Sarah Conway, Senior Vice President & Head of Lessor Origination, Pricing & Structuring, Deucalion Aviation joined Ascend by Cirium’s Head of Valuations George Dimitroff and Senior Valuations Consultant Thomas Kaplan on Thursday 30th March. They assessed the current environment, examined emerging trends, and explored the near-term outlook for the sector against the backdrop of rising inflation and interest rates.

Lessor competition is keeping lease rates low – for now

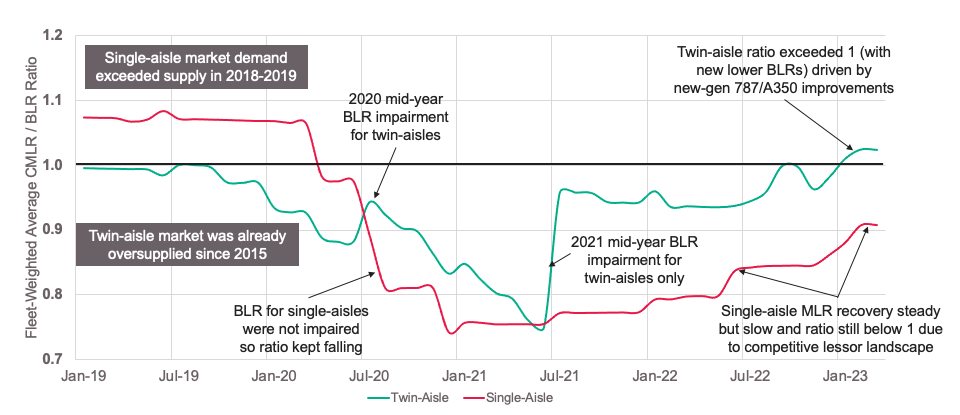

Assessing the values and lease rates landscape, Thomas Kaplan highlighted how lease rates are comparatively lagging behind values, particularly for single-aisles: “Lessor competition is very intense in the single-aisle fleet, driving pricing down, and we haven’t been able to see the interest rates and inflation filter through to get those lease rates up”.

“There’s still an overhang of aircraft from the lessor idle fleet from the pandemic, when lessors were having more difficulty placing aircraft when demand was very low,” he continued, “so with that supply still higher than the regular levels, it increases the competition and keeps the lease rates down, but we may see continued improvement and the trend is for improvement.”

Inflation is certainly having an impact and Sarah Conway pointed to a readjustment among lessors from a financing perspective. “Over the last few weeks, we’ve seen rates move again and that volatility is what we’re all trying to get our heads around when we’re looking at buying and selling aircraft today, and understanding whether it works from a financing perspective.”

Why haven’t aircraft lease rates risen with interest rates? “The industry is a bit like a drug addict that’s been addicted to low interest rates for 20 years or more, and is now going a bit cold turkey” said George Dimitroff. “But it’s adjusting, and I think the industry can adjust to the new interest rate environment, it just takes a bit of time to pass some of that onto customers and to adjust.”

Single-aisle Market to Base Lease Rate ratio lagging behind value ratio slightly; interest rate increases and reducing supply are slowly filtering through to lease rates but recovery is dampened due to strong competition between lessors to place aircraft

Don’t count on a part-out market resurgence this year

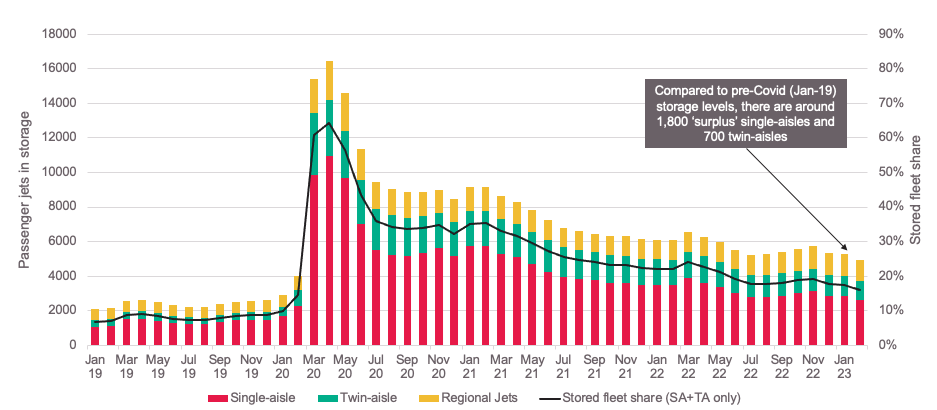

Despite high numbers of aircraft in storage, retirements have remained low in the years since the pandemic, with the annual total failing to reach 2019 levels every year since. The result has been a weak part-out market, as Thomas explained:

“The owners of aircraft have a choice whether they want to permanently retire their aircraft and tear it down, or just let it sit. They’d rather not tear down during a weak economic environment where they’d get less money for the engines and airframes, and there’s less demand for spare parts.”

