Cirium Ascend Consultancy is trusted by clients across the aviation industry to provide accurate, timely, and insightful aircraft appraisals. The team provides the valuations and analysis the industry relies on to understand the market outlook, evaluate risks and identify opportunities.

Discover the team’s industry reports & market commentaries. Read their latest expert analysis, viewpoints and updates on Thought Cloud.

Team Perspective

Sara Dhariwal, Senior Aviation Analyst, Lead Appraiser – Helicopters & AAM, Cirium Ascend Consultancy

Emergency Medical Services (EMS) helicopters have become a critical component of healthcare in many high-income countries. They enable patients in life-threatening conditions to reach hospital within the “golden hour”, often much faster by air than by road. In some markets, they are also used for inter-hospital transfers when specialised care is required.

The EMS helicopter sector is highly dependent on funding, which can come from public or private sources. Operating models vary widely and include:

- Government-funded services at national or local level.

- Privately-owned hospitals, particularly in the United States.

- Charity-funded operations, common in the United Kingdom.

- Publicly funded, non-profit organisations.

- Insurance and roadside assistance organisations, such as those in Germany.

Aircraft may be operated directly by these organisations or outsourced to commercial operators under contract.

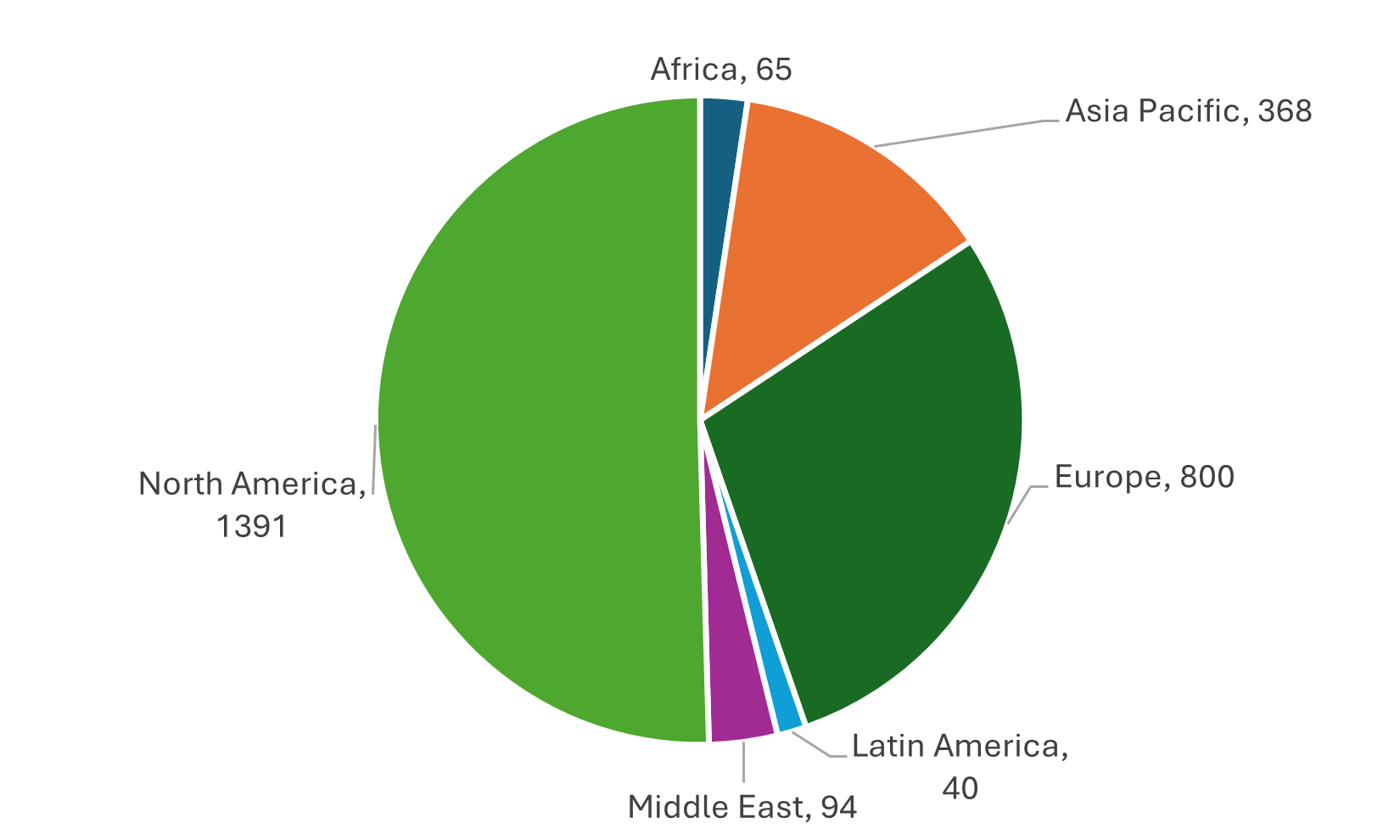

The largest EMS helicopter fleet operates in North America, with nearly 1,400 aircraft configured for emergency missions—accounting for around 50% of the global total. Europe ranks second, operating approximately 800 helicopters, which represents close to 30% of the worldwide fleet.

