Kevin O’Toole, Chief Strategy Officer, Cirium

How many passengers does an airline expect to carry over the next year, and of what nationalities?

The question is deceptively simple, and seemingly crucial for anyone carrying exposure to passenger liabilities. As any underwriter knows, the answer has been far from straightforward. But there is now data out there, which, with the addition of a data science model or two, is helping to paint the pattern of future flying. It is, after all, what airlines themselves use to build network plans through tools such as Cirium’s Diio suite.

Take the first part of the problem, around the change in flights and passengers for the year ahead. A reasonable starting point is to investigate the forward-looking schedule. That is, after all, a clear statement of intent by a carrier as to the future size and shape of its schedule over the coming year.

It is true that plans may change, especially in contact with real world events – witness the near chaos during the early months of the pandemic. But in normal times the variation is not unmanageable. The schedule published at the start of the 2025 for travel in June, for example, was around 5-6% ahead of the eventual plan as the month arrived.

Applying data science models to the schedule further reduces the difference, not to mention giving insights into the equipment flown. And as models improve, so do the estimates. Based on actual observed flying, Cirium has had success predicting seats flown within a percentage point or so, some 90 days out. That makes sense given that this is the typical selling period for a flight. For the same reason, changes are less marked once an airline has officially announced its summer or winter schedule.

