Herman Tse, Valuations Manager, Cirium Ascend Consultancy

The 157th IATA Slot Conference, scheduled to take place in Lisbon, Portugal from 18–20 November 2025, will serve as a pivotal forum for stakeholders in the aviation industry to address slot allocation and capacity management for the Northern Summer Season, spanning 26 March to 25 October 2026. As the industry continues its recovery and expansion in the post-Covid era, several factors including geopolitical tensions and ongoing aircraft supply constraints could pose potential challenges to sustaining growth momentum. This article examines the key themes likely to shape discussions at the conference and provides an outlook for airline capacity planning in 2026.

Historically, global GDP growth has exhibited a strong positive correlation with air-travel demand. As economies expand, rising disposable incomes enable more individuals to afford air travel, while businesses increase travel budgets during periods of economic prosperity. Consequently, GDP growth is a critical indicator for forecasting future passenger demand. Recent data shows that entering the fourth quarter of 2025, developing economies such as India and China have demonstrated notable improvements in GDP growth forecasts. The USA, after experiencing a trough in mid-2025, has rebounded to near 2% growth. Looking ahead to 2026, global GDP growth is projected to range between 2.4% and 3.1%, according to leading economic institutions and intergovernmental organizations. This positive macroeconomic outlook underpins a favourable forecast for air travel demand in 2026.

Chart 1: Development of 2025 GDP growth forecast

Source: EIU, World is calculated at Market Exchange Rates

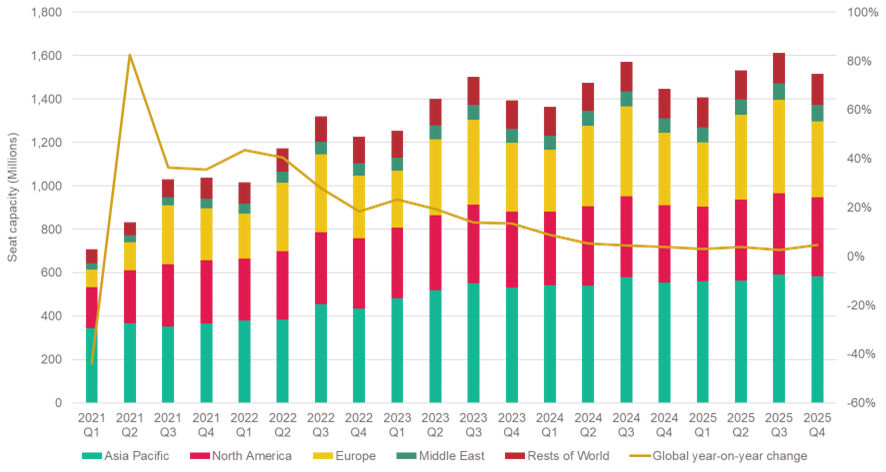

Cirium flight schedules reveal that global airline seat capacity has been on a steady upward trajectory since early 2024, with all regions recording positive growth in 2025. The Asia-Pacific region stands out, driven by robust domestic demand, particularly in China and India. However, further recovery in this region is contingent upon the resolution of geopolitical issues, such as the China-US relationship and Russian airspace overflight restrictions. The Middle East continues to solidify its role as a strategic hub for long-haul traffic between Asia, Europe, and Africa. Notably, some European carriers have scaled back operations in the Chinese market due to competitive disadvantages stemming from Russia overflight constraints, which favour Chinese operators.

Europe is also experiencing strong growth in both regional and international seat capacity, propelled by the resurgence of leisure travel, visiting friends and relatives (VFR) traffic, and the expansion of low-cost carriers (LCCs) in Southern and Eastern Europe. In contrast, the North American market presents a more nuanced picture. While the US domestic market has shown weakness, with year-on-year declines in the latter half of 2025, the international segment continues to grow, resulting in an overall positive capacity change for the region. Globally, seat capacity growth is expected to reach 3.6% by the end of 2025, with similar trends anticipated for 2026.

