Cirium Ascend Consultancy is trusted by clients across the aviation industry to provide accurate, timely, and insightful aircraft appraisals. The team provides the valuations and analysis the industry relies on to understand the market outlook, evaluate risks and identify opportunities.

Discover the team’s industry reports & market commentaries. Read their latest expert analysis, viewpoints and updates on Thought Cloud.

Sofia Zoidou, Senior Consultant, Cirium Ascend Consultancy

Amid the continued geopolitical conflict and a dramatic escalation of US tariffs, 2025 has been a rollercoaster for global trade.

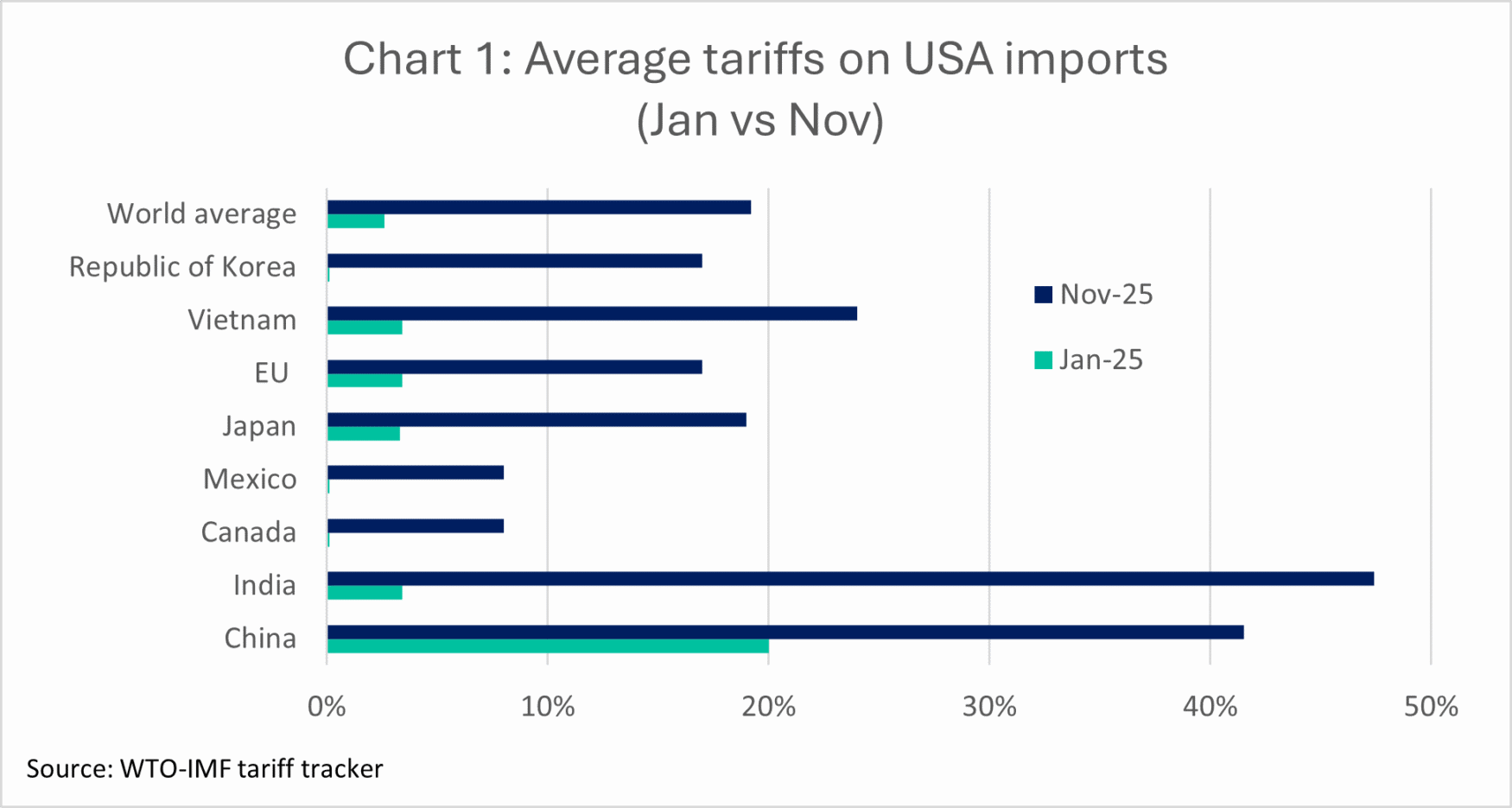

According to the WTO-IMF tariff tracker, the average tariff rate on US global imports rose seven-fold during 2025, climbing from 2.6% in January to 19.2% in early November. As the USA escalated tariffs for imports from all its major trading partners (Chart 1), this move has affected over $2.7 trillion of trade value so far.

