Cirium Ascend Consultancy is trusted by clients across the aviation industry to provide accurate, timely, and insightful aircraft appraisals. The team provides the valuations and analysis the industry relies on to understand the market outlook, evaluate risks and identify opportunities.

Discover the team’s industry reports & market commentaries. Read their latest expert analysis, viewpoints and updates on Thought Cloud.

Yinan Qin, Senior Aviation Analyst, Cirium Ascend Consultancy

Traffic and Yields

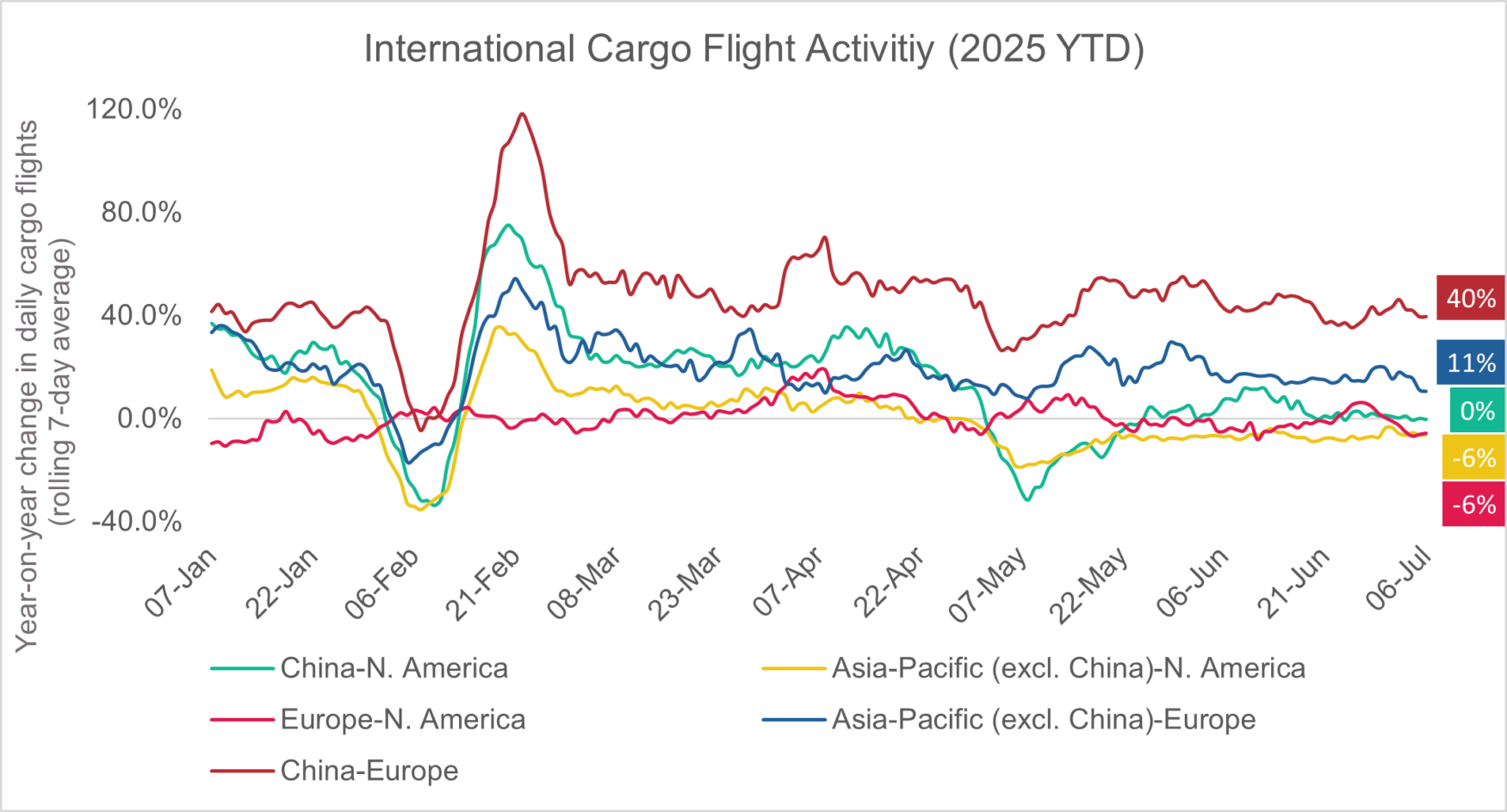

Based on Cirium’s year-to-date cargo flight data for 2025 across the major cargo traffic lanes, we observed a sharp decline in flight activity around February, coinciding with the announcement of new US tariffs. However, flights rebounded quickly as carriers employed front-loading strategies to mitigate tariff impacts before the initially announced effective date in May 2025. The latest data indicates that routes connecting to North America have been the most significantly affected. Unlike passenger flights, cargo operations are more flexible and responsive to market changes. As such, we anticipate continued in-time adjustments in cargo flight schedules in response to tariff developments. However, when and how future tariff issues will be resolved is still unclear at present.

