Mike Malik, Chief Marketing Officer, Cirium

Finding Space Between the Giants

While Gulf carriers built empires on long-haul wide-body operations, Royal Jordanian identified a different opportunity in the early 2000s. The airline positioned itself as the region’s connectivity specialist, deploying efficient regional jets to secondary cities that larger carriers couldn’t economically serve with 777s and A380s. Routes across the Middle East, North Africa, and the Gulf that seemed too small for the big players collectively created a robust feeder system.

This wasn’t just about filling gaps—it enabled frequency. More daily departures mean flexibility for business travelers, and flexibility converts to loyalty faster than price alone ever will.

Global Reach Through Strategic Leverage

The regional focus provided foundation, but Royal Jordanian’s 2007 entry into Oneworld transformed its competitive position. Suddenly, a carrier focused on short-haul connectivity could offer seamless global itineraries. A passenger could fly Royal Jordanian from a secondary Middle Eastern city through Amman, then connect onward via British Airways, American, or Cathay Pacific—all on one ticket with reciprocal benefits.

The alliance delivered network scale without requiring capital-intensive fleet expansion. Royal Jordanian maintained operational control over what it does best while gaining access to hundreds of global destinations through partnership infrastructure.

Differentiation Through Service Quality

When Air Arabia, flydubai, and Jazeera Airways disrupted the market post-2008 with aggressive pricing, Royal Jordanian faced a choice: compete on price or compete on value. They chose value.

The airline upgraded cabins, enhanced ground services at Queen Alia, and strengthened the Royal Club loyalty program while maximizing Oneworld benefits. The bet was straightforward—there’s a segment willing to pay more for reliability, comfort, and convenience, even in price-sensitive markets.

That positioning creates breathing room. Low-cost carriers optimize for different economics and different passengers. Full-service carriers that try to match LCC pricing while maintaining legacy cost structures can lose twice—once on margin, once on brand clarity.