Source: Cirium Core

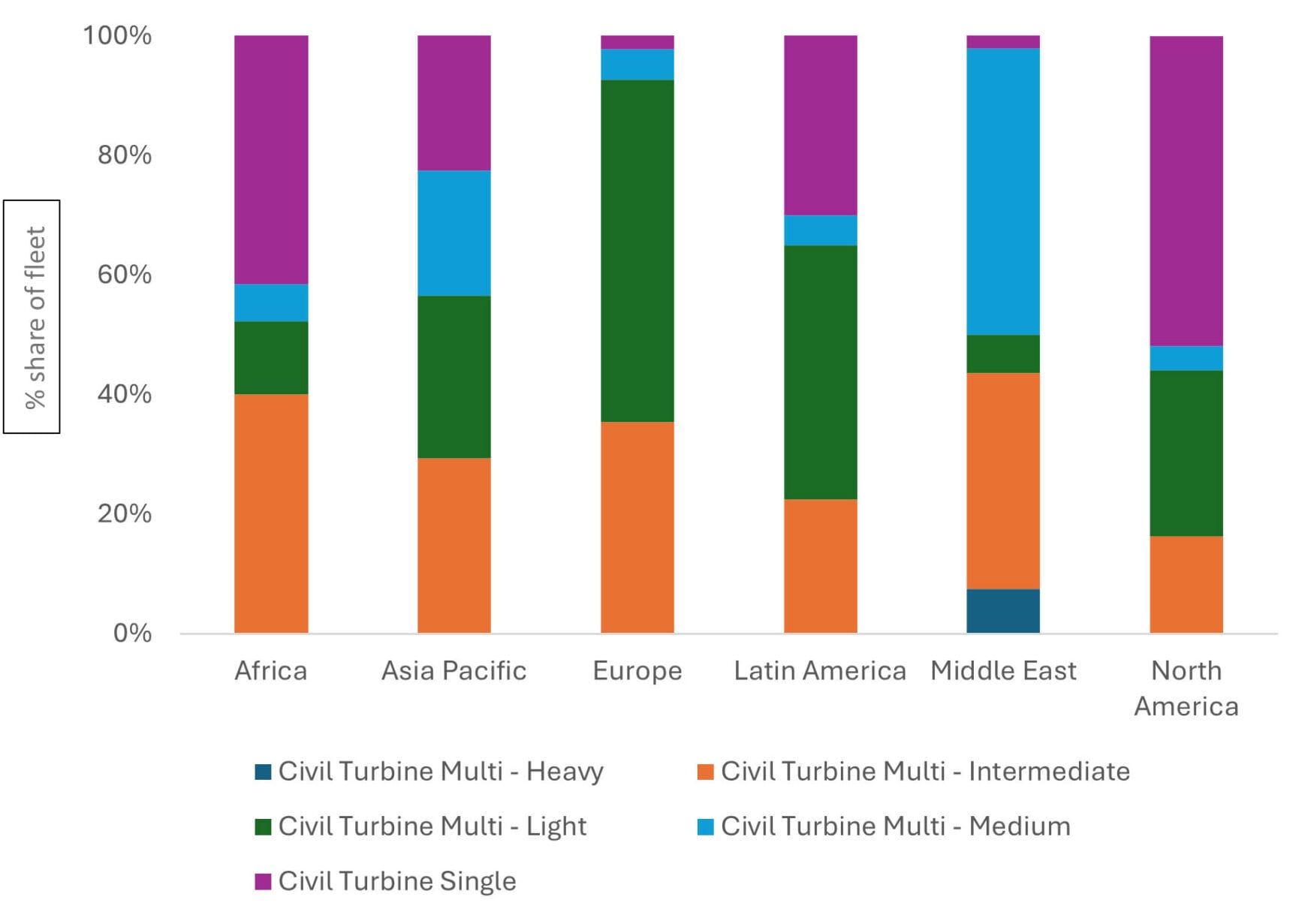

Fleet composition differs significantly between these regions. In North America, single-turbine helicopters make up just over half of the fleet. In contrast, Europe rarely uses single-engine aircraft for EMS, with these representing only about 3% of its total fleet. This disparity stems largely from the single-engine-out rule introduced as part of EASA safety regulations in the early 2000s. This rule required that helicopters operating in certain conditions (e.g., over densely populated areas or at night) must be able to continue safe flight and landing after an engine failure—something single-engine helicopters cannot guarantee.

There has also been a shift in operational philosophy. Rather than viewing helicopters solely as transport vehicles for moving patients from accident scenes to hospitals, Europe increasingly embraces the concept of delivering advanced emergency care onboard—similar to an ambulance. Consequently, cabin size has become a critical factor, driving a transition towards larger, medium twin-engine models, which now dominate the European EMS fleet.

Source: Cirium Core

Over the past decade, the EMS fleet has grown steadily at around 2.5% per year. This expansion has been partly enabled by lessors—of the approximately 560 helicopters added since 2015, 45% were leased aircraft. The leased share of the total EMS fleet is now at 14%, increased from 3% a decade ago.

The rise in leased fleet share within the EMS sector was likely driven by lessors seeking to diversify portfolios that had previously been heavily exposed to the volatility of the oil and gas market. Another contributing factor is the growing demand for larger, more complex helicopter configurations, which become significantly more accessible through leasing arrangements.

