READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS. MEET THE ASCEND BY CIRIUM TEAM.

By Daniel Hall, Senior valuation consultant at Ascend by Cirium

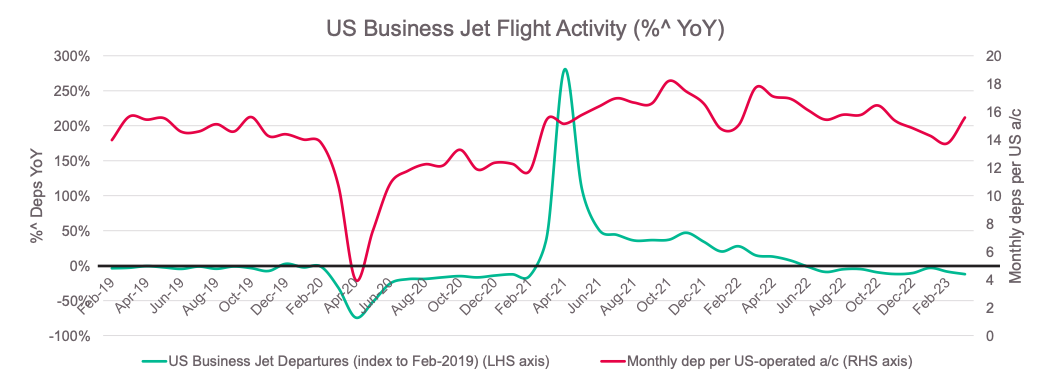

Much has been documented about business aviation’s impressive flight activity growth over the past two years. For example, almost 260,000 US business jet departures were recorded in October 2021, over 20% up on October 2019. Yet, we are now at a point where some of this activity is pulling back and many will be wondering just how much of the gains will stick? The pullback has been evident since Q4 2022; since then we have averaged almost 6% reduction for same month year over year departures of US business jets. In the most recent months, public FAA data shows activity some 9% down, year over year, but still some 9-11% up compared to 2019, albeit on a downward trajectory. The below chart visualizes this by presenting the year over year change for each month.

We can also study flight activity per-aircraft (because as fleet grows, total activity will generally grow, so that metric is not always the most meaningful). Recent years have seen significant gains here – with per aircraft monthly departures growing from a long-term average of 14 up to 18. This is still some way down on 20+ in the late 2000’s, but we have now dropped back down to long-term averages. It is a key trend to watch, but perhaps more encouragingly there is continued growth of the charter and fractional operator type category. These sectors operate 11,000 business jet and business turboprop aircraft globally, commanding an approximately 28% share.

In the below charts we can see their growth, particularly pronounced for the fractional operated fleet.

Both sectors are growing with new deliveries directly from the OEMs, but increasingly they are also taking aircraft from private / corporate operators. This is significant, because a charter / fractional operator will typically utilize the aircraft some 4-5 times more than a privately operated one (in terms of hours/cycles).

Therefore, looking at fleet size alone masks fleet productivity, and doesn’t fully account for greater demand on labor and the supply chain – things like crewing, fuel, maintenance, and FBO capacity, to name a few.

Operators are fragmented but the top four groups control over 1,600 aircraft. These fleet sizes are not dissimilar to large mainline commercial carriers.

Our understanding is that some of the reduction in flight activity has been experienced by reduced charter demand. There are various factors at play:

- Initial post-lockdown ‘revenge travel’ demand naturally benefited the charter segment.

- There are genuine macroeconomic concerns, reducing some demand.

- Supply of alternatives has restored, with scheduled airline service fully back.

- Charter pricing has increased, removing some of the lowest price demand customers.

In light of this, the question that arises is: will some operator business models that required continuous growth now find themselves in a challenging position?

Fractional operated fleet flying on the other hand appears to be continuing its flight activity gains. This was an operator category which initially had to turn away customers as it did not have enough aircraft to service existing customers. Deliveries have significantly accelerated now, and the largest groups, NetJets and Flexjet, seem committed to growth (including poaching pilots from commercial carriers). Fractional flying is both more committed and the logical upward progression from charter flying, so its continued growth is encouraging and perhaps here to stay.

We’ll keep watching this closely. While the industry is confident of keeping some of its new customers, further activity decline of the charter sector could eventually lead to operator difficulties resulting in aircraft sales activity, which will likely be at pricing lower than where appraisal values have risen to today.

LEARN MORE ABOUT CIRIUM FLEETS ANALYZER – SEE MORE ASCEND BY CIRIUM POSTS.