READ ALL OF THE LATEST UPDATES FROM ASCEND CONSULTANCY EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS. MEET THE ASCEND CONSULTANCY TEAM.

By Chris Seymour, Head of market analysis at Cirium Ascend Consultancy

The ACMI market in Europe is experiencing another good year, with over 430 wet-lease events recorded to date in the Cirium fleets database involving passenger jets and some 260 aircraft in operation in the summer peak. Passengers on a British Airways flight in Europe this summer may find themselves on a Finnair A321, or those going to Chicago on an Air Belgium A330-900.

Usage of aircraft on an ACMI (Aircraft Crew Maintenance Insurance) basis – commonly called wet-leases (or damp leases if no cabin crew supplied), had been growing strongly before Covid hit.

ACMI had become especially popular as a way of adding marginal capacity for the peak summer holiday season, when typically, two thirds to three quarters of activity takes place.

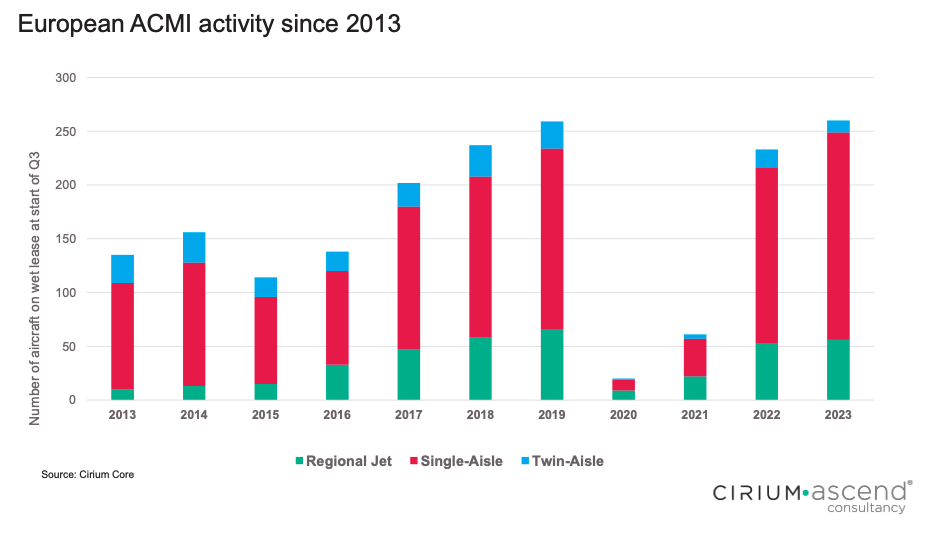

The chart shows that the wet leased fleet (at start of Q3 in peak summer season) increased in the mid-2010s to pass 250 in 2019, before the pandemic slump.

A bounce-back in 2022 came as airlines sought to rebuild their networks post-Covid and meet increased demand for holidays after two years of lockdowns. Delays in delivery of new aircraft due to supply chain issues exacerbated the lack of capacity, hence ACMI recovered strongly, and this has continued into 2023, with the wet leased fleet growing again and back to 2019 levels.

Some 100 European airlines have used wet leased aircraft since the start of 2022, and they encompass a wide variety of business models. Amongst the largest users have been the TUI Group, Eurowings, SAS, Swiss and Condor. TUI’s leisure routes have seen use of A320s and 737-800s up to A330-300 size, while Eurowings scheduled operations are using A320s and A220s. Both SAS and Swiss are using A220s and regional jets including CRJ900s at SAS and EJet E2s at Swiss. Between them they use these regional jets on thinner routes where their own mainline aircraft are too big.

The last 18 months have provided business for some 90 different groups or airlines, many of which specialize in ACMI. This is the case for Avia Solutions Group, which includes Avion Express, Smartlynx and Air Explore (AOCs in the three Baltic states, Malta and Slovakia) which accounted for 20% of the wet lease events. Following with 15% is Latvia’s airBaltic, which has supplemented its own scheduled operations by operating A220s for three other airlines.

Some operators specialise in twin-aisles, including Wamos Air (A330s) and EuroAtlantic (767s), but most focus on the single-aisles, which account for almost 80% of events. Examples of smaller operators of these include GetJet Airlines of Lithuania (A320s and 737-800s), Electra Airways of Bulgaria (A320s) and Titan Airways of the UK (A320 and A321s).

Wet leases have involved 445 individual aircraft over the period. Most popular types are the A320-200 and 737-800, with 34% and 16% of activity each, and both with an average aircraft age of 16 years, illustrating the importance of ACMI to keeping mid-life and older assets flying.

The 260 aircraft in current wet lease operation may represent only 5% of the European jet fleet, but on a micro level, are key to certain airlines operations. 80% of this fleet are also leased from operating lessors, so are also important to them to keep older assets in passenger operation.

As the OEMs sort out their delivery issues, it may be that some ACMI demand reduces in the coming years, but it seems likely that the flexibility that these aircraft offer for summer peak capacity or regional operations will see ACMI continue to be part of the European scene for years to come.

SEE MORE ASCEND CONSULTANCY POSTS.