Cirium Ascend Consultancy is trusted by clients across the aviation industry to provide accurate, timely, and insightful aircraft appraisals. The team provides the valuations and analysis the industry relies on to understand the market outlook, evaluate risks and identify opportunities.

Discover the team’s industry reports & market commentaries. Read their latest expert analysis, viewpoints and updates on Thought Cloud.

Yuanfei Zhao (Scott), Principal Aviation Analyst, Cirium Ascend Consultancy

Ongoing geopolitical tensions between China and the United States – exacerbated by sanctions, trade tariffs, and escalating diplomatic frictions – have significantly impacted Boeing’s commercial aircraft business in China. These macro-level challenges, compounded by internal setbacks such as the prolonged 737 Max issues, have severely restricted Boeing’s ability to deliver new jets and secure fresh orders from Chinese carriers.

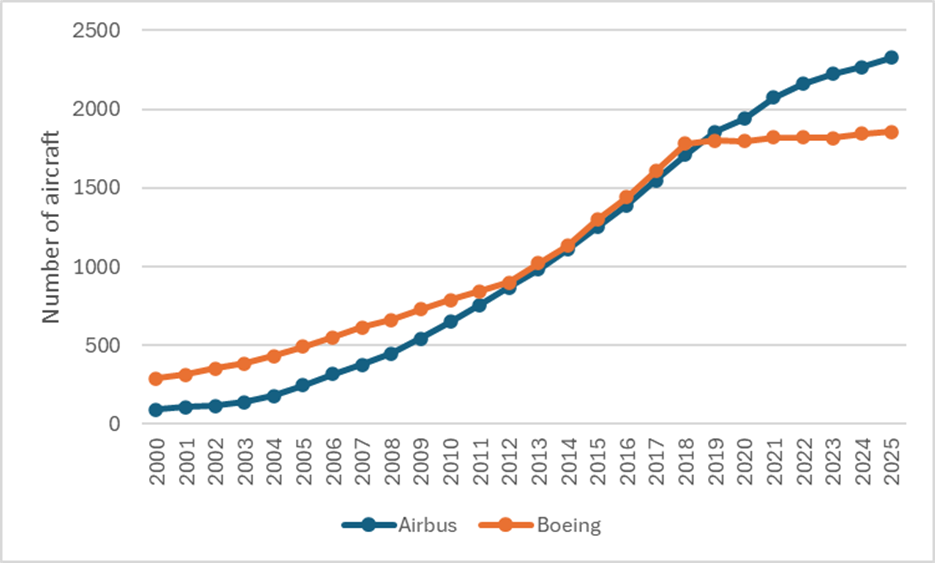

Against this backdrop, 2019 marked a pivotal turning point in the Chinese aviation market: for the first time, the number of single-aisle and twin-aisle Airbus aircraft surpassed that of Boeing in the region. This lead has continued to grow in subsequent years, reflecting not only evolving commercial preferences but also broader geopolitical shifts influencing airline procurement strategies.

Chart: Chinese airlines’ in-service and stored fleet trend

Source: Cirium Core. Data includes in-service and stored single-aisle and twin-aisle passenger and freighter jets

In early June 2025, reports emerged suggesting that China is preparing to place a major aircraft order with Airbus. While some sources anticipate a commitment of around 300 aircraft, others speculate the total could range between 200 and 500 units, comprising a mix of single-aisle and twin-aisle models. These developments align with an upcoming high-level diplomatic visit to China by key European leaders in July. Industry observers widely expect that a formal purchase agreement may be announced during or shortly after the visit, further reinforcing Europe’s expanding aviation partnership with China.

If this potential order comes to fruition, it will further widen the market share gap between Airbus and Boeing in China, solidifying Airbus’s position as the leading commercial aircraft supplier in the region.

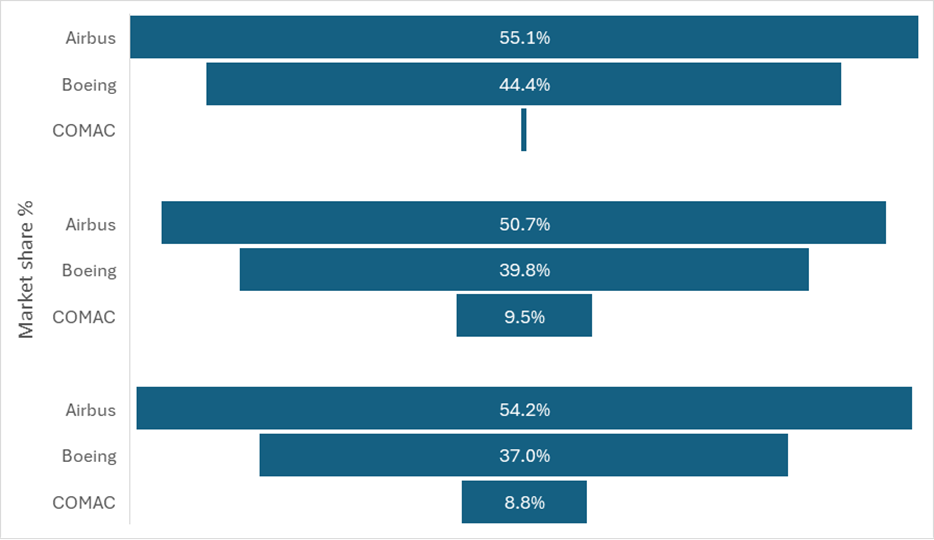

The accompanying chart below offers a high-level overview of the evolving fleet composition and market dynamics in China, with projected market share changes based on the assumption that all on-order aircraft are delivered. It illustrates three scenarios:

- The current in-service and stored fleet operated by Chinese airlines;

- The current fleet combined with existing firm aircraft orders; and

- The fleet from scenario 2 plus an assumed new Airbus order of 300 single-aisle and 100 twin-aisle aircraft – an average drawn from prevailing market speculation.

Chart: Chinese fleet share by OEM: scenarios 1, 2 and 3

Source: Cirium Core. Data includes in-service, stored, and firm orders by airlines for single-aisle and twin-aisle passenger and freighter jets

It is important to note that this analysis includes only firm orders placed directly by Chinese airlines, excluding those from lessors. The destination and placement of lessor-owned aircraft often fluctuate, making their inclusion uncertain. Additionally, Chinese airlines also have orders that are for unidentified customers by Airbus and Boeing, and these will be additional to this analysis.

Lessor orders for COMAC aircraft are largely concentrated among Chinese lessors and are expected to be primarily allocated to Chinese airlines in the future. This trend suggests that COMAC’s long-term market share could increase further – alongside anticipated gains for Airbus. Consequently, Boeing’s proportional market share may continue to decline unless there are substantial improvements in its standing within the Chinese market.

These developments highlight not only a shifting commercial landscape but also the increasingly strategic role that aviation plays in global geopolitics – where aircraft procurement decisions are shaped as much by diplomacy and international alliances as by operational needs and economic considerations.