EMS contracts are generally more stable and long-term than those in the offshore sector—and for good reason. EMS helicopters require highly specialised configurations, often tailored for compatibility with hospital equipment. A seamless ‘plug-and-play’ capability upon patient arrival is critical for continuity of emergency care. Consequently, transferring a leased helicopter between operators typically involves costly interior modifications. Longer contract terms help ensure a return on investment for lessors, making stability essential in this segment.

Outlook

Looking ahead, the EMS helicopter market seem to be entering a phase of consolidation rather than rapid expansion. With growth moderating to just over 1.5% annually according to Cirium Fleet Analyzer and driven primarily by Asia, the industry’s focus will shift from fleet enlargement to asset optimisation.

Approximately 30% of the existing fleet—largely concentrated in Europe and North America—will require replacement, underscoring the importance of lifecycle planning and cost efficiency. Cirium are expecting new deliveries to focus on twin engine types rather than single engine. New types like the H140 and the R88 are likely to stimulate demand.

For lessors, whose share of deliveries has plateaued, competitive advantage will increasingly depend on innovative leasing models and value-added services rather than scale.

In short, success over the next decade is likely to focus on operational resilience and strategic positioning in a market where replacement, not growth, defines the opportunity.

Attending European Rotors in Cologne, Germany? Sara will be taking part in the HEMS panel, Tuesday, 18th November at 15:15.