Cirium Ascend Consultancy is trusted by clients across the aviation industry to provide accurate, timely, and insightful aircraft appraisals. The team provides the valuations and analysis the industry relies on to understand the market outlook, evaluate risks and identify opportunities.

Discover the team’s industry reports & market commentaries. Read their latest expert analysis, viewpoints and updates on Thought Cloud.

Max Kingsley-Jones Valuations Manager, Cirium Ascend Consultancy

As ever, there was a lot going on around the Le Bourget chalets and halls, but here are some key takeaways:

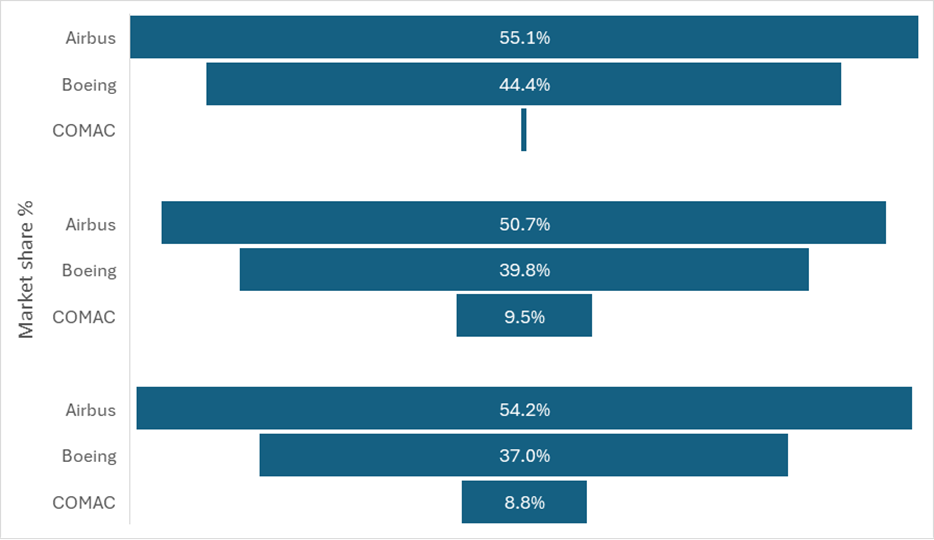

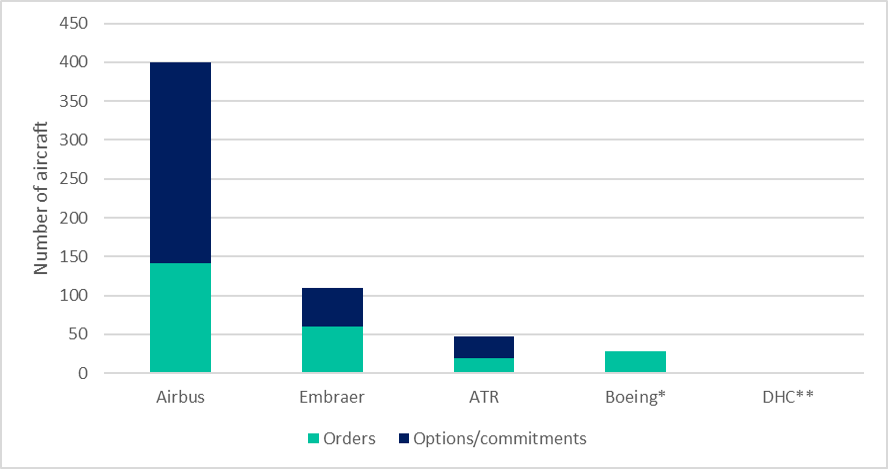

Airbus’s home run: The “home” OEM made the most noise as is usually the case, announcing some 400 orders and commitments during the show. Boeing, which has traditionally played down its participation in the so-called air-show “order race”, was intentionally quiet this time amid the Air India 787 tragedy which occurred just prior to Le Bourget. Despite Boeing’s low-key approach, total announcements at the show for commercial aircraft amounted to almost 600 orders and commitments. The show sales tally might have been even higher had anticipated announcements materialised from AirAsia (for “100” small single-aisles – A220s or perhaps E-Jet E2s) and Turkish Airlines (long-expected large order for 737s and Boeing twin-aisles).

