India’s Longhaul Reach

SUBSCRIBE TO ON THE FLY

India is today the world’s third largest airline market by seat capacity, behind only the U.S. and China. That’s quite a remarkable rise from being ranked number ten just before the global financial crisis of 2008. But let’s take a closer look.

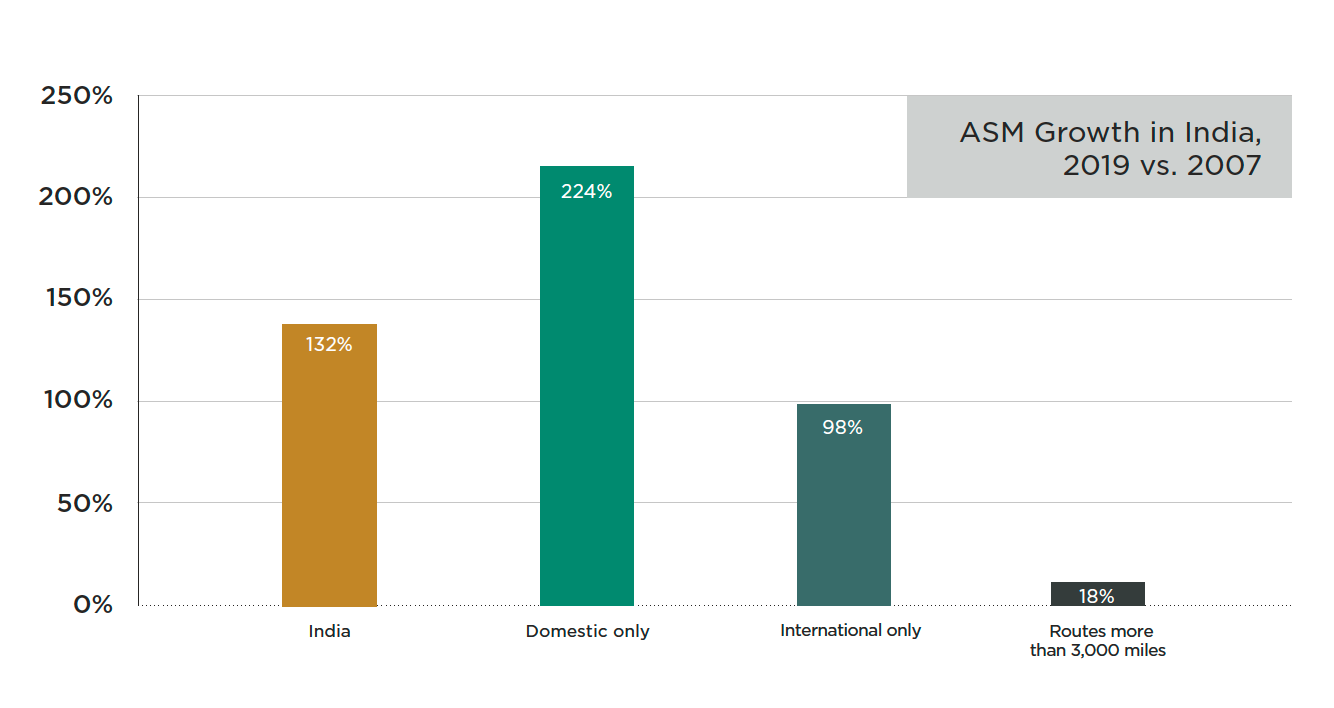

Measured by ASMs, India’s airline market grew 132% from 2007 to 2019. That’s remarkable, but not as impressive as the 224% growth for just its domestic market. Internationally, growth lagged at just 98%—remember that we’re measuring over a 12-year period. To drill down even deeper, let’s now look at India’s international routes longer than 3,000 miles, a good proxy for longhaul intercontinental journeys. Here ASMs were up a mere 18%.

Why has India’s intercontinental airline market been such a poor performer over the past decade? One reason is that many such journeys are handled through offshore hubs, most importantly those of the Gulf region like Dubai and Doha. A related reason is that India’s own airlines—because foreign rivals like Emirates are so strong in the longhaul market from India—have never been able to successfully crack this market. Jet Airways tried but perished, leaving Air India and Vistara as the sole Indian carriers flying widebodies today (Vistara has a mere two). In addition, many of India’s busiest longhaul markets—to North America, for example—are hypercompetitive because passengers have lots of hubs to choose from. They can connect in Europe, the Gulf, Istanbul and even East Asian gateways like Tokyo. Finally, India’s longhaul corporate premium market is still relatively small. Same more or less for its longhaul tourist sector. This forces airlines that compete on India’s intercontinental routes to rely mostly on price-sensitive VFR traffic (visiting families and relatives).

In the post-pandemic world, will India’s homegrown airlines find a way to expand more aggressively overseas? Air India has a new private sector owner. Vistara has more Dreamliners on order. IndiGo and SpiceJet hinted pre-pandemic that intercontinental markets are of interest. Keep your eyes on the Indian longhaul market!

Never miss an on the fly story. Sign-up to receive an email notice when a new story is published.

See more aviation analytics on the fly posts, here. For a closer look, schedule a demo.

Media contacts:

Rachel Humphries

June Lee

media@cirium.com