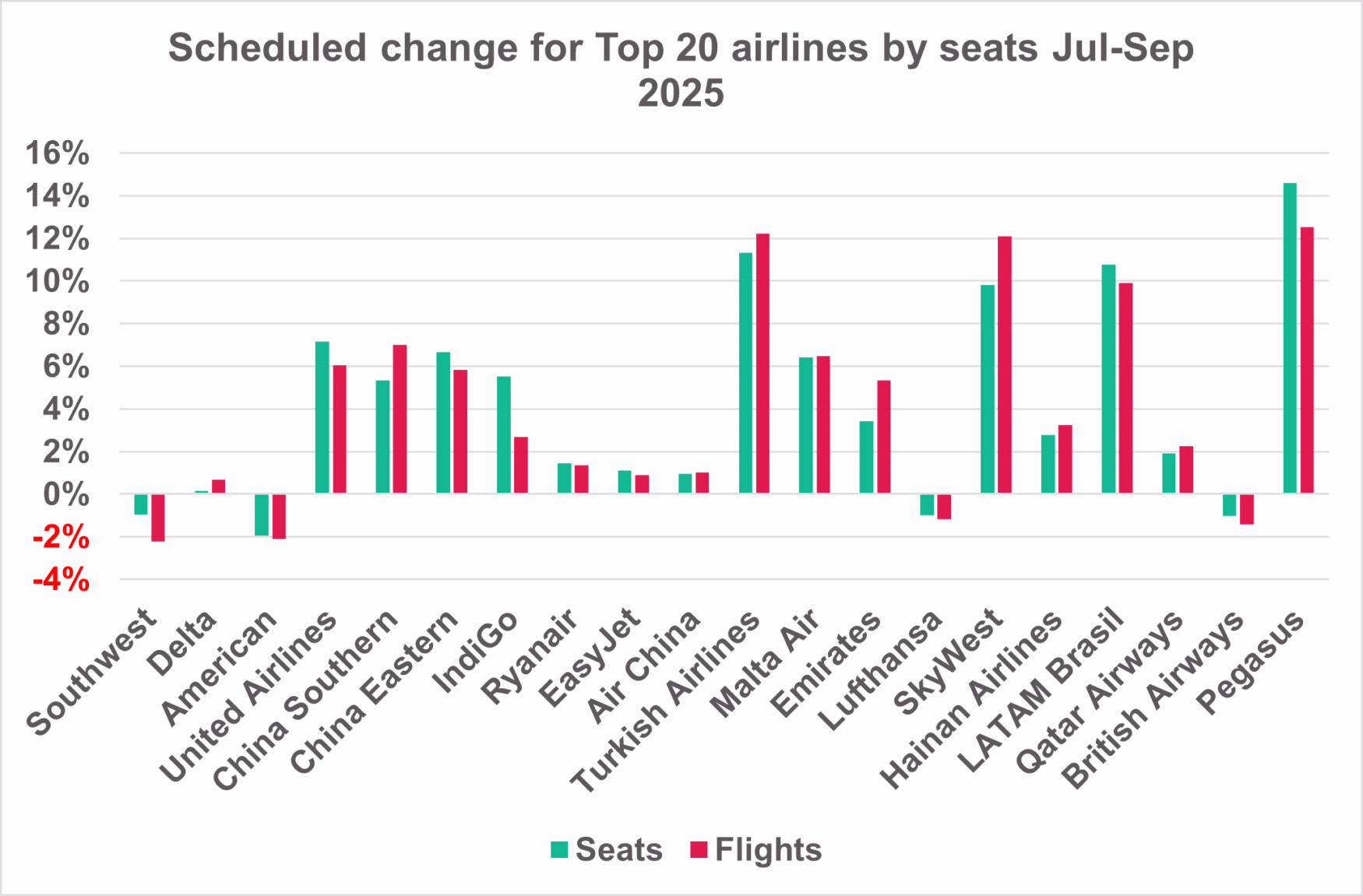

Even allowing for the gap between actual and scheduled flying, differences between airline plans are significant. As the peak summer months of July-September 2025 now approach, the industry’s overall growth in flights and seats (for airlines flying in both years), is set at just over 4%. Yet several US majors, such as Southwest, Delta and American, have filed schedules that are flat or even below those in 2024. So too have European mainline operators such as Lufthansa or British Airways. Other carriers are in more expansive mood, such as Turkish Airlines, Pegasus or LATAM Brasil, all showing bullish double-digit growth.

Source: Cirium Core

The number of seats offered, in turn, provides a reasonable proxy for the passengers flown. Load factors – the percentage of seats filled – tend to be relatively stable within a percentage point or two, assuming no major external events. It is a key task for airline revenue management teams to keep them so by varying fare levels. Building in other available factors, such as for seasonality, route type and aircraft configuration, will further refine the model.

Passenger liability

Answering the second half of the question, around nationality, is more intricate still. Short of studying the manifest, it is not possible to be certain about the number and nationality of travelers on a particular flight on any given day. Here too, there is a growing collection of potentially useful proxies to borrow from the air transport industry, which is itself now engaged in gaining a better understanding of directionality of travel and passenger segmentation.