Note: (narrowbody/widebody freighters) * total = all Asia-Pacific and Europe to North America, and Asia-Pacific to Europe

Source: Cirium Core

Global air cargo yields, which are also highly sensitive to market dynamics, were volatile from 2020 to 2022 but have stabilised since late 2023, staying about 33% above pre-Covid levels. On major long-haul routes like Europe-North America, rates are back to pre-pandemic levels, while Asia-Europe and Asia-North America rates remain elevated due to capacity constraints and geopolitical tensions. While the full impact of US tariffs on yields remains to be seen, a return to pre-Covid pricing levels appears unlikely in the near term.

Freighter Fleet Overview

The global freighter fleet has grown steadily over the past two decades. As of mid-2025, there were over 1,400 widebody and more than 800 narrowbody freighters in service. Growth in widebody freighters has been driven by new factory-built freighters, Passenger-to-Freighter (P2F) conversions, and reactivations of aging widebody freighters during the pandemic. Narrowbody freighters also surged in popularity but now face an oversupply issue, with roughly 26% in storage compared to 13% for widebodies — both figures remain above pre-pandemic levels.

A closer examination of the stored fleet reveals that a higher proportion of inactive narrowbody freighters, particularly the Boeing 737-800 and Airbus A321, are owned by lessors compared with widebody freighters. Many of the parked narrowbody freighters are awaiting conversion or struggling to secure lessees that would be willing to pay a rent premium for the high feedstock and conversion costs. Additionally, the overheating engine leasing market may also encourage lessors to lease engines out separately to obtain better premiums than leasing the entire freighter.