US tariffs on Chinese goods have currently settled at an average 41.5%, following a temporary truce via the trade deal reached in early November. This was after tariffs on China ballooned from an average 20% at the start of the year to a staggering 143% at the peak of the two nations’ trade confrontations in April.

Meanwhile, US tariffs on imports from India, the fastest growing nation in terms of real GDP according to the IMF, rose from 3.4% in January to 47.4% in November, with no trade deal yet at hand (although, reportedly, significant progress has been made in December).

The introduction of import tariffs by the world’s biggest economy as an international trade deterrent should have in theory painted a bleak picture for the world’s economic outlook. Yet, the impact has been surprisingly more subdued than originally expected – so far.

According to the US Bureau of Economic Analysis (BEA), US real GDP contracted by 0.6% in Q1 2025 before rebounding at 3.8% in Q2 (annualised figures as per BEA methodology; Q3 figures expected later in December), whilst data from the National Bureau of Statistics of China suggests the Chinese economy grew by 4% year-on-year in the first nine months of 2025, which is on par with the same period last year. Compared with previous years, this bolsters the argument of a structural GDP growth deceleration in China, as opposed to a tariff-ensuing slow-down.

Looking forward, the IMF World Economic Outlook projects the world’s real GDP will continue to grow at a rate of 3.2% in 2025 and 3.1% in 2026, i.e. largely in line with 2024 (3.3%), despite the reasonably anticipated slow-down in the USA (2% US GDP growth projected for 2025 and 2.1% forecast for 2026 vs. actual 2.8% in 2024).

On this footing, global air cargo has also held up. Cargo tonne kilometres (CTKs) were up annually by 3.3% year-to-date (Jan-Oct), according to IATA’s Global Outlook for Air Transport, just published in December. IATA now estimates the year for global air cargo will close at 3.1% growth, beating its earlier forecast of just 0.7% for 2025.

Key driver of acceleration in the air cargo market has been the expansion of the Asia-Pacific to Europe flows, with CTKs on this corridor in January-October up by 10.6% year-on-year. However, the fact that among Europe’s international routes, only those with Asia and North America (+7.1%) grew year-on-year, suggests a meaningful part of this growth may be due to exporters’ repositioning supply chains and rerouting cargo flows to circumvent tariffs.

In contrast, CTKs between Asia-Pacific and North America declined for the sixth consecutive month in October, leading to 1.2% expected contraction for North America in 2025, as per IATA. In addition to the tariffs, the USA’s lifting of the “de minimis exemption” for imports of small value Chinese packaged goods (worth $800 or less) in May has contributed to this decline.