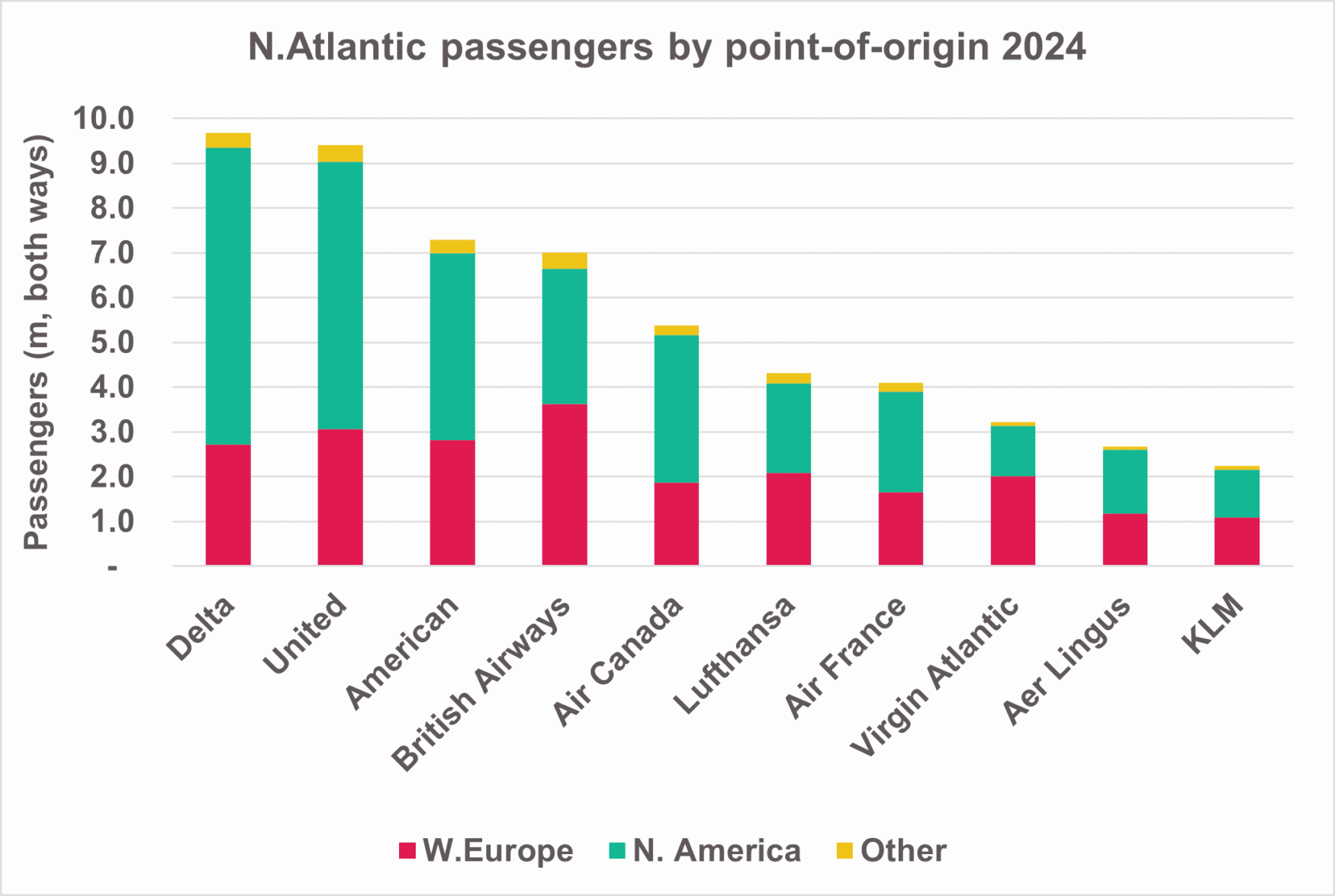

One big clue is available from Point of Sale (POS) data collected through the global agency booking channel. The high-density market between Western Europe and North America (USA and Canada) helps illustrate the point. The advance of joint venture services has long-since ended any simple assumptions that flag-carriers predominantly serving their own nationals.

POS data for 2024 suggests that while the overall market swung toward North America, likely helped by a strong US dollar, carriers from Western Europe carried just over half of all travelers. In other words, European carriers increased their share of US originating traffic.

Source: Cirium Core

British Airways, KLM and Lufthansa each had more than 40% of passengers starting their journey on the opposite side of the Atlantic, while Air France posted a small majority. US majors carried higher shares of their own nationals, but still collectively with a third from Europe. Also worth noting that 4% of passengers came from other world regions.

Admittedly the data is not perfect. The location from where a ticket is purchased does not necessarily confirm the nationality of the buyer. Agencies, especially online, may channel ticketing through a central regional hub, masking the true location of the booker. The data is also only a sample, albeit a large one. At an aggregate level, though, it provides a fairly consistent regional picture, and the data is only getting better.

Other sources of location data, including from consumer search and spend, look promising in providing deeper clues, not only to point of origin, but also to the demographic of the traveler, often otherwise limited to cabin class and booking source.

A smart combination of both network analytics and point-of-origin could perhaps finally begin to add some deeper colour in answering that simple question over future passenger numbers and nationality.

This article was originally published in Cirium’s Aviation Data in Insurance report. For more insights and analysis into the evolving role of data in aviation insurance, read the full report.