Cirium Ascend Consultancy is trusted by clients across the aviation industry to provide accurate, timely, and insightful aircraft appraisals. The team provides the valuations and analysis the industry relies on to understand the market outlook, evaluate risks and identify opportunities.

Discover the team’s industry reports & market commentaries. Read their latest expert analysis, viewpoints and updates on Thought Cloud.

Team Perspective

Yinan Qin, Senior Aviation Analyst, Cirium Ascend Consultancy

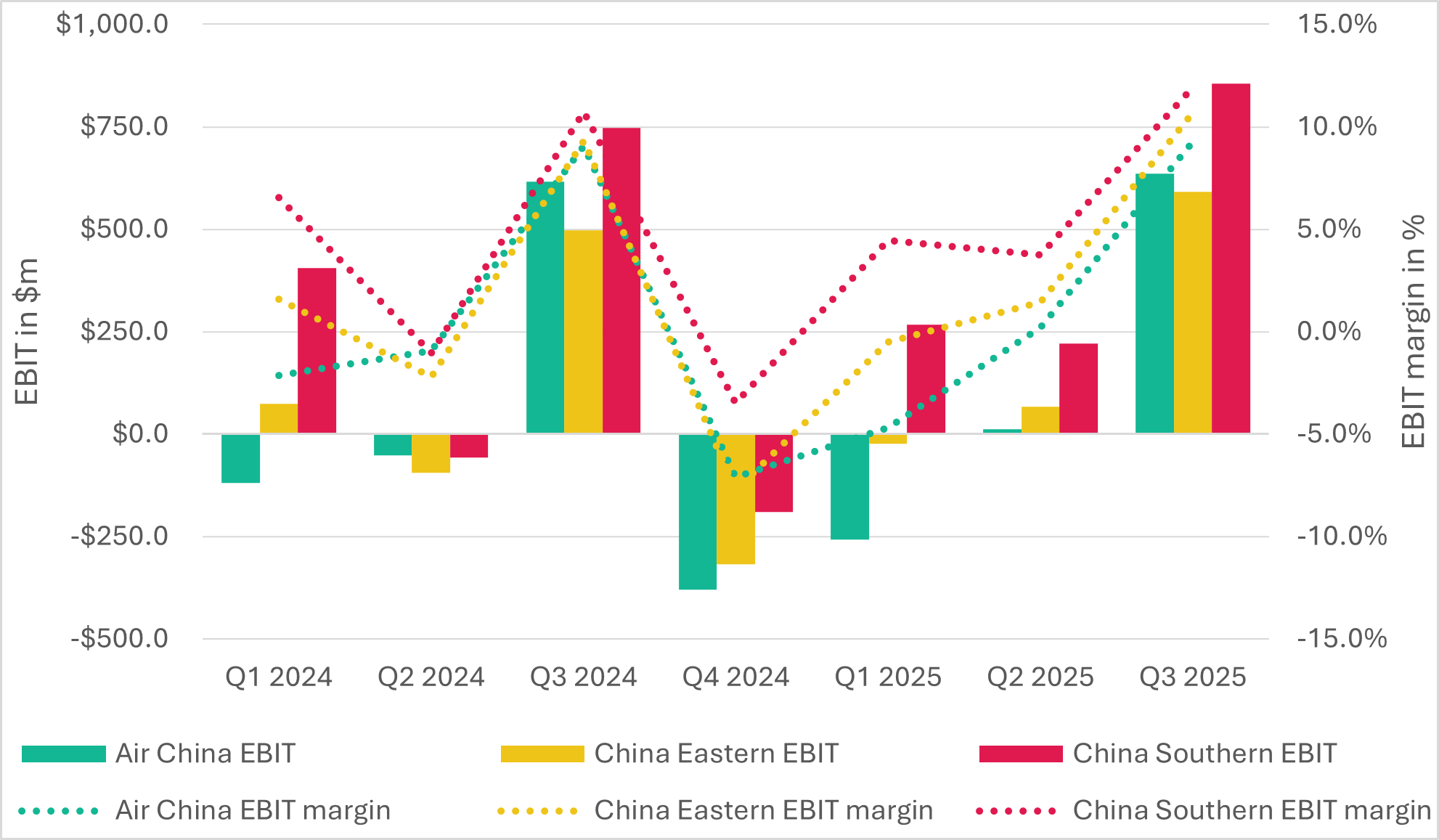

Following the release of their 2025 third-quarter financial reports, China’s “big three” airline groups (Air China, China Eastern and China Southern) have delivered a robust post-pandemic performance.

All three carriers posted modest revenue growth and continued year-on-year improvements in operating profit, led by China Eastern, which recorded a 19.4% increase in operating income and a 32.5% rise in net profit compared with Q3 2024.

On the leverage and liquidity side, all three airlines reported a decline in their net debt/EBIT ratios compared with the same quarter last year, coupled with an improved liquidity profile, except for Air China, which recorded massive debt repayments that outpaced the growth of cash flow generated from operating activities.

Boosted by an exceptional Q3 performance and improving Q2 results, China’s “big three” delivered their first profitable nine-month’s financial result since the onset of the pandemic. This milestone was met with a positive market reaction, reflected in rising share prices.

Chart 1: Chinese ‘big three’ airlines quarterly EBIT and EBIT margin (post 2024)

