Andrew Doyle, Senior Director, Market Development, Cirium

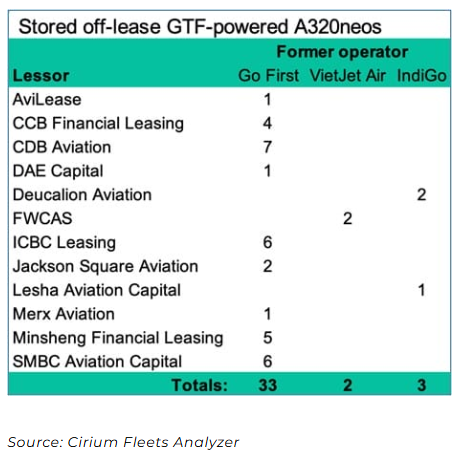

By mid-July over half of operating lessor mainline passenger jet aircraft in storage were Airbus A320neos powered by Pratt & Whitney PW1100G geared turbofan (GTF) engines, Cirium Fleets Analyzer data shows. However, the vast majority of these were placed with operators, leaving only 38 – most of which were formerly operated by the now defunct Go First of India – designated as off-lease.

Fleets Analyzer reveals nine lessors have 33 stored GTF-equipped neos that were with Go First, while two had been operated by VietJet Air and three by IndiGo. Cirium Ascend Consultancy estimates there are only around 140 additional off-lease single-aisles of all types in storage, plus around 20 widebodies.

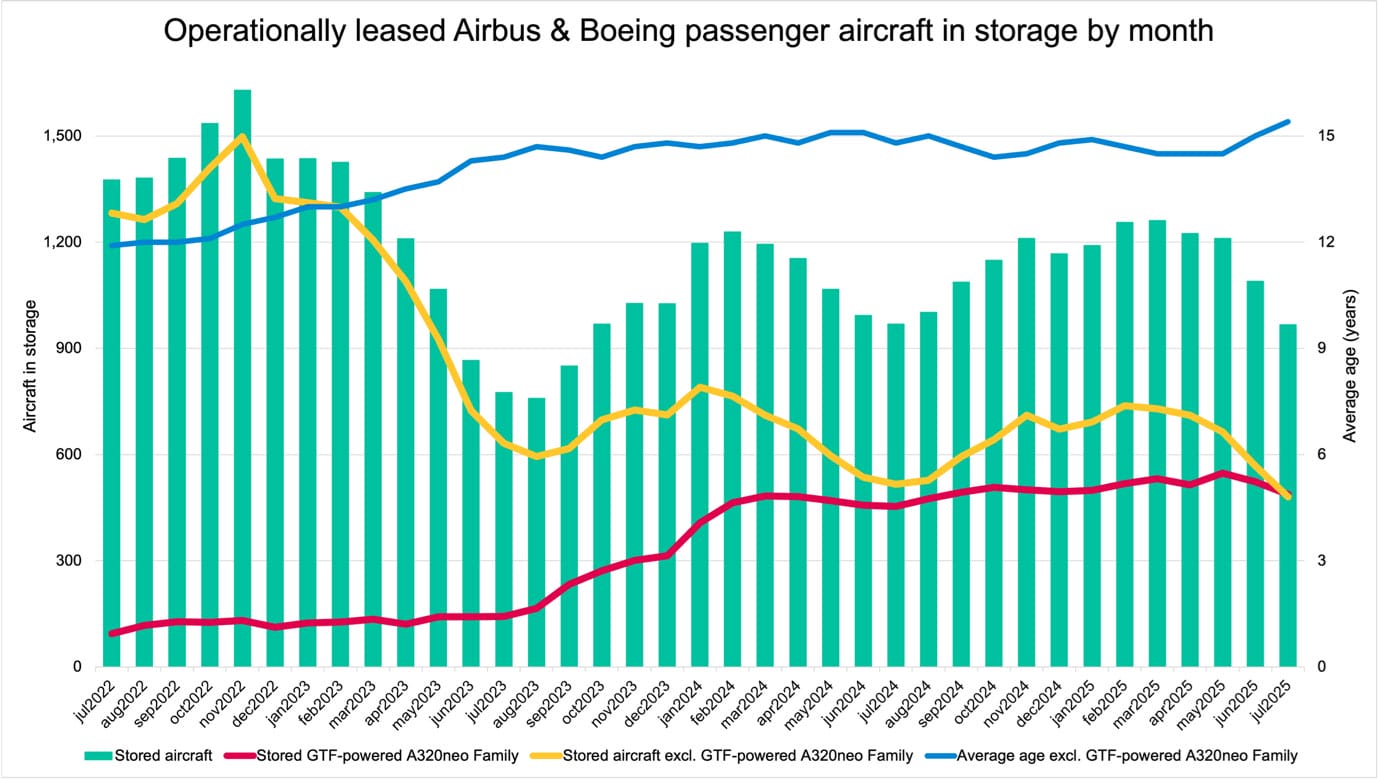

Meanwhile, the overall stored GTF A320neo fleet has stabilised at approaching 500 aircraft – principally due to the shortage of engines caused by well-documented powdered metal contamination issues – while the inactive inventory of all other models declined from a 12-month peak of almost 800 in January 2024 to around 480 by July 2025.

Excluding GTF A320neos, the average age of stored operating lessor aircraft has increased from 12 years in July 2022 to 15.4 years for the same month in 2025.

Source: Cirium Fleets Analyzer

A net total of approximately 150 operationally leased 737-800s and A319/A320ceos entered storage between August 2023 and January 2024. However, these types have since seen a resurgence in demand thanks to the ongoing GTF issues and the supply chain difficulties preventing new aircraft production rates reaching planned levels.

Operating lessors in July accounted for almost 1,500 delivered GTF-powered A320neo family single-aisles, of which just over a third are inactive. Of the top 30 lessors for this type (with portfolios of 10 aircraft or more) AerCap and SMBC Aviation Capital’s airline clients have seen the biggest impacts in terms of absolute numbers, although some smaller lessors have a greater portion of their smaller portfolios on the ground.

Overall, fewer than half of the approaching 2,300 Airbus and Boeing passenger aircraft listed by Cirium as stored in July 2025 were operating lessor-managed. However, collectively they managed more than 83% of the just over 600 stored GTF A320neos.

Meet the Cirium team at ISTAT EMEA 2025.

Hear from Stephen Burnside, incoming Global Head of Cirium Asend Consultancy, Tuesday 7th October 2025 at 14:00.