- Aerospace

- Airline

- Airports

- Expert view

- Industry trends

- Operations

- Sustainability

Spotlight on Hamburg: emerging commercial aviation trends

Hamburg is the world’s third-largest aviation cluster, and northern Germany’s principal air travel hub. Andrew Doyle examines traffic, fleets and emissions data to explore how operations at Hamburg Airport are being reshaped.

Cirium is proud to be a member of Hamburg Aviation, supporting the businesses, research institutions and networks across aviation industry in the Hamburg metro region.

Andrew Doyle

Senior Director, Market Development

Cirium

Hamburg Airport is northern Germany’s principal hub for international and domestic commercial passenger flights (and the country’s fifth largest overall), but how have its operations been reshaped since the pandemic? Cirium data shows that while overall tracked flights remain down compared with the 2019 peak, average flight distances, aircraft seat capacities and load factors have risen, while CO2 per passenger kilometre (ASK) is sharply down.

| Year | Depts. | Avg. Dist. (km) | Avg. Flight Mins. | Avg. Seats | Avg. Pax Load Fact. | Avg. AC Age | Total ASK (m) | Total CO2 (kt) | Avg. CO2/ ASK (g) |

| 2019 | 67,726 | 1,026 | 94 | 169 | 83.3% | 10.0 | 13,110 | 979 | 74.7 |

| 2020 | 24,411 | 1,005 | 90 | 163 | 66.4% | 10.2 | 4,498 | 321 | 71.3 |

| 2021 | 25,003 | 1,200 | 104 | 168 | 67.6% | 10.2 | 5,690 | 390 | 68.5 |

| 2022 | 44,119 | 1,187 | 104 | 171 | 80.6% | 10.5 | 10,029 | 704 | 70.2 |

| 2023 | 50,919 | 1,201 | 105 | 171 | 83.3% | 10.7 | 11,531 | 787 | 68.3 |

| 2024 | 54,607 | 1,233 | 108 | 173 | 83.6% | 11.1 | 12,837 | 875 | 68.2 |

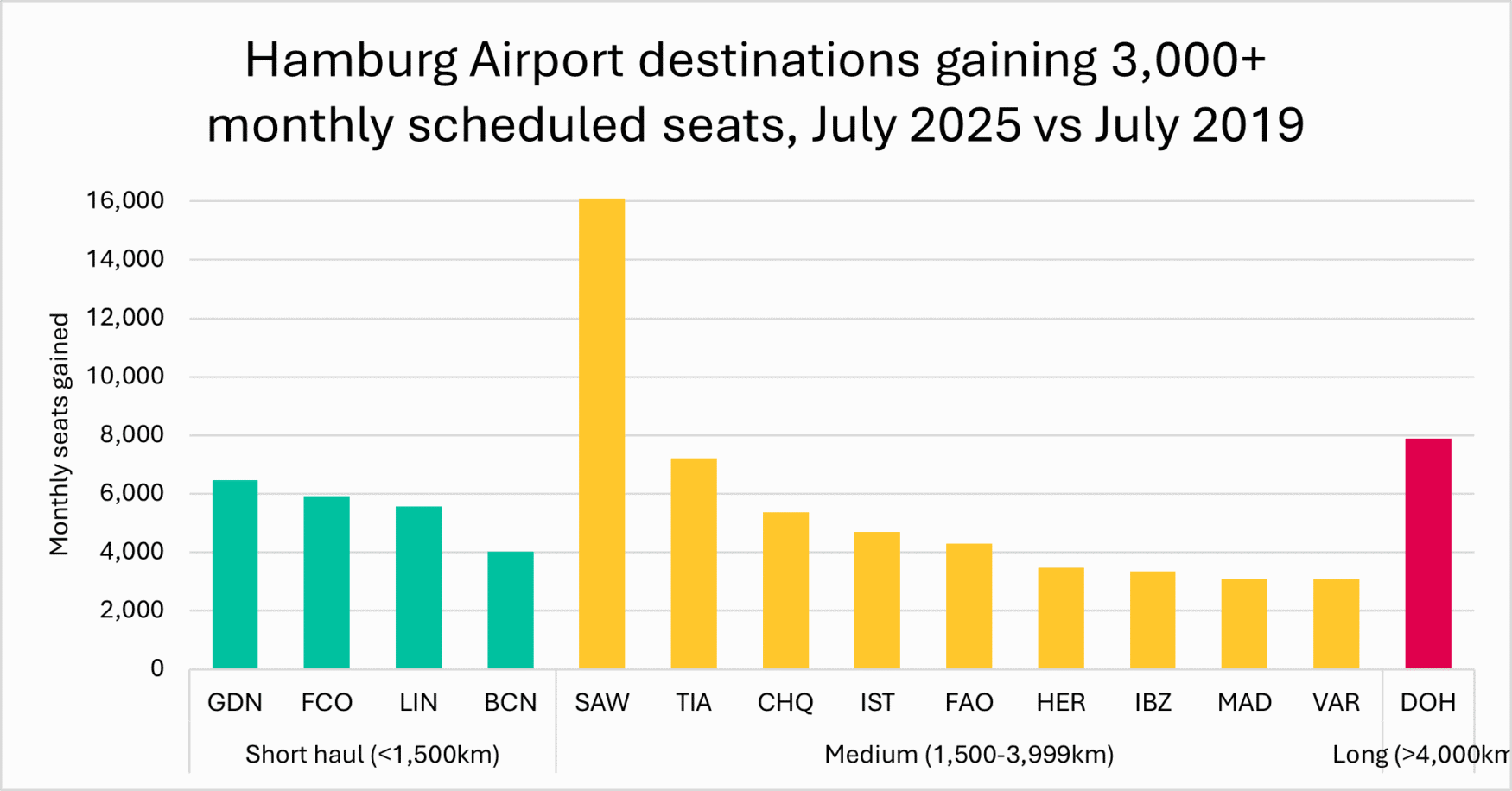

The European cities of Gdańsk, Rome, Milan and Barcelona have been the biggest short-haul gainers in terms of available seat capacity since 2019, while Istanbul’s two airports are the stand-out beneficiaries among medium-haul destinations. Long-haul scheduled passenger routes remain thin on the ground, but Qatar Aways is planning to offer almost 8,000 additional seats to its Doha mega-hub during July 2025, compared with the same month six years previously.

