READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM ANALYSTS AND CONSULTANTS, EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS.

MEET THE ASCEND BY CIRIUM TEAM

By Rob Morris, Global head of consultancy at Ascend by Cirium

The recent emergence of the Omicron variant serves as a reminder to us all of the risk to regional and global passenger traffic recovery, where we saw much progress throughout 2021. As we opened the year, global revenue passenger kilometres remained some 70% below volumes in 2019. For October 2021 IATA reported that traffic was now ‘only’ 49% below the October 2019 levels. While demand in some markets remains fundamentally impacted, the recovery of 21% points at a global level thus far this year is a consequence of domestic and shorter-haul international markets strengthening as rapid vaccine progress and other measures allowed governments to be become increasingly confident in removal of travel and other personal restrictions.

As recovery progressed, in the background we were all conscious that mutations of the virus could change its behaviours and risk. Omicron illustrates the pace of that mutation, for the naming logic of each variant using the Greek alphabet reminds us that there have been eight variants identified since we learnt of the Delta variant, but all of these are classified only as ‘variants of interest’ by the World Health Organisation. Omicron is the first mutation since Delta to be defined as a ‘variant of concern’. This is a consequence of the initial indications of its potentially increased transmission and wider health risks.

In light of this definition, many governments have moved rapidly to address the increased risk by tightening travel restrictions. Markets where Omicron was initially identified were moved to ‘red lists’, requiring more stringent testing regimes before and immediately after travel and in most cases lengthy quarantines in government approved facilities. We already know that such restrictions frustrate the pace of recovery and thus it does seem likely that we should prepare for a period of slowing growth, or even temporarily reduced demand.

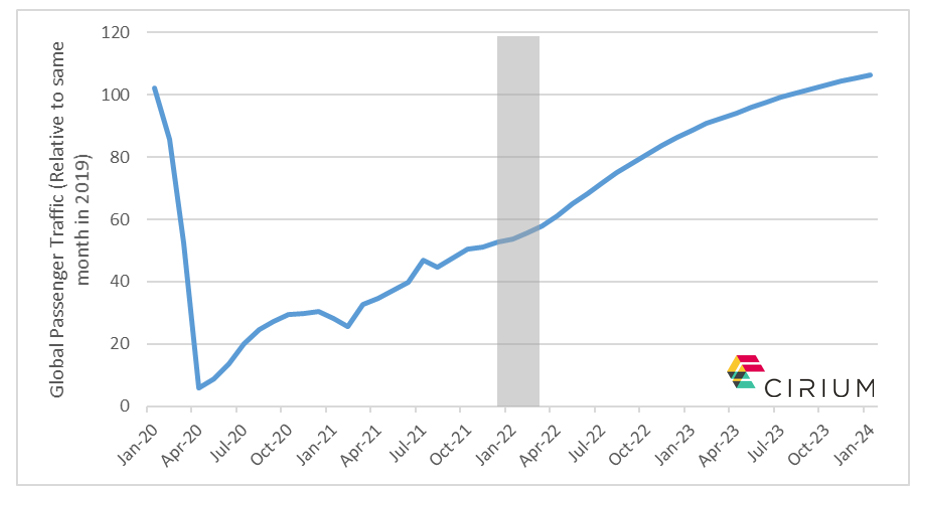

Since the onset of the pandemic Ascend by Cirium has been projecting demand recovery with a scenario approach. On either a regional or global basis we have been hypothesizing monthly traffic volumes relative to 2019 levels, and then monitoring actual performance against those hypotheses. Using this logic we are now up to Scenario 6 (so not quite as many scenarios as we have Covid variants), which was remodeled in September of this year after observations of regional traffic recovery through July 2021 which suggested that our prior base case Scenario 4 was becoming increasingly pessimistic in several regions. The progress of global traffic recovery for this scenario is set out in the chart above.

This shows our expectation that the pace of traffic recovery will slow over the next few months as demand dampens in line with typical seasonal trends in the Northern Hemisphere. Recovery is then expected to accelerate again in 2022 driven by increasing seasonal demand plus the release of frustrated demand in markets which are able to see further easing of travel restrictions as the pace of vaccine progress globally accelerates even further and the impact of those vaccines on the virus becomes more evident.

Whilst it is too early to know the true impact of Omicron, the impact of an Omicron like variant is implicit in our expectation of slowing pace of recovery this winter. For now (and until science derives a greater understanding of the impact of this newest variant, which itself will have an impact on travel restrictions) all we can do is observe our trusted indicators – scheduled capacity, completed flights, aircraft tracked, stored aircraft inventories, etc. All of these are monitored on a fortnightly basis in our Covid-19 Aviation Recovery Monitor deck, which also covers actual demand progress against our scenarios (available for clients by annual subscription; please contact me if you are interested to receive this) – to see if the impact on demand varies from our regional and global hypotheses. Thus, we will be able to know if Omicron will fundamentally alter the trajectory of the recovery, or if it is just one more bump along the road.