Note: Widebody and Narrowbody Freighters only

Source: Cirium Fleets Analyzer

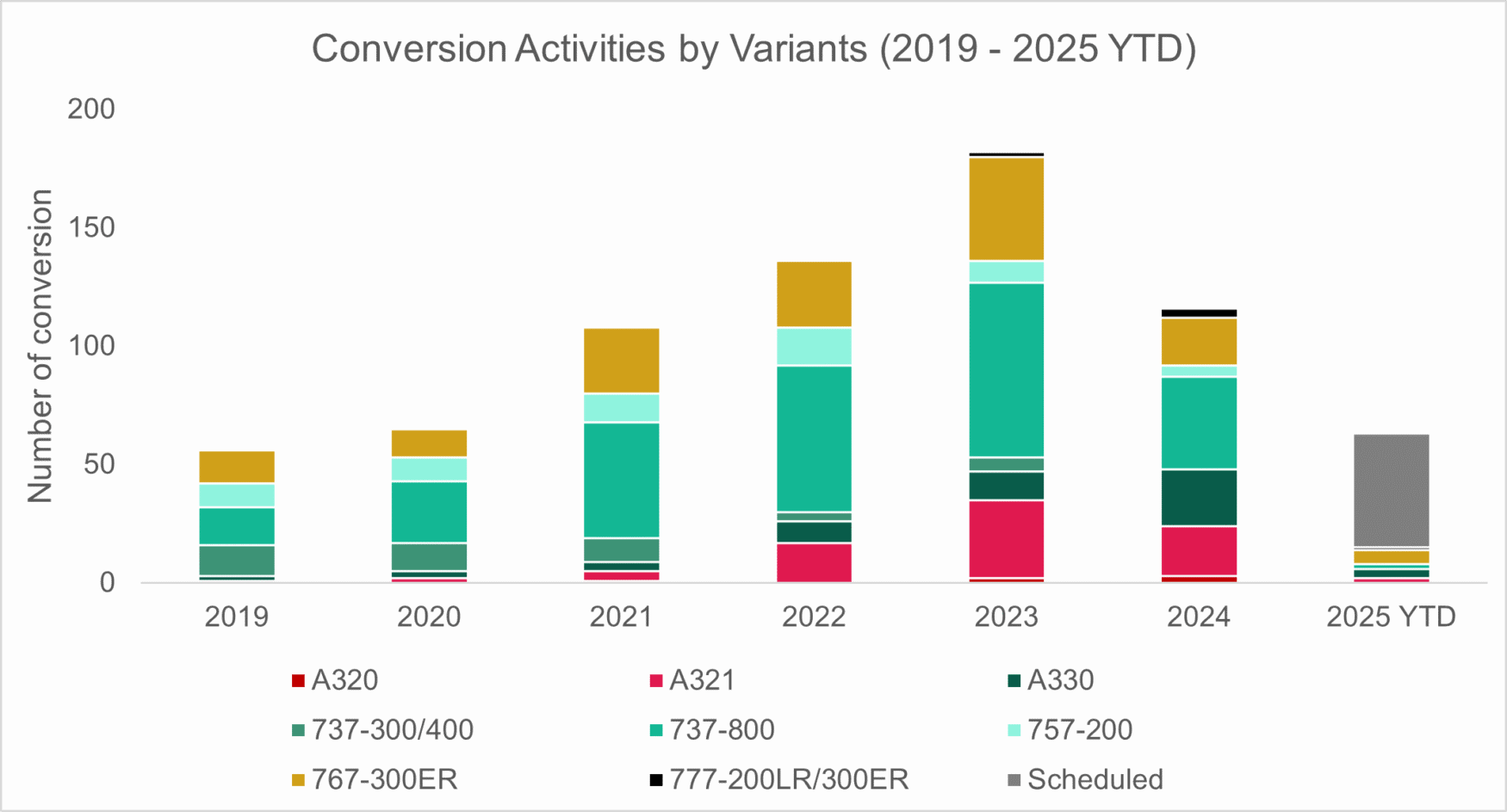

P2F conversion activity slowed significantly this year, especially for the Boeing 737-800, with only 15 conversions completed. About 48 aircraft, mostly widebody freighters, are scheduled for conversion in 2025. The conversion backlog has dropped to around 320 units, mainly comprising the Boeing 737-800, Airbus A321, Airbus A330 and Boeing 777-300ER. However, some backlog aircraft may return to passenger service due to rising conversion costs, weakening freighter demand, and supplemental type certificate (STC) approval delays.

Note: Widebody and Narrowbody Freighters only

Source: Cirium Fleets Analyzer

On the factory-built freighter side, about 25 new freighter orders have been placed so far in 2025, mostly for the Airbus A350F and Boeing 777-200LRF. Qatar Airways has placed the largest order for the upcoming 777-8F, while the Airbus A350F has attracted a broader customer base, including lessors. With production of the Boeing 767 and 777 set to end in 2027 and current order slots likely sold out, the market may face a potential supply shortage. Ongoing OEM delivery delays and uncertainty surrounding Boeing 777X certification could further contribute to the anticipated production gap in the short to medium term.

Source: Cirium Core; Press Release

Freighter Valuation and Lease Rate trends

An analysis of Cirium Market Values of selected key 20-year-old freighters indicates that Market Values have remained resilient over time, particularly for widebody freighters. The only exception has been the Boeing 747-400F, whose decline in value is largely due to its Market Value now being primarily driven by engine. A similar trend is observed in the leasing market. Lease Rates have remained generally robust following the volatility experienced during the pandemic.

The sustained demand for widebody freighters, combined with continued delays in the delivery of new factory-built freighter, slow progress in the certification of the Boeing 777 P2F conversion programme, rising maintenance costs, and limited MRO slots are all contributing to the resilience of current Market Values. These factors are expected to continue placing upward pressure on freighter valuations until supply-side constraints ease. As such, we anticipate that Market Values will likely remain robust in the near term.

Note: Value as of June 2025

Source: Cirium Valuation Analyzer

In conclusion, the global air cargo market is expected to remain supply-constrained in the near future, especially for widebody capacity. Despite North America’s status as a key air cargo market segment, routes to North America face the most immediate uncertainty due to tariffs, broader structural factors – including limited production capacity, slowing P2F conversions and elevated yield levels – suggesting a prolonged period of moderate demand and a mix of continued tight supply (widebodies) and gradually decreasing oversupply in the short-to-medium term.