Paris 2025 Commercial Aircraft Orders and Commitments

Source: Cirium Fleets Analyzer/OEMs (*ANA order, not announced by Boeing; ** two DHC orders)

Power play: The CFM RISE open-fan powerplant mock-up was a crowd pleaser on Safran’s stand in Le Bourget’s main exhibition hall. The concept is in the news as a potential front-runner to propel Airbus’s proposed next-generation single-aisle. With Airbus saying it aims to launch the new aircraft by the end of this decade, the open-fan architecture of RISE alongside is under evaluation alongside advanced shrouded-fan design concepts from rival engine OEMs. To that point, Pratt & Whitney outlined the progress of its work with fellow RTX company Collins to ground-test and then fly a hybrid-electric version of the A320neo’s PW1100G. Meanwhile the P&W Canada division disclosed that it is working closely with Airbus’s regional arm ATR to study a hybrid-electric powered turboprop derivative, in what is effectively a reboot of the regional aircraft OEM’s Evo project. This reduced-emissions design had previously been slated for a 2030 debut, but the target now is around 2035.

Big twin: The A350-1000 had a particularly strong show, securing a total of 35 orders and 25 commitments from two clients – Riyadh Air and Starlux Airlines. Sales of the largest A350 variant have been solid this year to date, with the 62 announced so far accounting for two-thirds of the type’s 2025 tally. The variant now holds for almost 40% of the firm backlog for A350 passenger models, which totals around 700 orders. Talk of an A350 stretch has restarted, after previously being mooted a decade ago as the “A350-2000”. A larger derivative of the R-R Trent XWB-powered twinjet, which would pitch Airbus’s biggest aircraft directly at the 777-9, could open the door to an alternative engine option. This could perhaps be an advanced derivative of the Trent, or even a solution from Cincinnati. But would GE have the appetite to support a rival to the GE9X-powered Boeing?

Regional resurgence: ATR and Embraer announced almost 160 orders and commitments between them. US-based public charter operator JSX placed commitments with ATR for 15 firm and 10 options in a deal touted as a potential signal of a turboprop revival in the USA. But there have already been several false dawns in that regard. Meanwhile Embraer’s ongoing success with its E175 was underlined by a deal from SkyWest Airlines for up to 110 aircraft. The OEM has secured 150 orders since the start of last year for the GE CF34-powered variant and said it expected this market would “continue for many years”. But Embraer was extremely disappointed to lose out to Airbus in a crucial campaign at LOT for small single-aisles, which signed for up to 84 A220s to replace its E-Jet E1s. The Brazilian OEM hinted that “geopolitics” may have helped sway the decision away from the E-Jet E2 in Toulouse’s favour.

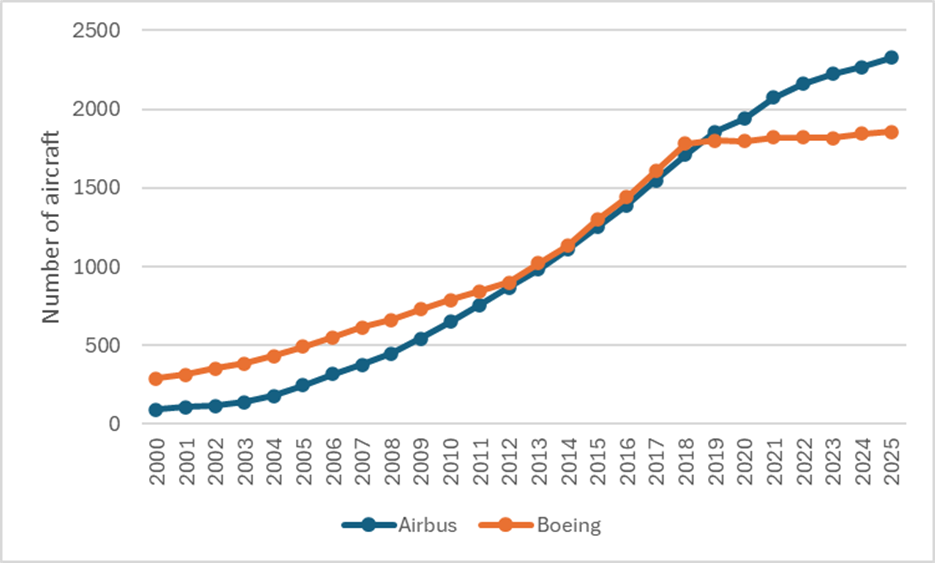

Supply snags: Despite deliveries being 5% down year-on-year in the first five months of 2025 (243 vs 258), Airbus restated its intention to raise shipments this year by around 50 aircraft to at least 820 units. Commercial chief Christian Scherer pointed to “almost 40 gliders” among the A320neo family production system where aircraft have been rolled out but are awaiting powerplants – specifically CFM Leap-1As. “Were it not for those engineless aircraft our delivery performance would be slightly above plan right now,” he said. In the widebody production system, cabin-equipment supply “remains a little bit of a bottleneck”, added Scherer. Meanwhile, the OEM is gearing up to implement the take-over of former Spirit AeroSystems production sites as part of the US primary supplier’s restructuring and merger with Boeing.