Source: Airline Financials; Cirium Ascend Consultancy

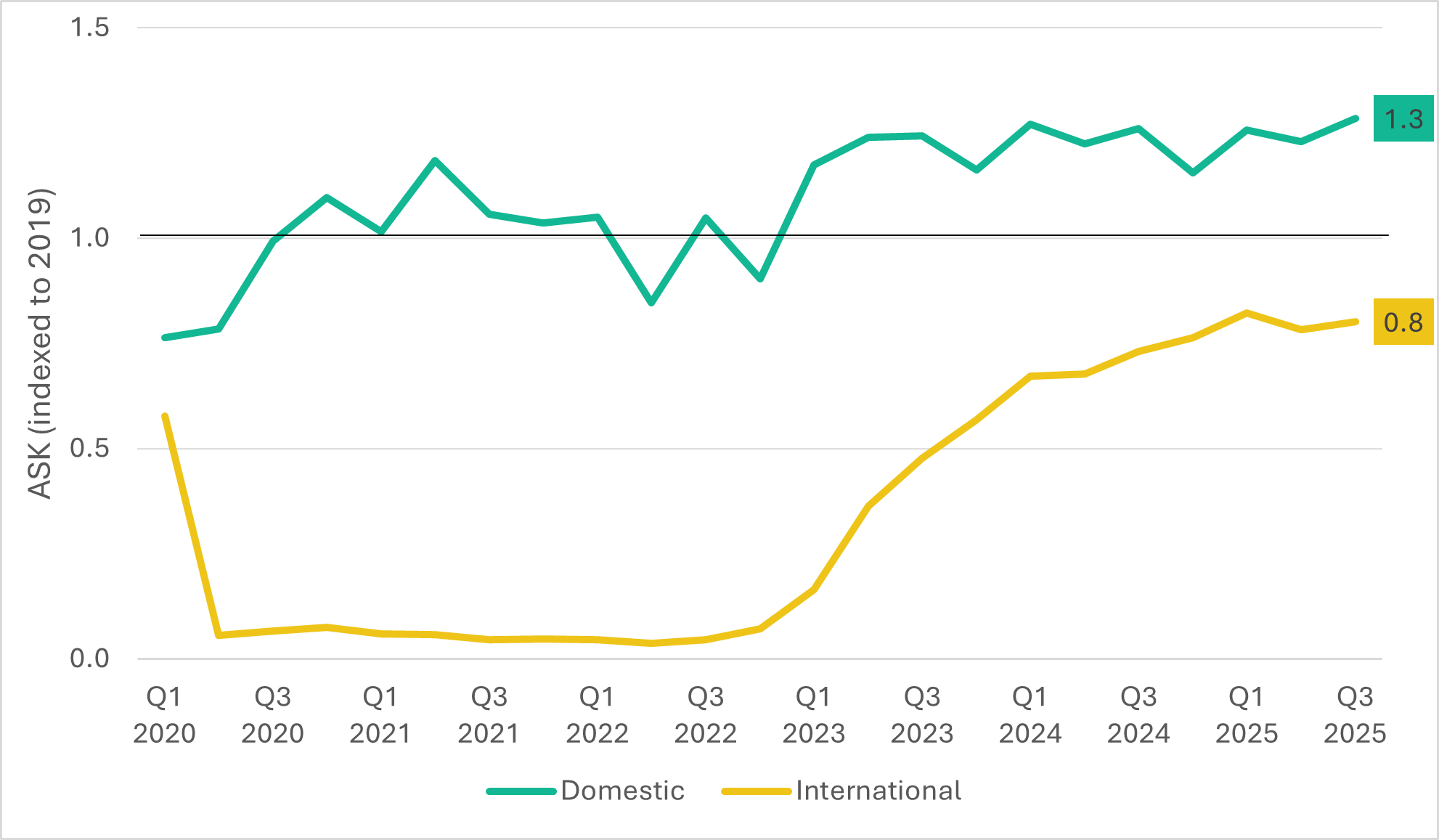

According to Cirium schedules data, although Chinese domestic market capacity shortly surpassed 2019 levels during Q3 2020 and Q1 2022, it consistently exceeded pre-pandemic levels starting in 2023. While the international market segment remains 20% below pre-pandemic levels at present, it has shown a moderate recovery trend since 2023. Supported by favourable travel and visa policies and an economy further emerging from the impact of the pandemic, both inbound and outbound passenger volumes have begun to climb.

Chart 2: Chinese market air traffic capacity recovery (ASK, indexed to 2019)

