Vanessa Gu, Asia Finance Editor, Cirium

Power to perform: The aircraft engine market was broadcast live Thursday 25th September.

The cost of maintaining new-generation engines is expected to be higher than current-generation engines even with improvements in hardware, supply and the easing of MRO constraints.

That is as the latest engines are requiring more shop visits than those of 10 years ago as more efficient fuel burn has inadvertently resulted in quicker wear and tear, and shorter time on wing.

While ongoing improvements such as Pratt & Whitney’s GTF Advantage programme and more durable blades on the CFM International Leap engines are expected to allay some of those issues, “it still is an altogether different level of cost on engines now compared with the previous generation,” says Giles Thomas, Managing Director at Charlotte Parker Associates.

“So it will get better. I don’t think, unfortunately, we’re going to get back to the levels of time on wing and product robustness, or reliability … that we, for example, saw relatively now on the CFM56, V2500, widebody, GE CF6, Trent 700 which were pretty predictable,” he adds, while speaking on a panel Cirium’s ‘Power to perform: the aircraft engine market’ webinar.

At the same time, the unreliability of new-generation engines has made an increasing number of airlines “a bit reluctant to look into the new technology aircraft also because there’s a lot of risk which they got to take on that,” says Mahesh Kumar, chief executive of Capital A subsidiary Asia Digital Engineering, who was also on the panel.

That reluctance has been exacerbated by engine manufacturers moving away from power-by-the-hour agreements as OEMs have underestimated the amount of maintenance and repair their engines need, says Kumar.

Coupled with the ongoing supply chain crunch and MRO slot constraints, the values and lease rates of old and new generation engines have rocketed in the past six years, leaving airlines to bear the brunt of added costs.

“That’s the interesting part of it – your product [new generation engines] is not reliable, the value of your engine went up because the demands spiked up, so on that I would say the airlines are on the suffering part of it,” Kumar states.

Engine values and lease rates

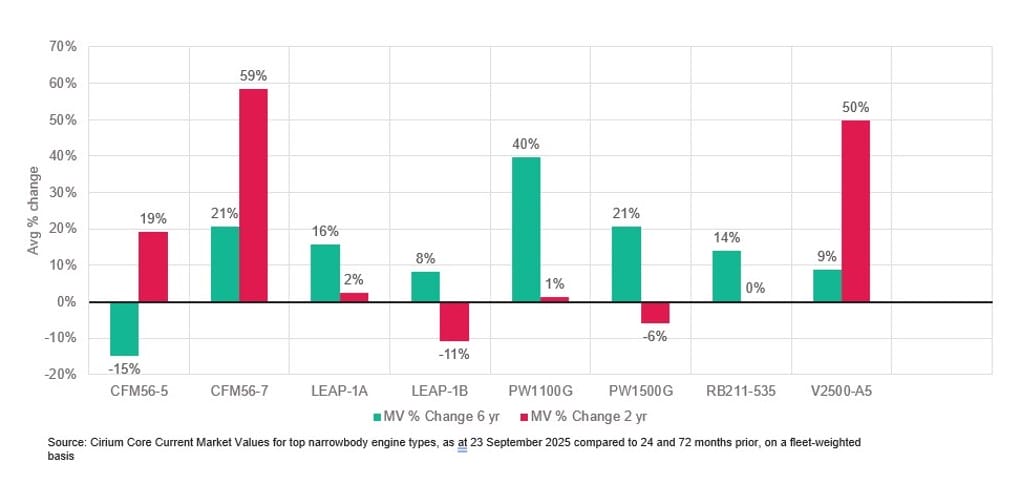

The market lease rates of narrowbody and widebody engines have gone up by 34% and 23%, respectively, while market values are up 14% and 5%, respectively, compared to September 2019, details Cirium’s Senior Valuations Analyst Lionel Olonga on the webinar.

Breaking it down further for narrowbody engines, the increase in value is most pronounced over the last two years for CFM56-7B engines that power Boeing 737-800s and International Aero Engines V2500 powering Airbus A320ceos.

The increase in values for -7Bs are mainly driven by the NGs operating for longer due to delivery delays, while the increase for V2500s are due to operators which have A320neos powered by Pratt & Whitney’s PW1100G engines in their fleet renewal plans increasing the use of their existing -ceos, explains Olonga.

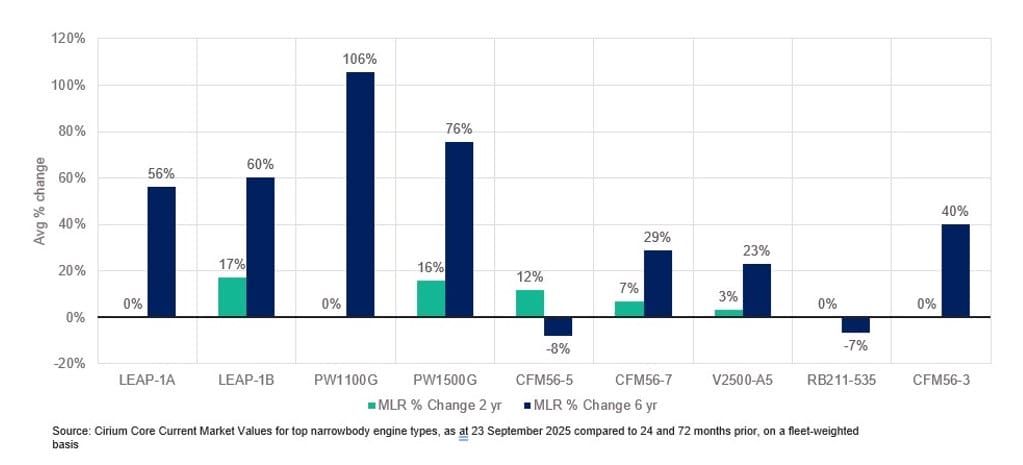

On market lease rates, PW1100G has seen a more than two-fold increase on lease rates compared with 2019, while the Leap-1A and -1B engines have seen a more than 50% increase.