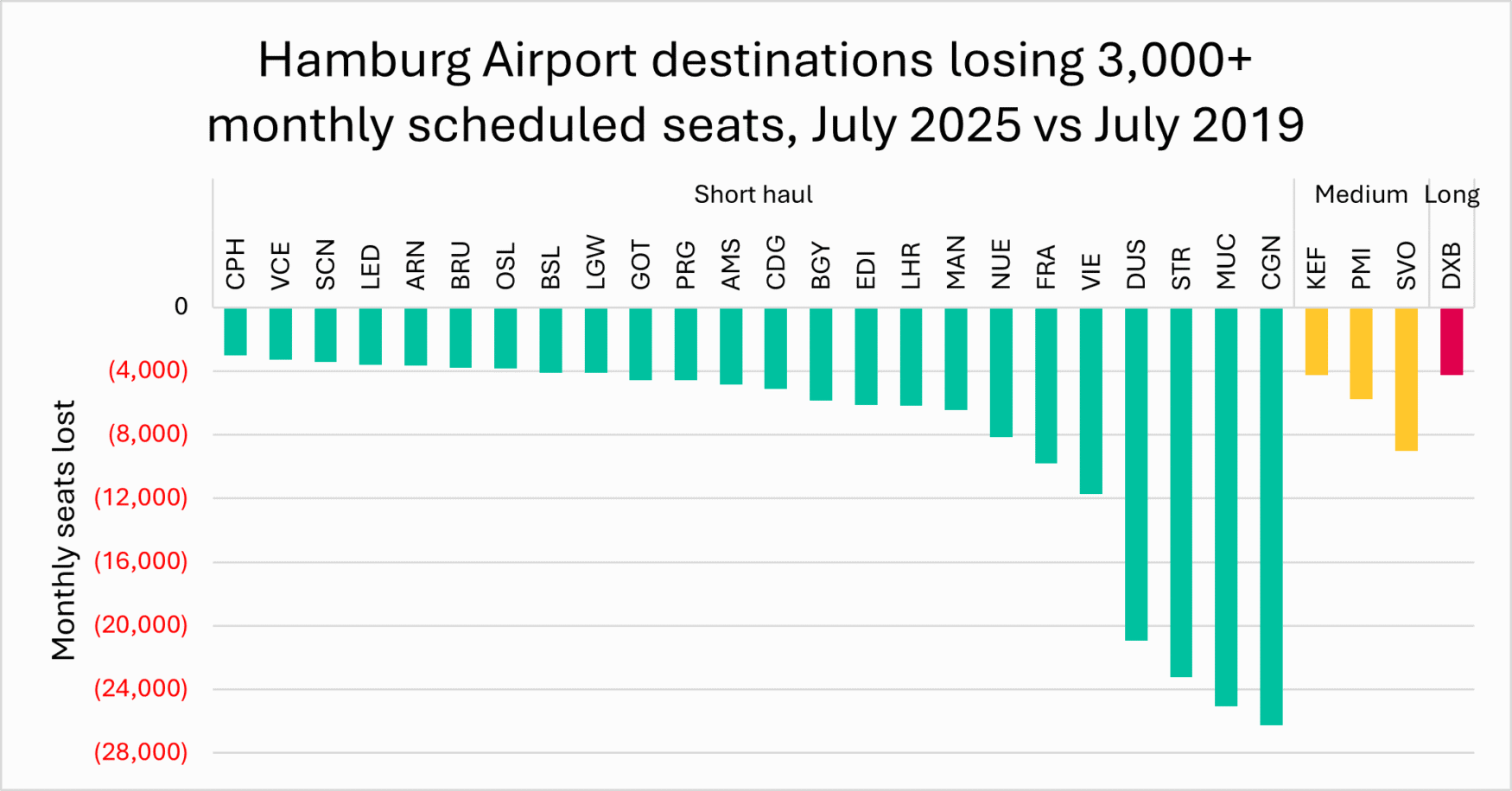

Perhaps unsurprisingly, the biggest losers by seat capacity have been the German domestic destinations of Düsseldorf, Stuttgart, Munich and Cologne, as internal travel patterns have changed since the pandemic and high-speed rail has grown its market share due at least in part to environmental considerations. Looking further afield, Emirates has cut its capacity to Dubai, but this has been more than offset by the extra seats provided by Qatar.

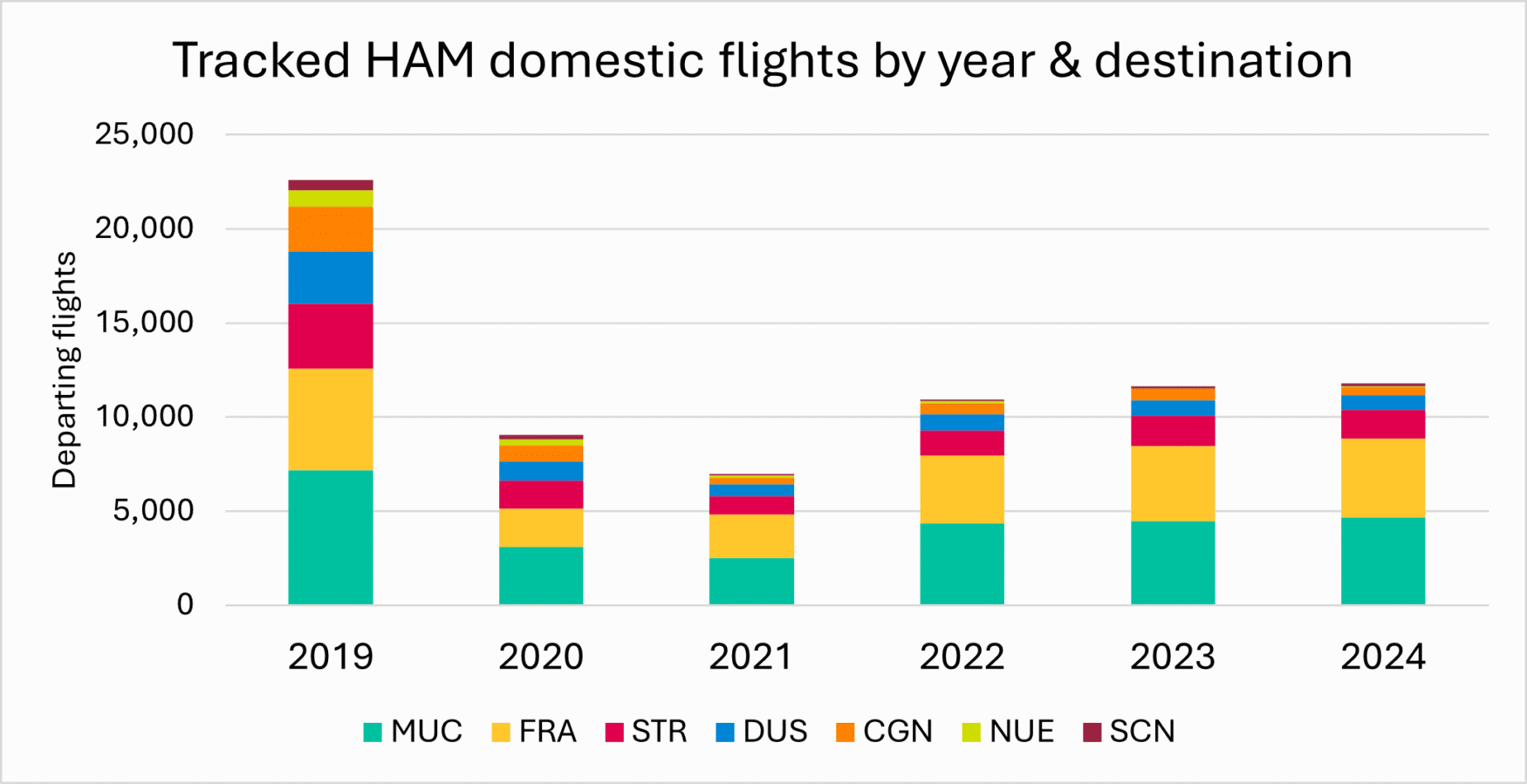

Digging a little deeper into the structural changes to the domestic market we can see that in terms of overall flight volumes the level has for the past three years stabilised at approximately half that seen in 2019.