Source: Cirium schedules data

Note: As of Nov 2025, Bi-directional traffic

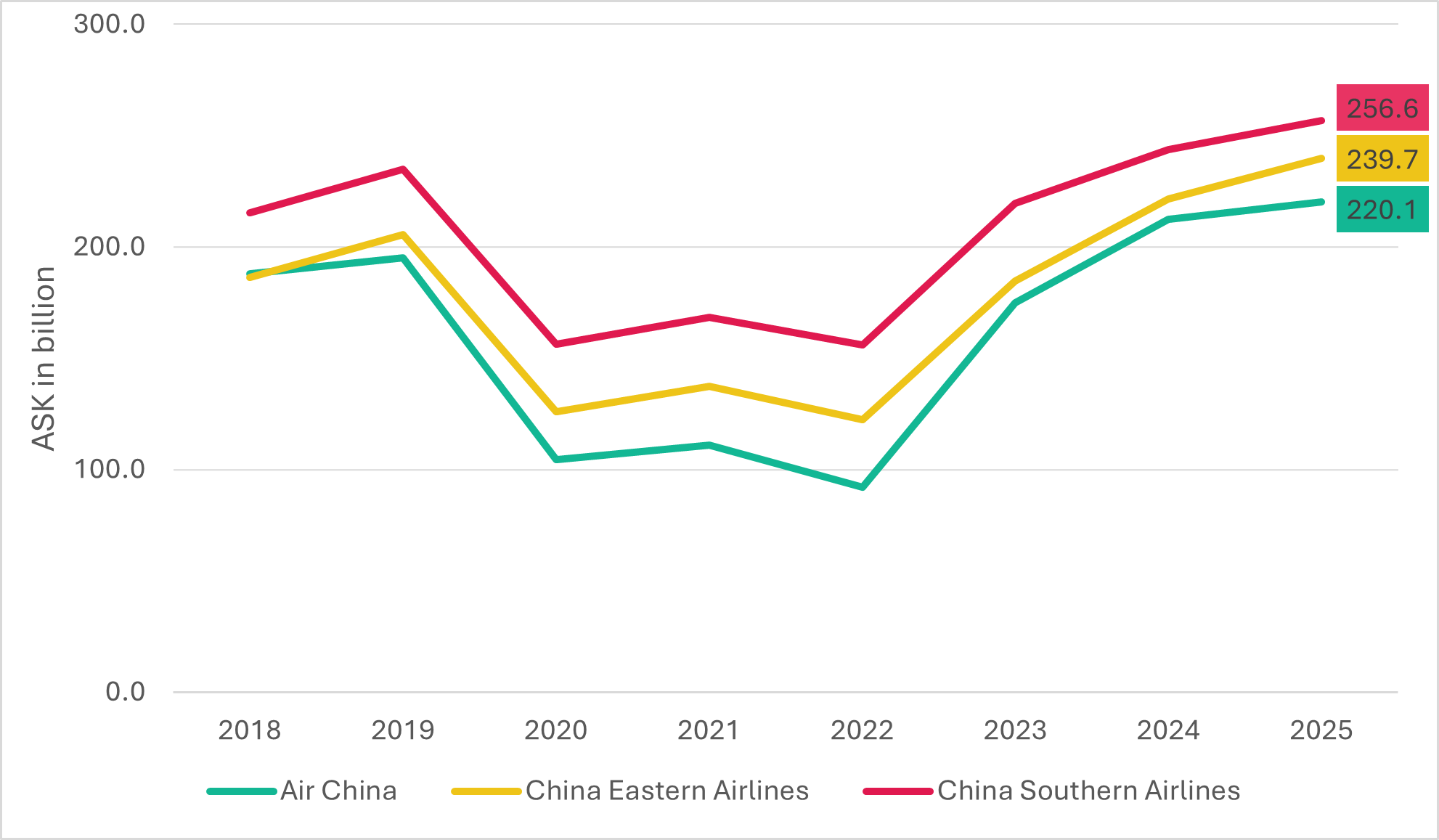

Benefitting from the large Chinese domestic market scale, Chinese airlines experienced an efficient capacity recovery during the post-pandemic period. Cirium’s schedules data shows that the capacity of the “big three” have largely outperformed their pre-pandemic capacity benchmarks, with ASKs exceeding 2019 levels as of 2023.