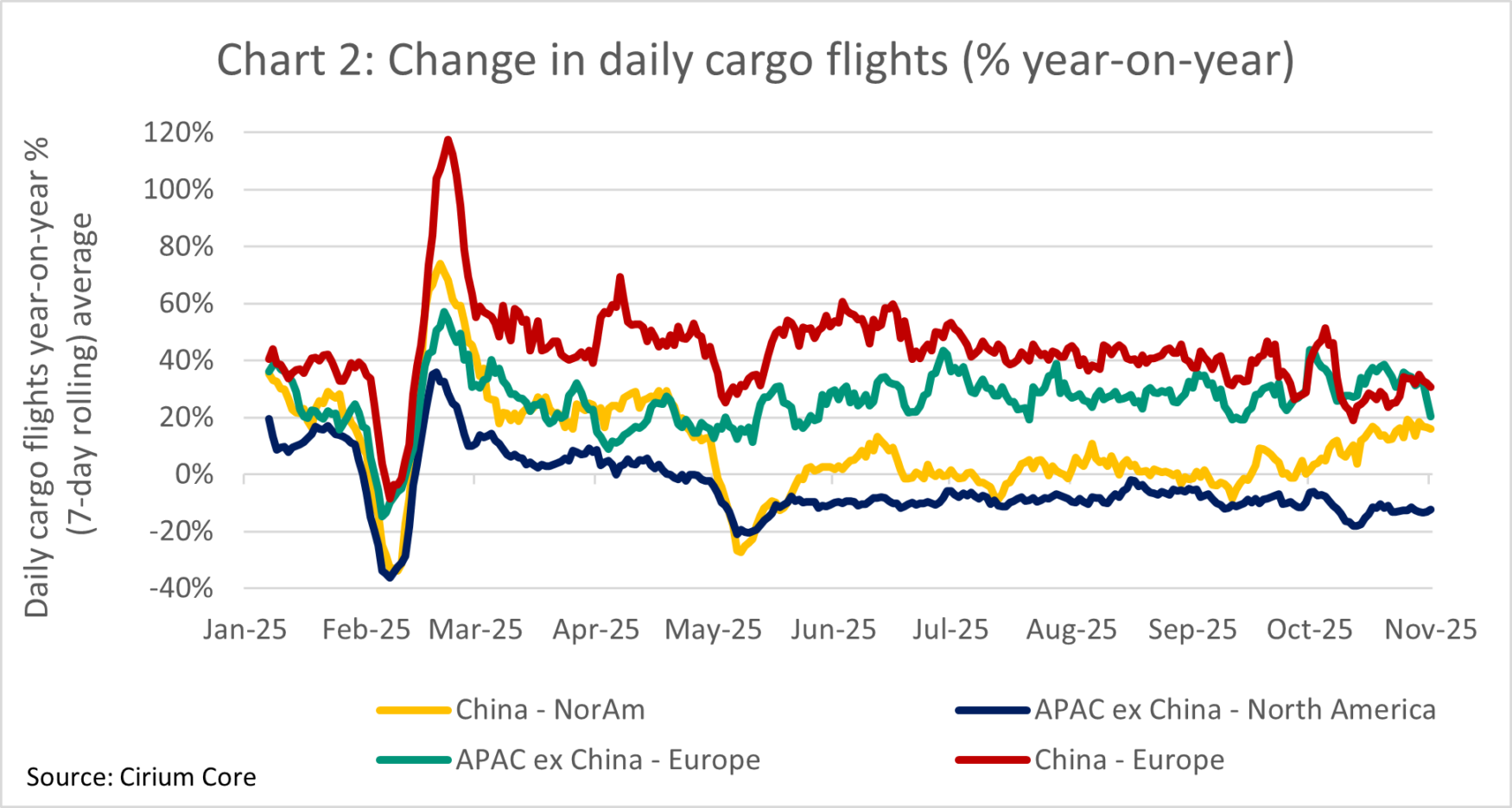

Cirium’s tracked utilisation data for cargo flights confirms these trends (Chart 2; note all-cargo flights represent about half of global CTKs, the remaining captured in passenger jet belly capacity). In the first nine months of 2025, the number of cargo flights from China to Europe rose by 41% year-on-year, with flights from Europe to China also up by 52%. Total flights from the rest of Asia-Pacific to Europe also increased by a significant 23%. Whilst daily flights from China to North America have returned to growth after the summer months, flights from other Asia-Pacific destinations (excluding China) into North America remain contracted by 4% year-to-date and not yet showing signs of recovery, which in turn signifies capacity removal from the route.

Notwithstanding the resilience in the air-cargo markets amidst the uncertainty in 2025, it remains to be seen how much of the growth represents new and sustainable organic demand, and if the levels of rerouting and trade flow recalibration observed this year, offsetting some of the tariffs’ impact, will permanently hold true.

With the Euro area’s GDP growth projection at a mere 1.2% in 2025 as per the IMF, i.e., well below its average forecast of +1.6% for advanced economies, it is debatable how much European demand can propel air-cargo growth going forward.

Despite air cargo typically transporting high-value time-sensitive goods, such as pharmaceuticals and high-tech components, part of Asia to Europe cargo also comprises retail e-commerce purchases. Specifically for low-value-goods’ packages entering the EU, of which more than 90% comes from China, the estimated trade value has more than doubled to $19.1bn in the two years to 2024, having now reached $20.5bn in the first nine months of 2025, Reuters reports.

However, in view of concerns around health and safety regulation compliance, and the competitive ramifications for the European industries, from November 2026 or earlier, the European Commission plans to introduce new customs and handling fees on low-value packages – a development likely to deplete the air cargo volumes from Asia to Europe to some degree.

Moreover, the USA’s extension of the “de minimis exemption” removal to small value parcel shipments from all countries, in addition to China, since August is likely to further squeeze US air cargo volumes going forward.

Lastly, following the ceasefire in the Middle East, most major container-shipping carriers are now resuming Red Sea/Suez Canal transits, after detours added around 10 extra days on their Asia-Europe voyage, which accounts for approximately 10% of global container volumes (East to West is 30-40%). On this basis, and in view of the continuing decline of shipping freight rates, it is likely any benefit from substitution by air cargo will subside in the forthcoming months. For these reasons, and with IATA’s outlook suggesting CTK growth slowing to 2.6% year-on-year in 2026, the air cargo market’s performance is one to closely watch, as it balances between growing demand and the effects of regulatory and geopolitical developments.