Commercial aviation faces a complex landscape in 2025, showing clear momentum while facing new challenges that hold the potential to reshape the sector’s trajectory.

In Commercial aviation in 2025: cruising or climbing?, MUFG’s Head of Aviation Research joined Cirium Ascend Consultancy’s Max Kingsley-Jones and Sofia Zoidou to explore the key factors shaping the industry’s path forward. In a lively and wide-ranging discussion, they shared data, insights and perspectives on commercial aviation’s outlook in the near-term and beyond.

Tariffs Create Industry-Wide Uncertainty

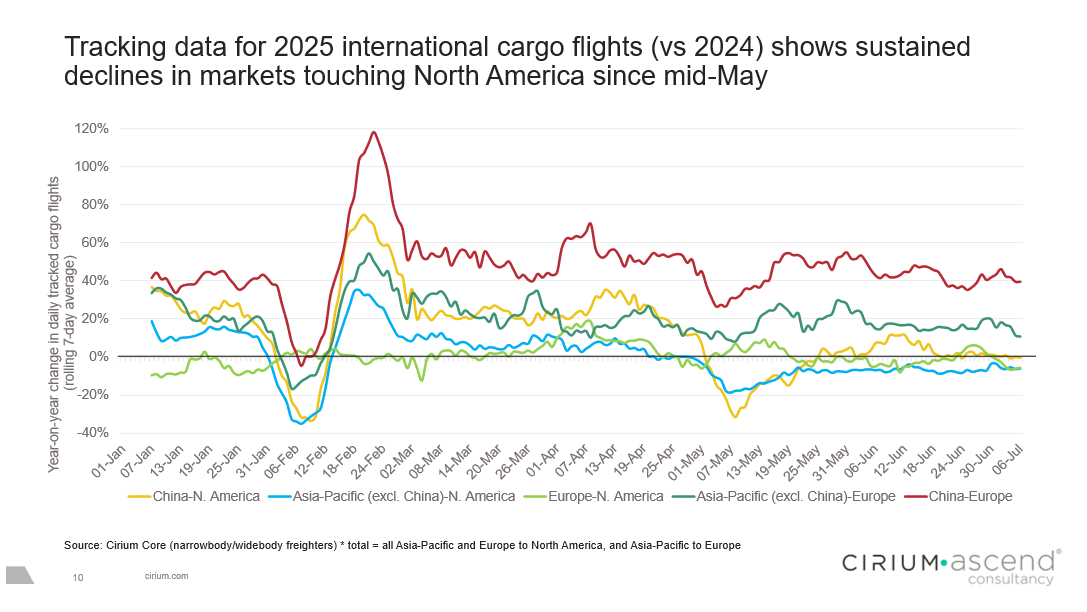

Trade tensions dominated much of the discussion, with tariffs emerging as a significant and wide-ranging risk factor. Max Kingsley-Jones emphasized that “tariffs pose a risk to all the parameters, be it demand, supply, and also to aircraft values.” He pointed to slowing demand for cargo already showing in tracking data, with international cargo flights demonstrating a sustained year-on-year decline since mid-May in markets touching North America.

On the risk to aircraft values, Max explained that new aircraft values are unlikely to increase due to the tariff themselves, as this ‘tax’ is not an intrinsic part of the asset’s value. However, if tariffs cause a reduction in new aircraft deliveries, that will further tighten supply and increase positive pressure on secondary market values and lease rates.

The ripple effects of tariffs will extend beyond manufacturers. Simon Finn highlighted aviation’s unique vulnerability, noting “it’s difficult to think of another industry that’s more globalised than aviation.” He pointed to how the industry’s interconnectedness leads tariff impacts to cascade throughout the supply chain, forcing manufacturers to determine what is passed onto the customer, and if they can’t, how to absorb the costs themselves.

Production Recovery Faces Continued Delays

Despite ongoing efforts to scale production, original equipment manufacturers (OEMs) remain behind their pre-pandemic output levels. The industry continues to grapple with supply chain constraints that have pushed full recovery timelines from 2025 to 2026.