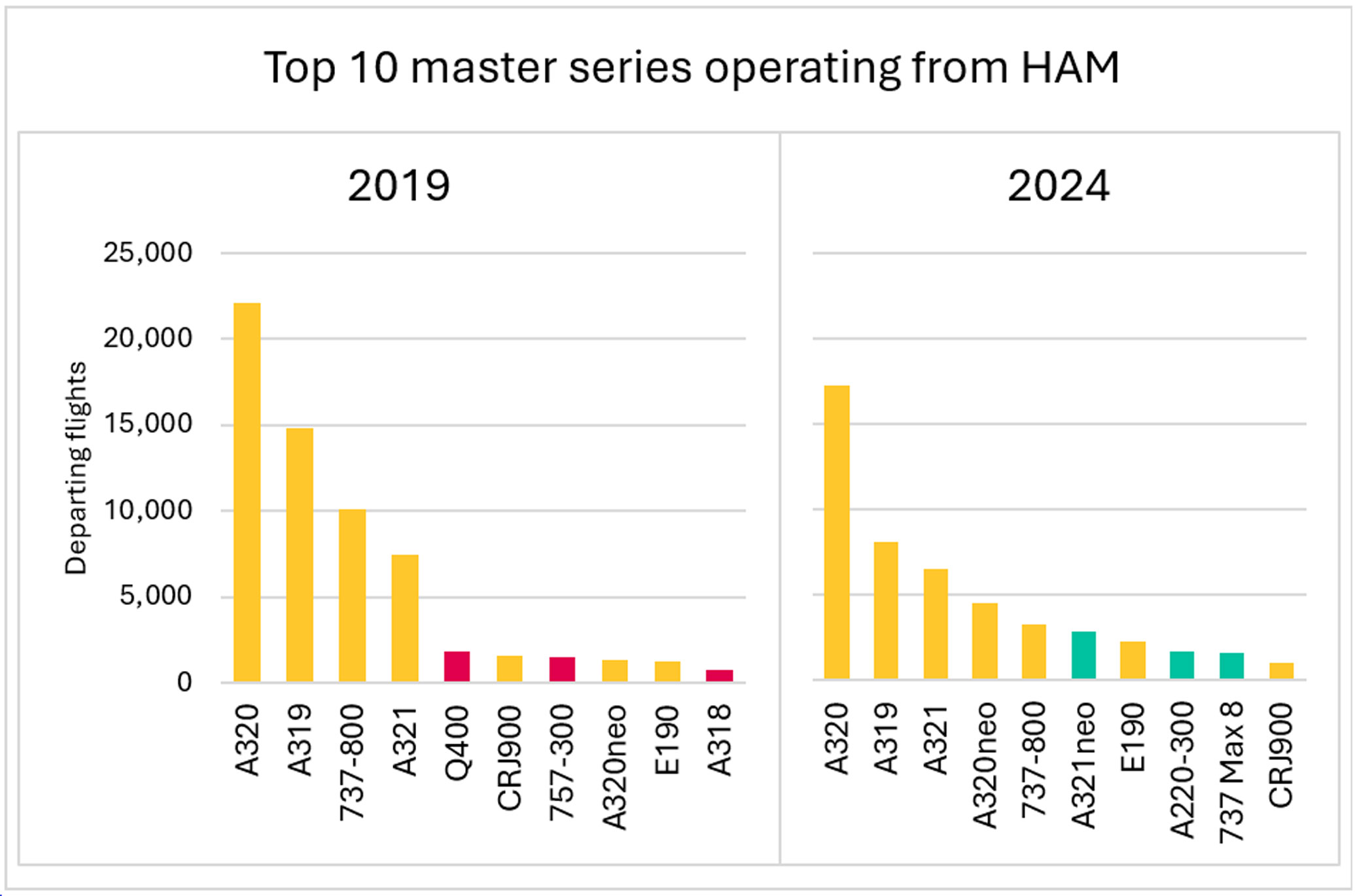

Meanwhile the flight-weighted average age of aircraft serving Hamburg Airport has edged up from 10 years to just over 11 years, but average CO2/ASK for departing flights has reduced by almost 9%, thanks to increasing adoption of latest-generation aircraft types. For example, the proportion of departing flights using Airbus A320neos has significantly increased, while A321neos, A220s and 737 Max 8s were not present at the airport at all in 2019. Conversely, flights by the relatively inefficient A319 have sharply declined over this time period.

