had hit turbulence. From Q3 into Q4 2022 the average Market Value trend NPS across all surveyed types surveyed declined by 6 points, while lease rates were also subject to a correction. It is worth emphasizing however, that both metrics remained firmly in positive territory. The question was whether this was just a temporary blip or the start of a more entrenched decline?

Results from the January 2023 Market Values survey suggests that the former may be more accurate. Between our last Values survey in October 2022 and January 2023, the average NPS has rebounded from +22 points to +29 points.

However, as the chart above show the driver of this recovery has not been new aircraft, but rather 10-year-old types; specifically, the Airbus A320ceo and A330-300, as well as the Boeing 737-800NG and 777-300ER.

Such was the performance of these types, that for the first time ever, individual NPS for all ten types within CAMSI are now positive, indicating a broad-based recovery in Values. Conversely, new types saw their NPS stagnate. On average, new types still have higher scores, but the gap is closing fast and we await results from February’s Lease Rates survey, which is currently live.

The reasons behind the resurgence are manifold. Firstly, from a statistical point of view, new aircraft such as the Airbus A320neo and Boeing 737-8 (Max) have seen stratospheric rises in NPS since we began CAMSI so some reversion to mean is inevitable.

Secondly, evidence suggests that OEMs are nowhere near tackling the multitude of challenges which are leading to delays in the deliveries of new narrowbody aircraft.

This is much to the chagrin of airlines who are screaming for capacity, as well as lessors in need of new metal in order to grow. Not only this, but when aircraft do arrive, operators are often having to contend with lower than expected despatch reliability from the latest generation of ultra fuel-efficient engines.

All of which appears to be leading the market to look more favourably on older aircraft in order to provide lift. In other words, if an airline’s new aircraft aren’t arriving on time or are “going tech”, to use industry parlance, then what other choice do they have but to rely on older aircraft? They may be less fuel efficient than their successors, but in the face of resurgent travel demand, any safe and reliable means of getting paying passengers airborne is better than none at all.

*Source: Barclays Bank

1Source: Schroders

We are always looking for further respondents to reflect all aspects of the market, who can then benefit from receiving the full set of results (above is only a top line summary). The CAMSI survey takes only 3 minutes to complete, yet provides respondents with the most comprehensive picture of the aircraft value market trends available. If you would like to participate, please contact michael.graham@cirium.com. Participants will receive a complete and detailed analysis of the survey results, with ten or more graphics included.

SEE MORE ASCEND BY CIRIUM POSTS.

READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM ANALYSTS AND CONSULTANTS, EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS.