Cirium Ascend Consultancy is trusted by clients across the aviation industry to provide accurate, timely, and insightful aircraft appraisals. The team provides the valuations and analysis the industry relies on to understand the market outlook, evaluate risks and identify opportunities.

Discover the team’s industry reports & market commentaries. Read their latest expert analysis, viewpoints and updates on Thought Cloud.

Team Perspective

Max Kingsley-Jones, Head of Advisory, Cirium Ascend Consultancy

The Airbus A330ceo’s recovery momentum has continued through 2025, with the -200/300 combined in-service passenger fleet now at 88% of the total inventory. Meanwhile, the number of A330 freighters in service – including both converted aircraft and factory freighters – is close to passing the 100-aircraft mark.

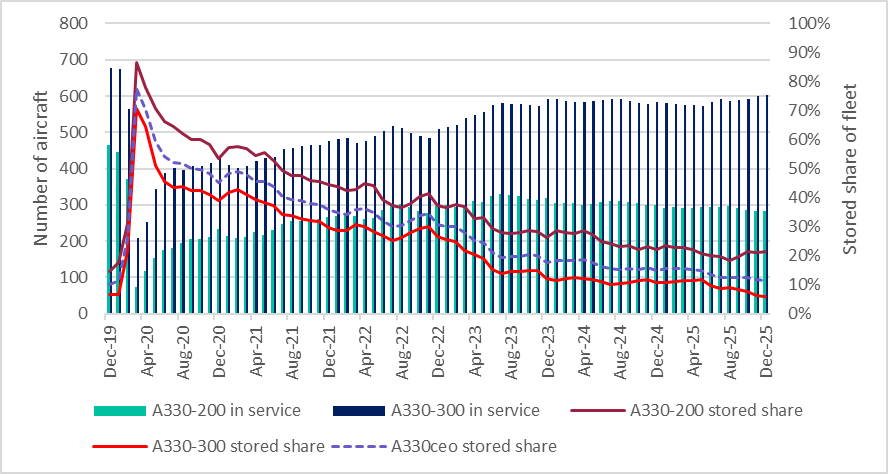

The A330-300 recovery has fared particularly well, with the in-service passenger fleet having just nudged above 600 units, according to Cirium data (chart 1). This the highest it has been since the Covid crisis began and just 10% below the 680 aircraft in-service tally back in late 2019.

Just 6% of the passenger -300 fleet remains stored, compared with 21% of the -200’s, which is not enjoying the same strength of recovery as its bigger sister. The in-service -200 passenger fleet is now at around 280 aircraft, having peaked at 330 in mid-2023. The current -200 operating fleet is two-fifths behind its pre-Covid level of 460 aircraft.

Chart 1: A330 passenger fleet recovery trend

Source: Cirium Fleets Analyzer

The ongoing deficit of passenger widebodies has been driving the recovery of the passenger A330ceo market, bolstering Market Values and Lease Rates over the last couple of years. Most recently, Cirium increased Market Values for both the A330-200 and the -300 High Gross Weight variants in September 2025 by 12% on a fleet-weighted average basis.

The -200/300’s combined storage inventory (115 aircraft) is now less than 12% of the passenger A330ceo’s total fleet. The 26% decline in the stored inventory through 2025 (from 155 aircraft) has been driven by several factors, including: aircraft being returned to passenger service; being converted to freighters or being parted out. Cirium has so far recorded a total of 25 A330ceo passenger retirements for 2025, including 16 -200s and nine -300s.

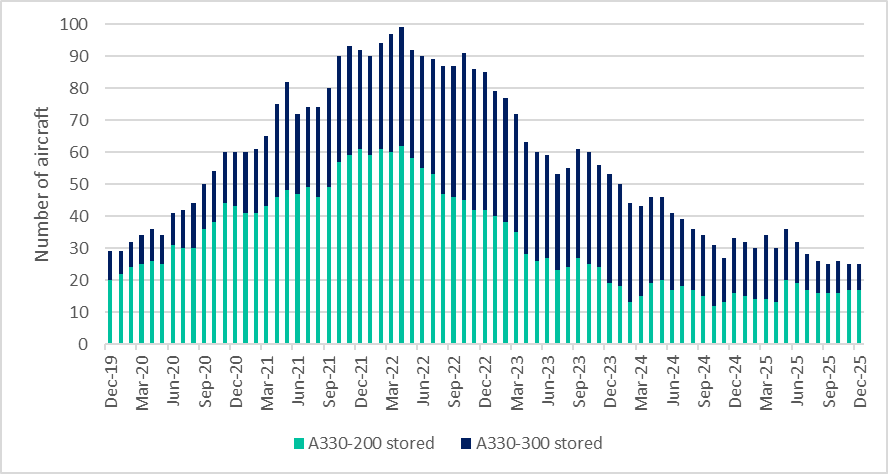

Chart 2: Lessor-managed passenger A330ceo stored inventory

Source: Cirium Fleets Analyzer

The number of stored passenger A330ceos managed by lessors has declined by 25% over last 12 months and now stands at just 25 aircraft (chart 2). This total includes 17 A330-200s and only eight -300s. The lessor-stored tally had peaked in Q2 2022 at around 100 aircraft, and the inventory decline is another good measure of the current health of the A330 market.

On the cargo front, Cirium data shows that the A330 full-freighter fleet has risen by a fifth over the last 12 months to 97 aircraft, including 38 -200 factory freighters and 59 EFW-converted aircraft (21 -200P2Fs and 38 -300P2Fs). Cirium recorded 13 A330 freighter conversions in 2025 and shows at least 11 more scheduled in 2026, including the first of up to 30 -300BDSFs by Israel Aerospace Industries for lessor Avolon.

Probably the biggest issue that the A330 conversion market faces is the lack of feedstock due to the strength of demand for passenger aircraft. Given Airbus and Boeing look set to face continuing issues for the next 2-3 years at least in achieving significant increases in widebody deliveries, it’s hard to see any near-term softening of the A330 passenger market – barring of course any unforeseen external factors.