Chart 3: Chinese ‘big three’ airlines capacity (post-2018)

Source: Cirium schedules data

Note: Bi-directional traffic as of Nov 2025; excludes each group’s subsidiaries

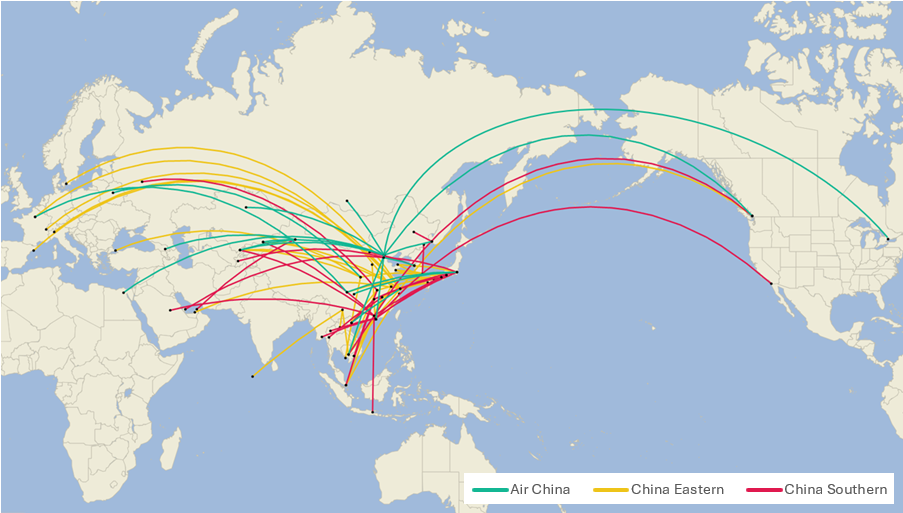

With their eyes on the big recovery potential of the international market and government policy support, all three major carriers have accelerated the restoration and expansion of international routes, with China Eastern standing out as a notable example.

