- Aerospace

- Air finance

- Airline

- Ascend Consultancy

- Expert view

- Industry trends

Airlines face headwinds amid tariffs, uncertainty and shifting demand

Moody’s recent downgrade of its outlook for the global airline industry reflects a broader shift in sentiment, as carriers brace for a more challenging operating environment in the second half of the year. Herman Tse asks if the market outlook is truly that pessimistic.

Cirium Ascend Consultancy is trusted by clients across the aviation industry to provide accurate, timely, and insightful aircraft appraisals. The team provides the valuations and analysis the industry relies on to understand the market outlook, evaluate risks and identify opportunities.

Discover the team’s industry reports & market commentaries. Read their latest expert analysis, viewpoints and updates on Thought Cloud.

Herman Tse

Valuations Manager

Cirium Ascend Consultancy

The global aviation industry is experiencing a period of heightened volatility, driven by mounting macroeconomic pressures, geopolitical instability, and evolving consumer behaviour. One of the most pressing challenges is the imposition of U.S. tariffs. Although some have been postponed or reduced, they have already impacted both consumer and business confidence.

Moody’s has recently downgraded its outlook for the global airline industry to negative, citing growing economic uncertainty and escalating trade tensions. The rating agency also revised its forecast for global airline operating profits, slashing expectations from previously anticipated double-digit percentage growth to a modest 1%. This downgrade reflects a broader shift in sentiment across the industry, as carriers brace for a more challenging operating environment in the second half of the year.

Is the market outlook truly that pessimistic? The International Air Transport Association (IATA) released its revised 2025 Global Outlook in June, projecting slower passenger traffic growth for this year than previously forecast. Revenue-passenger-kilometres (RPK) are now expected to grow by 5.8% year-over-year (YoY), down from the 8% projected in December 2024. This more conservative estimate better aligns with the current economic and geopolitical landscape.

Airline executives across major regions have begun signalling strategic shifts in response to these challenges. In the United States, Delta Air Lines CEO Ed Bastian remarked in April that “growth has largely stalled,” highlighting the airline’s decision to scale back capacity growth in the second half of 2025. In Europe, Virgin Atlantic CFO Oli Byers noted early signs of softening demand from the U.S. market, prompting a more cautious approach to capacity planning. Meanwhile, in Asia, Singapore Airlines Group emphasised its readiness to respond swiftly to evolving market dynamics, reinforcing the importance of agility in today’s climate.

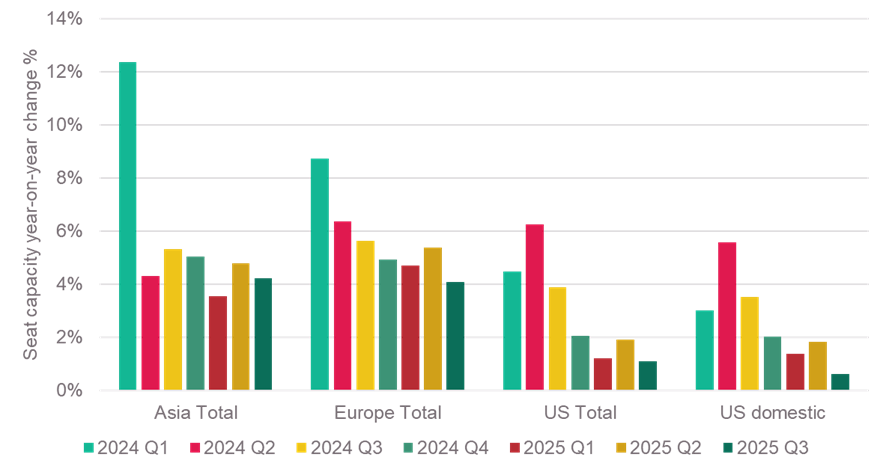

According to Cirium data, airlines have already begun adjusting their scheduled seat capacity growth for the third quarter of 2025. The U.S. market, particularly the domestic segment, is experiencing the sharpest decline, likely driven by inflationary pressures and reduced travel demand linked to tariff concerns. In contrast, other major markets have remained relatively stable. The Asia-Pacific region is expected to continue its growth trajectory, while European routes are projected to see moderate but steady gains through the remainder of the year.

Chart 1: The scheduled seat capacity growth trend

Source: Cirium Core, Schedules dated 6 June 2025

Globally capacity is currently scheduled to increase by 5.3% in Q3, somewhat below even the IATA traffic expectation. Meantime, Q2 has softened in line with those airline statements, now projecting 5.5% increase over Q2-2024 as compared to expected growth of 7.0% from the schedule filed some 12 weeks ago.

Amid the turbulence, one positive development for airlines is the decline in fuel prices. Brent crude oil has dropped from over $120 per barrel in 2022 to below $70 today, easing pressure on one of the industry’s largest cost components. This decline provides some financial relief. In response, there is room for carriers to lower ticket prices to stimulate demand and improve load factors. Airlines are focusing on optimising existing schedules and improving efficiency.

Chart 2: The oil price trends

Source: US EIA, IATA, dated 30 May 2025

Despite the headwinds, the global aviation outlook is not as pessimistic as some may believe. Most airlines are still expected to remain profitable in 2025, supported by disciplined cost management and flexible network strategies, and IATA expect global aggregate net profits of $36 billion, actually marginally increased over 2024. However, the outlook for 2026 is far more uncertain, with macroeconomic risks and geopolitical tensions likely to persist. In this dynamic environment, staying ahead of market shifts is critical. Access to aviation data and actionable insights provided by Cirium will be essential for industry players to mitigate risks, seize opportunities, and make informed strategic decisions.