The part-out market is showing signs of a return, as Rob Morris highlighted in a recent article; in the first two months of 2023, retirement levels were similar to 2019. However, George pointed out that while the part-out market should return, other types of buyers are outbidding part-out companies for aircraft.

“The aircraft are needed as fliers, simply because you don’t have new deliveries and because some of the airlines’ own aircraft are down for maintenance, waiting for MRO slots” he observed. “I definitely can’t see the part-out market returning to 2019 levels this year unless there’s a major event that causes airlines or lessors to start selling.”

Sarah added a lessor’s perspective, pointing to demand among airlines to extend their leases on aircraft due to be parted-out. “Obviously that’s an easy decision as a servicer in many cases, especially if you’re looking at a 20-year-old asset to extend for one more summer.”

“The cycle will change, it’s just nobody would have ever modelled getting an extension at that 20-year point when that deal was being considered, whereas in the last six to twelve months that has become a real opportunity,” she concluded, “but I believe it’s a short window.”

Stored fleet saw renewed fall in December, as more China/Asia aircraft returned to service, but inventory share remains 6-8% points above pre-Covid levels

The conditions are in place for a revival of lessor trading

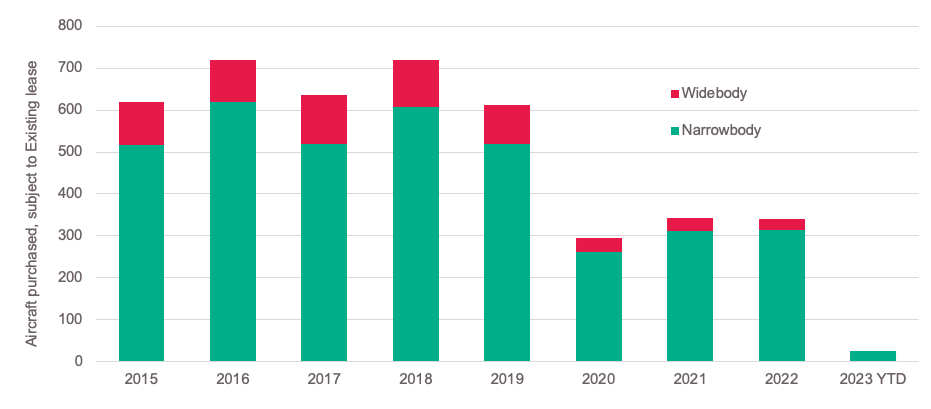

Another area yet to reach pre-pandemic levels of activity is lessor trading, swaps of aircraft between lessors with a lease attached. Trades halved from over 600 in 2019 to 300 in 2020 and have remained stubbornly below 400 each year since. Will 2023 buck the trend?

The live viewers were split in an audience poll, with 43% expecting trades to top 400, if not reach 2019 levels, closely followed by 40% who foresaw trades to remain at a similar number. Sarah indicated the longer timeframes now required to close deals are inhibiting trades, with more opportunities for deals to fall through. However, she pointed increased talk of deals at recent industry events, and the return of widebodies as tradable assets as the key change in recent months.

“It’s a higher interest rate environment where financing has allowed for break gains and potentially a positive impact, given where book values have been sitting and how valuations have been effected over the last few years” she explained. “Widebodies were the trickier asset class to consider, especially standalone assets not packaged with a portfolio of narrowbodies, so the widebody trading side should continue to increase as we go through the year.”

George agreed, adding that as many leases restructured in 2020 have now been paid back, lease contract volatility is decreasing. “You have a bit more predictability about what you’re getting in terms of your revenue streams, cost of borrowing and cost of funds as well, although it’s still pretty volatile on a day-to-day basis.”

“I think some of the key dynamics that you need to trade aircraft with lease attached are starting to stabilize, and that should open the door for more trading.”

Volume of trades of aircraft with lease attached has come down significantly during the pandemic

Watch the webinar on-demand

To access the full presentation, including the full discussion between the panelists and deeper analysis of individual aircraft types including the Airbus A320, watch the webinar on-demand.