Cirium Ascend Consultancy is trusted by clients across the aviation industry to provide accurate, timely, and insightful aircraft appraisals. The team provides the valuations and analysis the industry relies on to understand the market outlook, evaluate risks and identify opportunities.

Discover the team’s industry reports & market commentaries. Read their latest expert analysis, viewpoints and updates on Thought Cloud.

Johnny Yung, Senior Aviation Analyst, Cirium Ascend Consultancy

Aircraft are capital-intensive assets and airlines typically employ a range of financing instruments, including debt issuance, finance leases, and operating leases, to fund their fleet requirements. Recently some operators have begun exploring offshore yuan-denominated financing as an alternative to the conventional US Dollar-based structures. However, adoption outside of China remains limited, with only a few carriers—such as Turkish Airlines and Korean Air—reportedly engaging in such arrangements with AVIC Leasing, CCB Leasing, ICBC Leasing and BOCOM Leasing. Broader uptake among major international airlines is expected to take time.

What are the strategic and financial motivations behind Turkish Airlines and Korean Air adopting yuan-denominated financing?

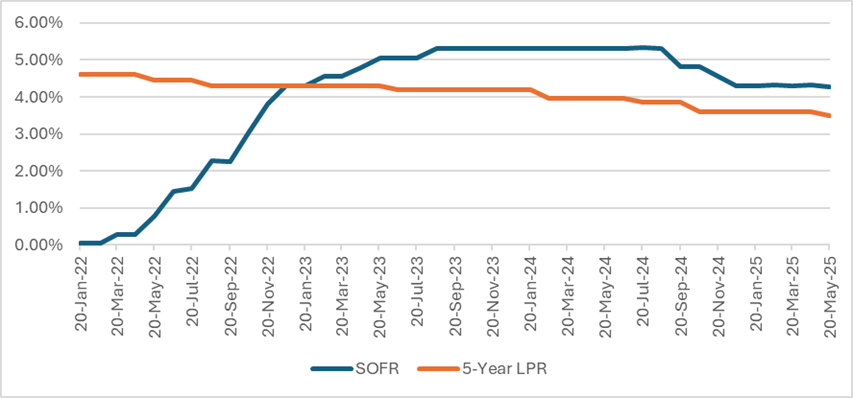

The interest rate associated with a specific financing arrangement is typically composed of two components: the risk-free rate and the borrower’s risk premium. While the risk premium remains consistent across different financing currencies, the risk-free rate varies depending on the loan tenor and, more critically, the benchmark rate of the chosen currency. When comparing the US Secured Overnight Financing Rate (SOFR) with the People’s Bank of China Loan Prime Rate (LPR), it becomes evident why yuan-denominated financing may offer comparatively lower interest rates.

Chart 1: The trend of SOFR and 5-Year LPR

Sources: FOMC, PBOC

While yuan-denominated financing offers the advantage of lower interest costs, it also introduces potential foreign exchange risk since debt repayments are denominated in yuan, typically not the domestic currency of the airline. Airlines can mitigate this risk by generating yuan revenues.

According to Cirium FM Traffic data, Korean Air derived approximately USD 470 million for the routes related to China in FY2024. This amount seems adequate to service the debt associated with its yuan-denominated financing for one A350 and one A321neo aircraft. As per Cirium valuations and assuming a 75% loan-to-value, the assets financing requirement here is around USD 162 million.

In contrast, Turkish Airlines generated an estimated USD 364 million for China-related routes in FY2024. Although this figure is relatively modest, the airline’s decision to pursue yuan financing for three A350 aircraft is part of a broader strategy to diversify funding sources across multiple currencies. In addition to yuan, Turkish Airlines has secured financing in four other currencies, underscoring its commitment to managing currency risk through diversification.

Is there potential for increased adoption of yuan-denominated financing in the future?

Interest rate trend

According to the Federal Open Market Committee’s (FOMC) most recent projection released in March 2025, the Federal Funds Rate is expected to decline gradually from the current 4.25% to around 3.1% by 2027. As the cost of U.S. dollar funding trends downward, the relative appeal of yuan-denominated financing may diminish, given the narrowing differential in potential interest cost savings. However, if Chinese interest rates were to follow a similar forward trend then interest might sustain.

China traffic recovery

As international air traffic to and from China continues to recover, airlines are positioned to generate increased yuan-denominated revenue. The chart below illustrates the gradual restoration of capacity to China by non-Chinese carriers.

Chart 2: Capacity to/ from China of non-Chinese carriers

Source: Cirium Core, Schedule

Beyond serving as a natural hedge against currency risk, the regulatory challenges associated with repatriating yuan – such as the need for official approvals – further incentivise the use of yuan-denominated financing.

Next potential candidate?

From a revenue composition perspective, airlines with higher ticket sales originating from China will potentially be the next candidate as it offers natural hedging and lower interest cost, for example Cathay Pacific, which has already entered the offshore yuan bond market with its debut issuance in 2021. In addition, several Middle Eastern and Southeast Asian carriers have expressed interest in exploring yuan-denominated financing, reflecting growing regional engagement with yuan-based funding solutions.