These increases come on the back of an uptick in maintenance costs and green time value for new generation narrowbody engines – such as the Leap and GTF – which have increased by over 50% in the last six years, while those for CFM56s and V2500s are 10-30% higher, says Olonga.

Widebody engines also tell a similar story, with maintenance costs and green time values up 60% for new generation engines and a 10-30% uptick for older generation engines.

Gradual decline to sane pricing

The current issues facing the industry have been described as a perfect storm that is expected to bare its teeth until the end of the decade.

However, as the supply of new aircraft increases and as MRO constraints ease, there will be a “readjustment”, says Thomas, though he cautions it will be gradual and measured.

As older aircraft retire with the incoming new generation jets, Thomas is of the view that values of CFM56s or the V2500s “will certainly decline”.

“A decline, I should clarify, doesn’t mean … necessarily, very quickly. And what I mean is decline from the current very high levels today” to “historic levels pre-Covid” before the aircraft types start retiring in volume, he says.

An example of “high levels”, he details, is how he heard anecdotally that “completely run out” CFM56 engines with no performance left and “virtually done” life limited parts trading for above $3 million.

“Therefore, that sort of elevated level of value, which is purely a factor of lack of MRO capacity and lack of power supply, that will disappear, so therefore the engine values would, for that sort of engines, go back to a million or less,” he goes on to say.

In the meantime, however, values for engines are expected to stay high as airlines continue to grapple with a litany of issues ranging from MRO slot constraints and unreliability of new generation engines.

Kumar says the need for spares is not merely about manufacturers producing the required engines but also related to increased shop visits due to engine reliability issues.

And shop visits now have longer turnaround times and increased costs, and from an airline’s perspective, “it might make sense to get another engine in, rather than putting the older engine for a shop visit,” states Kumar. This in turn further drives up values.

Regardless of when the gradual fall of values might happen, Thomas cautions: “If one is investing in engines today, one needs to be very aware of what engine build standard one is investing in, so that you have some knowledge and competence in the longevity of that particular engine variant of any new engine technology engine.”

Premature aircraft partout will continue (for now)

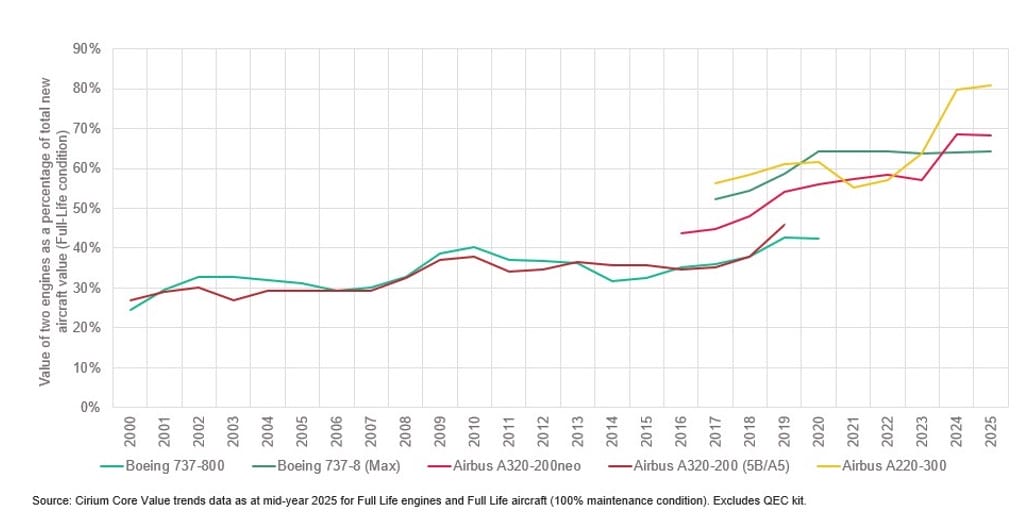

There are at least 15 A320neo family aircraft that have been retired for part-out as the value of a pair of engines is hovering close to 70% of total aircraft value for the type, says Olonga.

With the value of engines taking up such a big portion of aircraft value, the interest in purchasing aircraft for the engine or for parting them out is expected to continue.

Thomas recalls how one airline said it was doing four engine changes in the next 10 days “purely to keep its fleet flying”, highlighting a “horrendously complex situation which is not going to be cured quickly”, meaning demand for part-out engines will remain high.

At the same time, for lessors, leasing an aircraft at a price they need while taking into consideration the high engine values may be hard for airlines to swallow.

“Therefore the solution for engines is actually pretty neat, and the byproduct of that also is all the serviceable used material from the rest of the aircraft and airframe,” says Thomas.

Kumar likewise concurs that interest in parting out new generation aircraft will continue, recounting that an airline was willing to lease a widebody just to drop both the engines and put it back to operations.

“It makes complete sense for the lessors to just drop the engines from the aircraft and then lease it where they can make a better margin out of it, rather than leasing the whole plane,” he says, adding that it also reduces transition and redelivery costs.

Despite the continued interest, it is widely acknowledged that the parting out of six-year-old aircraft with years of service left due to part shortages and limited MRO slots is highly unsustainable.

While Thomas expects the situation to continue in the shorter to medium term, he hopes to see “common sense and normal rules of the aviation industry returning in a couple of years’ time”.

Power to perform: The aircraft engine market is now available to watch on demand.