According to Cirium schedules data, during Q3 2025, China Eastern added a net 17 international routes on top of the 170 routes operated in Q3 2024, primarily focussing on European and South Asian market segments. Air China and China Southern also recorded net increases of 12 and 15 international routes in Q3 2025, compared with Q3 2024 respectively. China Eastern disclosed plans to continue increasing the flight frequencies on several routes connecting key cities in South Asia (Singapore, Kuala Lumpur and Bangkok) during Q4 2025 and further expanding its international routes in the first half of 2026. Meanwhile, China Southern announced its focus on boosting capacity on routes connecting Australia in 2026.

Chart 4: New international routes launched by ‘big three’ in Q3 2025 vs Q3 2024

Source: Cirium schedules data

In addition to sustained growth in air travel demand and the successful strategy of expanding international market segments, wider profit margins were largely driven by precise cost-control measures implemented by the carriers, along with benefits from stable jet fuel prices and the appreciation of the yuan against the US dollar during the first three quarters of 2025. However, these factors represent short-term advantages and may not persist in the longer term. Continued depreciation or volatility of the yuan against the US dollar would heighten operational uncertainty, given that Chinese airlines’ primary currency exposure is to the US dollar.

However, one issue became particularly concerning in 2025. Although traffic grew strongly in the first half of 2025, airlines saw only a modest improvement in passenger yields, largely due to intense market competition, commonly described as “involution”. This term refers to competition becoming excessively intense without creating additional value, resulting in diminishing returns for all market participants. In the aviation market, this refers to situations where Chinese carriers engage in aggressive fare undercutting to gain market share, often driving prices below sustainable levels.

Industry experts have also recognised this issue and have begun addressing it through regulatory measures. In 2025, regulators summoned several Chinese airlines for closed-door meetings to address concerns over excessively low ticket prices. Authorities mandated that fares must not drop below CNY200 ($28) and announced continuous price monitoring, warning that any airline selling below this threshold would face penalties. The rationale for the minimum fare is that the marginal cost per seat on many routes exceeds this amount, aligning with the authorities’ objective of preventing predatory pricing below costs.

In August 2025, the China Air Transport Association (CATA) officially released the “Self-Discipline Convention on Air Passenger Transport” (Convention), aimed at standardising the domestic air passenger market. The Convention emphasises that online travel platforms and ticketing agents must strictly adhere to airlines’ published fares, usage conditions, and refund/change policies, and prohibits unauthorised bundled sales or surcharges.

The fourth quarter is typically weaker in the Chinese market than the first three quarters due to the absence of public holidays. This contrasts with the US and European markets, where Thanksgiving, Christmas and New Year continue to drive visiting friends and relatives (VFR) travel demand. Even so, Q4 traffic is expected to see year-on-year growth, supported by strong booking momentum and robust air travel recorded during October’s Golden Week.

The positive financial performance over the first nine months is a strong indicator of aviation market recovery and could further boost confidence in the financial outlook for Chinese airlines. International routes remain a critical driver of airline profitability, with load factors on high-yield segments playing a major role in earnings flexibility. In the first half of next year, Chinese carriers are expected to capitalise on increased capacity and supportive policies to boost yields and widen profit margins, potentially reducing losses or even returning to profitability. If strong load factors carry through to summer, combined with gradual fare yields’ recovery and stable costs, Chinese airlines could achieve a meaningful recovery in 2026.