Cirium Ascend Consultancy is trusted by clients across the aviation industry to provide accurate, timely, and insightful aircraft appraisals. The team provides the valuations and analysis the industry relies on to understand the market outlook, evaluate risks and identify opportunities.

Discover the team’s industry reports & market commentaries. Read their latest expert analysis, viewpoints and updates on Thought Cloud.

Richard Evans, Senior Valuations Consultant, Cirium Ascend Consultancy

With the first examples of the Airbus A321XLR variant now in service, the network plans for this sub-type of the extremely successful A321neo are starting to become clearer.

There are now four airlines with aircraft in regular service, with at least two more to come by the end of 2025. It has not all been plain sailing for the new variant, however, with delays due to certification and seat supply issues. There has also been the news that Wizz Air is exiting the Abu Dhabi market, which calls into question its commitment to the XLR.

Airbus does not formally split out variants within its A321neo order book. Cirium’s Fleets Analyzer currently shows a total of 15 aircraft delivered (11 in service and 4 currently stored), plus a firm order backlog of 461 units for commercial customers. This represents around 9% of the total A321neo backlog, but there could be additional commitments that have not been made public.

To what extent the XLR is a niche version of the type, or not, is a relevant question for financiers and lessors, especially given the XLR commands a price premium for its capability. To illustrate this, Cirium’s Values Analyzer shows a Full-Life Market Value (FLMV) of $62.4m for a brand-new baseline A321neo (no ACTs, 93.5t Max Take-off Weight). This increases to $66.8m for an A321neo, with 3 tanks fitted and 97t MTOW. Although not an official nomenclature, this configuration is often referred to as an A321neo LR. For the XLR, FLMV increases to $71.9 million. For comparison, the smallest twin-aisle type currently in production, the 787-8, commands a FLMV of $127.9 million.

A321XLR order book, as at 17 September 2025

Source: Cirium Fleets Analyzer

The status of JetBlue’s order is unclear, with its first two aircraft destined for sale to Altavair on delivery, for onward lease to Aegean Airways. It also appears likely that the Wizz Air Group will convert some of its backlog to other versions of the A321neo.

By the end of 2026, there are set to be at least 13 airlines flying the XLR, operating in a wide variety of seating layouts. Many, such as Aer Lingus, Air Canada, Aegean, American and United, will fly with lie-flat business class seats, in contrast to Wizz Air and other Low Cost Carriers (LCCs) flying with high-density seating layouts of 230-240 seats. Qantas plans two different layouts, with initial deliveries having a 37 inch pitch business product, but then others with full lie-flat business class for longer routes.

The selling point of the XLR is additional range. Airbus markets the type as having a range of up to 4,700 nautical miles (nm), but this is subject to caveats. Firstly, this is the range with a standard dual-class seating configuration. Fitting more seats will mean less range. Secondly, real-world routings and headwinds generally cut the true capability, for great circle distances, by around 15%. Thus, the longest route that could be reliably flown year-round may be more like 4,000 nautical miles great circle. This is similar to London to Denver, or Sydney to Bangkok.

For airlines configuring just 138-155 seats, the range capability may, conversely, be more than 4,000 nautical miles. These type of configurations, including business class and premium economy seats, are clearly aimed at high-yield premium markets.

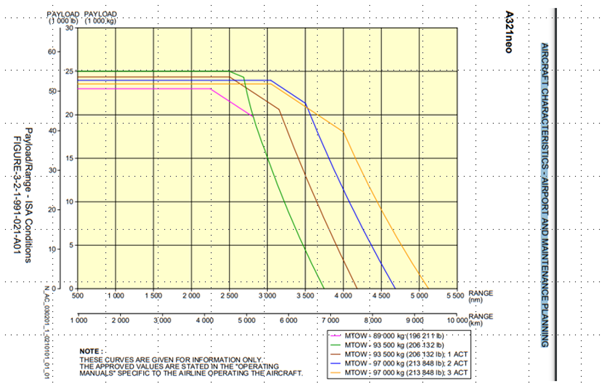

Airbus has not yet published a payload-range chart on its Airport Operations and Aircraft Characteristics website, but the below chart including the A321neo LR (97,000kg MTOW with 3 ACTs) highlights the issue of payload capability. It shows that for an LCC, such as Wizz Air with 239 seats, the aircraft is operating very close to its maximum payload of around 23 tonnes.

A321neo payload-range capability

Source: Airbus

We believe the XLR will have a marginally higher empty weight than the LR, but that Airbus is looking to increase the MTOW from 101t to 101.5t to restore payload and/or range capability. It is thus likely that the XLR will have a similar maximum payload to the A321LR. This means that fitting 230 seats or more results in hitting maximum payload on routes with high luggage needs – typical of many routes to/from the Middle East, Africa, and Latin America. This is not an issue for network airlines, where they are fitting low-density dual-class or three-class layouts.

The big question, therefore, is where do the XLR operators plan to fly their aircraft, and how far can they extend operations into markets previously only available to longer-range twin-aisle types?

The longest routes currently flown by the initial operators are shown on the map below. Iberia’s Madrid-San Juan route is 3,448 nm great circle distance and Aer Lingus’s Dublin-Nashville flight is 3,394 nm. Wizz Air’s Gatwick-Jeddah and Milan-Abu Dhabi services are both around 2,550 nm. This highlights that the XLR is not really required for most Middle East to Europe operations, but also that the initial operators are not pushing the range out to anywhere near Airbus’s marketing figure. As an example, Etihad Airways recently stated it saw the A321LR as sufficient for its needs.

Longest current A321XLR routes, November 2025

Source: Cirium schedules data

For reference, the longest A321LR route today is Sharjah to Kuala Lumpur by Air Arabia, with 215 seats, at 2,990 nm. This matches very well with the A321LR range in Airbus’s payload-range diagram of around 3,500 nm, before track and headwinds are accounted for, at 21t of payload.

Several other airlines have announced their initial A321XLR routes. Aegean has said it will fly to Mumbai (2,783 nm) and Delhi (2,697 nm) initially, potentially followed by Bangalore (3,216 nm). It will have a code-share partnership with IndiGo, who will also use its first XLRs on these two markets. Lastly, Air Canada will operate the type on Montreal to Edinburgh (3,031 nm), Toulouse (3,569 nm) and Palma de Mallorca. The latter is the longest route announced yet, at 3,777 nm, and will be a summer-only service.

Analysis of existing and planned XLR routes indicates the real-world range network capability of the XLR (taking into account headwinds and track deviation) comes out more like 3,500-4,000 nm with low-density seat layouts, or considerably less for a 239-seat Wizz configured aircraft.

To conclude, the A321XLR looks set to be a very important aircraft for many airlines, especially those seeking to maximise premium revenues on thinner business or leisure-focussed routes.

For LCCs, it may be less attractive. For them, ancillary revenue is very important and flying longer missions does not necessarily maximise this. There may be more hold-bag fees and more opportunity to sell meals on longer flights, but there are fewer flights per day to do so. Having a sub-fleet of XLRs may also limit the ability to maximise asset utilisation across both short and long sectors.

It is still too early to accurately forecast what proportion of the A321neo fleet the XLR will represent long-term. It may well be a relatively niche product, but has already been ordered by several influential major carriers. Liquidity could be an issue, but major network airlines tend to retain their aircraft longer, so this could be mitigated, such that the premium pricing for the type is justified.