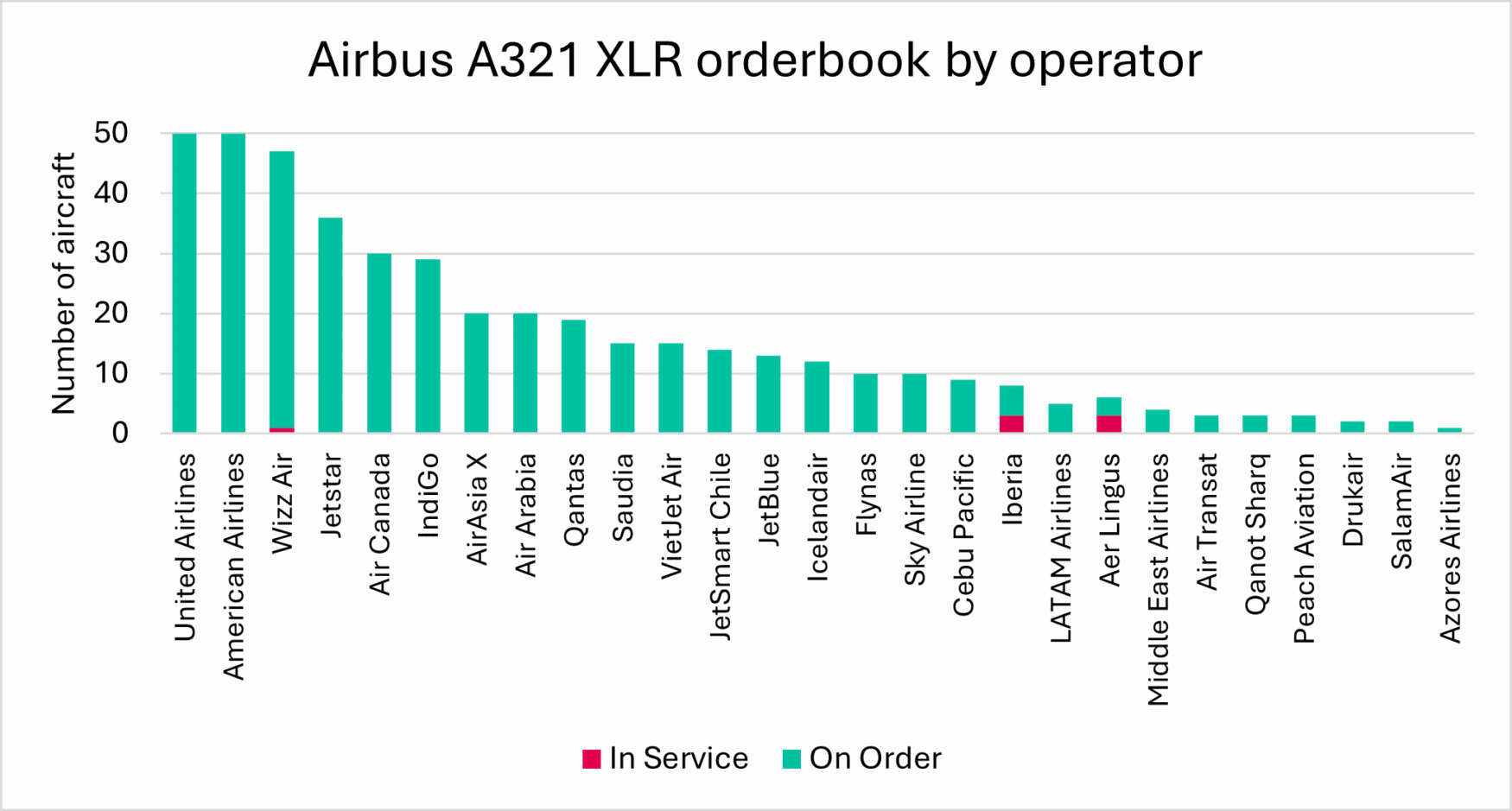

Hamburg Airport could stand to gain additional longhaul connections in the medium-term thanks to the introduction of the A321XLR, which is assembled in the city at the manufacturer’s Finkenwerder site. This latest development of the single-aisle A321neo is designed to enable airlines to launch long thin routes that could not be flown profitably with widebodies. Seven aircraft have entered service to date, with Aer Lingus, Iberia and Wizz Air. However, non-European carriers such as Air Canada, American Airlines, JetBlue, Saudia and United Airlines may look to deploy the aircraft to secondary hubs such as Hamburg if they can identify sufficient demand.

Discover how Cirium data and analytics enable smarter decision-making across the aviation industry. Book a meeting with our experts today.