Chart 2: Global seat capacity trend

Source: Cirium Core, Flight schedules dated 31 October 2025

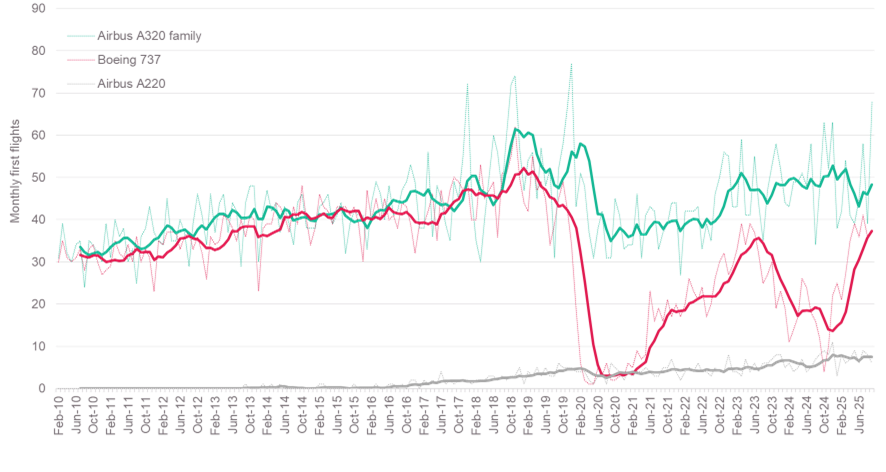

Despite the optimistic demand outlook, the industry continues to grapple with aircraft supply shortages. During the pandemic, it is estimated that over 3,600 aircraft deliveries from Airbus and Boeing were cancelled or deferred, creating a significant deficit. However, the situation has gradually improved, with both manufacturers ramping up production rates. Data from Cirium Fleets Analyzer indicates that the Airbus A320 family averaged 55 first flights per month in Q3 2025 and reaching 68 in September 2025. Boeing has also shown progress, averaging 38 737 first flights over the past three months following the resolution of 737-9 and FAA certification challenges in 2024. Cirium Ascend Consultancy estimates 1,390 single-aisle and twin-aisle aircraft to be delivered by the two major OEMs in 2025. The global passenger fleet now exceeds 22,000 aircraft, compared to 20,000 in 2019.

Chart 3: The monthly first flight trend of single-aisle aircraft from Airbus and Boeing

Source: Cirium Core, Fleets Analyzer dated 13 October 2025

While the aircraft deficit persists, it is now significantly lower than the initial shortfall. Cirium Ascend analysis estimates the single-aisle passenger aircraft shortage at fewer than 200 units, while the twin-aisle deficit remains around 700. The longevity of single-aisle aircraft has been extended, aided by relatively low and stable oil prices, which make continued operation of older models economically viable. Conversely, many older twin-aisle aircraft were retired or converted to freighters during the pandemic and are unlikely to return to passenger service. Repeated delays to the Boeing 777X program is expected to prolong the shortage of twin-aisle aircraft, potentially impacting long-haul capacity planning.

In summary, the outlook for passenger demand in 2026 remains robust, supported by continued recovery in international travel, easing supply constraints, and sustained growth in emerging markets. Global airline seat capacity in 2026 is projected to increase by approximately 3-4% compared to 2025. However, growth rates will vary across regions, reflecting differing market dynamics and operational challenges. Airlines are expected to maintain disciplined capacity management, balancing expansion with the realities of ongoing aircraft supply shortages and operational complexities.

Cirium is a proud sponsor of the 157th IATA Slot Conference. Don’t miss the opportunity to connect with the team to learn more about how we’re supporting the aviation industry with data and insights to power smarter decisions across operations.

Whether you’re optimizing network planning, enhancing day-of-operations performance, or evaluating route economics, we enable you to unlock new efficiencies and opportunities.

Secure your meeting with the team today – we look forward to seeing you in Lisbon!