The Operational Discipline Behind the Rankings

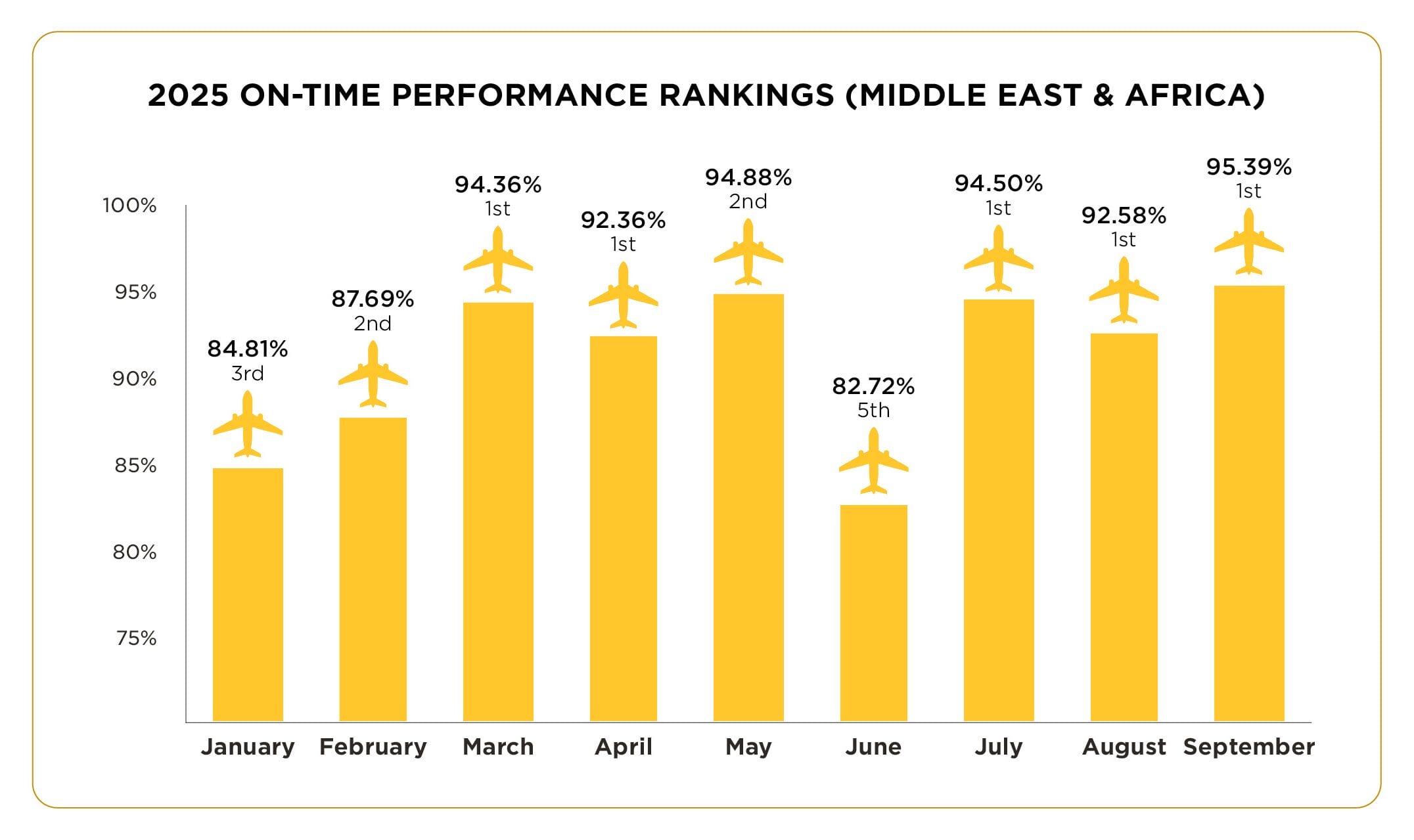

Royal Jordanian operates over 500 weekly flights with more than 110 daily departures from Amman, spanning four continents. That operational intensity requires precision, and the 2025 performance data demonstrates sustained execution:

Looking at these month-by-month results, what stands out isn’t just the peaks—it’s the consistency. Using Cirium’s definition of on-time arrivals within 15 minutes of schedule, Royal Jordanian maintained discipline even when they slipped to 5th in June. The airline had finished 3rd regionally in the 2024 Annual Review with 87.02% OTP and 99.31% completion rate.

These aren’t isolated wins. They represent systematic process management across route planning, turnaround operations, and real-time decision-making under operational pressure.

Leadership and Execution

What changed under Chairman Said Darwazeh and CEO Samer Majali wasn’t the strategy—Royal Jordanian’s regional focus predates their tenure. What changed was execution discipline. Majali, who returned to Royal Jordanian in 2021 after leading Gulf Air and SaudiGulf Airlines, brought additional operational discipline that shows in the numbers.

The 2024 results tell the story: operating profit jumped 260% to JD11.8 million on revenues of JD745.6 million, while carrying 3.7 million passengers. More telling—the airline is self-funding fleet modernization rather than relying on government capital injections. The leadership has plans to have had 70% of the fleet renewed by year-end.

Fleet decisions drive operational performance. Based on the most current information from Cirium Fleets Analyzer, the airline operates 35 Aircraft currently with 11 on order. Order book includes a six B787-9’s, three A321’s, one A320 and one E195 E2. The average age of the current fleet is 8.7 years. This fleet mix is clearly about matching equipment to mission—and creating the frequency advantage that built the business model in the first place.

Lessons for Mid-Sized Carriers

H.E. ENG. SAMER ABDELSALAM MAJALI, Vice Chairman / Board Designee CEO, Royal Jordanian

Royal Jordanian’s performance offers a template, particularly for mid-sized carriers navigating between legacy constraints and LCC disruption. The lessons are transferable:

Strategic focus beats scale ambition. Trying to compete everywhere usually means winning nowhere. Royal Jordanian identified underserved regional routes and dominated them rather than fighting for share on contested long-haul corridors.

Alliances multiply capability without multiplying cost. Oneworld membership gave Royal Jordanian global network reach without the capital requirements of building it organically. For carriers lacking the resources of Gulf super-connectors, alliance leverage becomes essential infrastructure.

Service differentiation requires operational proof. Promising better service means nothing if flights don’t depart on time. Royal Jordanian’s OTP performance validates their service positioning—customers paying premium fares need reliability first.

Strategic Clarity in a Crowded Market

Royal Jordanian didn’t try to become Emirates or match Ryanair’s cost structure. They carved out defensible territory and executed with precision. What strikes me about their approach is the clarity—in an industry where many carriers struggle to articulate what makes them different, Royal Jordanian’s focus is unmistakable.

That September result—95.39% with perfect completion—isn’t an outlier. It’s what happens when strategy and execution align consistently. With three months remaining in 2025, I’m watching closely to see if they can maintain this momentum through year-end.