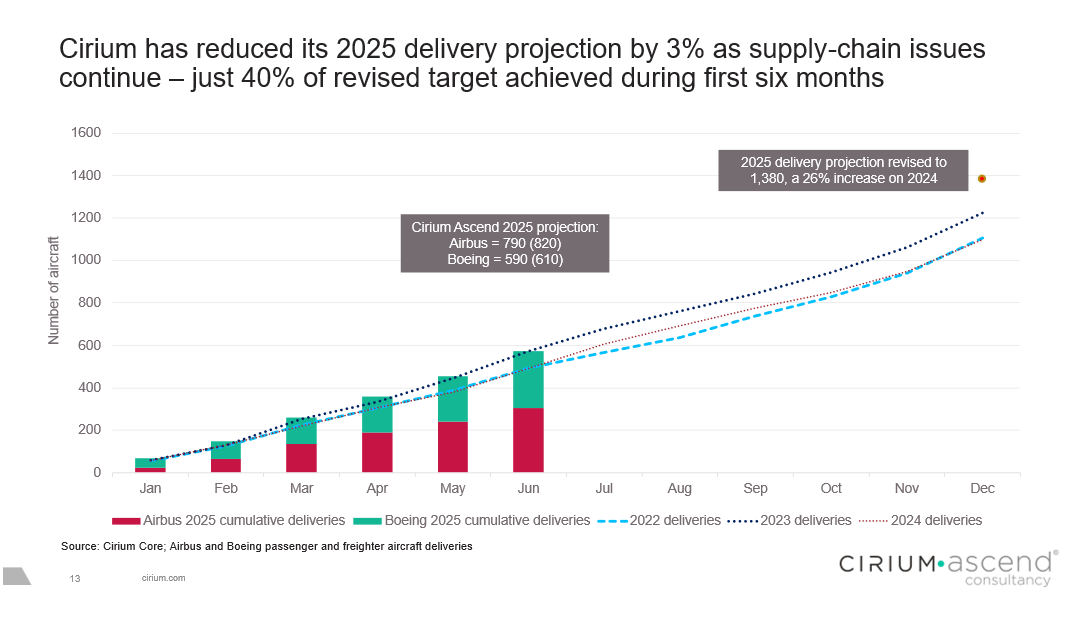

Current projections show the challenge ahead. Max noted that manufacturers “are still going to be behind in 2025,” compared to their stated targets, with much depending on supply chain. Cirium recently reduced its 2025 delivery projection by 3% as these issues persist, with only 40% of the revised target achieved during the first six months.

Airbus faces particular scrutiny in meeting delivery targets. The company delivered 232 A320neo family aircraft in the first half of 2025, representing about 38% of the full-year forecast. Engine availability remains a bottleneck, with approximately 40 additional aircraft ready for delivery once their CFM LEAP engines arrive.

Boeing’s recovery trajectory appears more promising, though both manufacturers must navigate ongoing supply chain complexities that continue to constrain industry-wide production capacity.

Engine Supply Chain Bottlenecks Persist

Engine availability has emerged as a critical constraint on aircraft deliveries. CFM’s LEAP engines power a significant portion of new aircraft, but supply limitations have created delivery delays across the industry.

The data reveals the scope of this challenge: about 40 aircraft remain as “gliders” awaiting their LEAP engines before delivery completion. CFM accounted for 54% of total A320neo family deliveries in the first half of 2025, highlighting both the engine’s market dominance and the bottleneck’s industry-wide impact.

These engine-related delays contribute to the broader production constraints facing manufacturers as they work to meet airline demand and fulfil existing order backlogs.

Future Aircraft Development Accelerates Despite Current Challenges

Looking ahead, the industry shows signs of preparation for the next generation of commercial aircraft. Both manufacturers and suppliers are advancing technologies that will define aviation’s future, even as current production faces constraints.

Airbus continues developing its next-generation single-aisle aircraft, targeting a launch by 2030 for delivery around 2038. The CFM RISE open-fan engine technology, showcased as a potential powerplant for this program, represents significant advancement in propulsion efficiency.

Simon expressed optimism about engine technology readiness, stating it’s “fair and reasonable to expect the engine manufacturers to push their technologies and have something ready for the early 2030s.”

Market dynamics also support future growth. Airbus and Boeing combined net orders in the first half of 2025 exceeded 1,000, approaching the full-year 2024 total of 1,171. This strong order momentum, boosted by 300 orders added in June alone, indicates sustained airline confidence in long-term demand recovery.

The emergence of new competitors adds another dimension to future market dynamics. Simon suggested China’s political will to produce an indigenous commercial aircraft may see Comac emerge as a major manufacturer in the long term. He pointed to favourable historic parallels with Airbus’s emergence, but cautioned this may take a decade or more to materialize. “Comac is in a powerful position, but there’s a lot of work to do”.

Watch the Webinar on Demand

To access the full presentation, including analysis of the capacity and emission trends, the Paris Air Show and more, register to watch the webinar.