Harry Chan, Head of Greater China, Cirium

- Japan, South Korea, Hong Kong SAR, Thailand and Singapore account for 50% of China’s total international seat capacity.

- Japan maintains its position as the most popular destination, with South Korea following closely behind.

- Southeast Asia presents mixed results, with Vietnam, Malaysia and Singapore growing in popularity, while Thailand declines.

- Shanghai Pudong Airport (PVG) continues to dominate as China’s primary international hub.

As China’s National Day Golden Week approaches, the aviation industry is closely examining seat capacity trends to prepare for this peak travel period. Taking a look at Cirium’s data between 29th September and 10th October across the years, we are able to identify shifts in both domestic and international travel trends, destination preferences and key aviation hubs.

A detailed examination of seat capacity, particularly on international routes, offers comprehensive insight on how airline operations can strategically plan to meet the expected surge in demand during this holiday period.

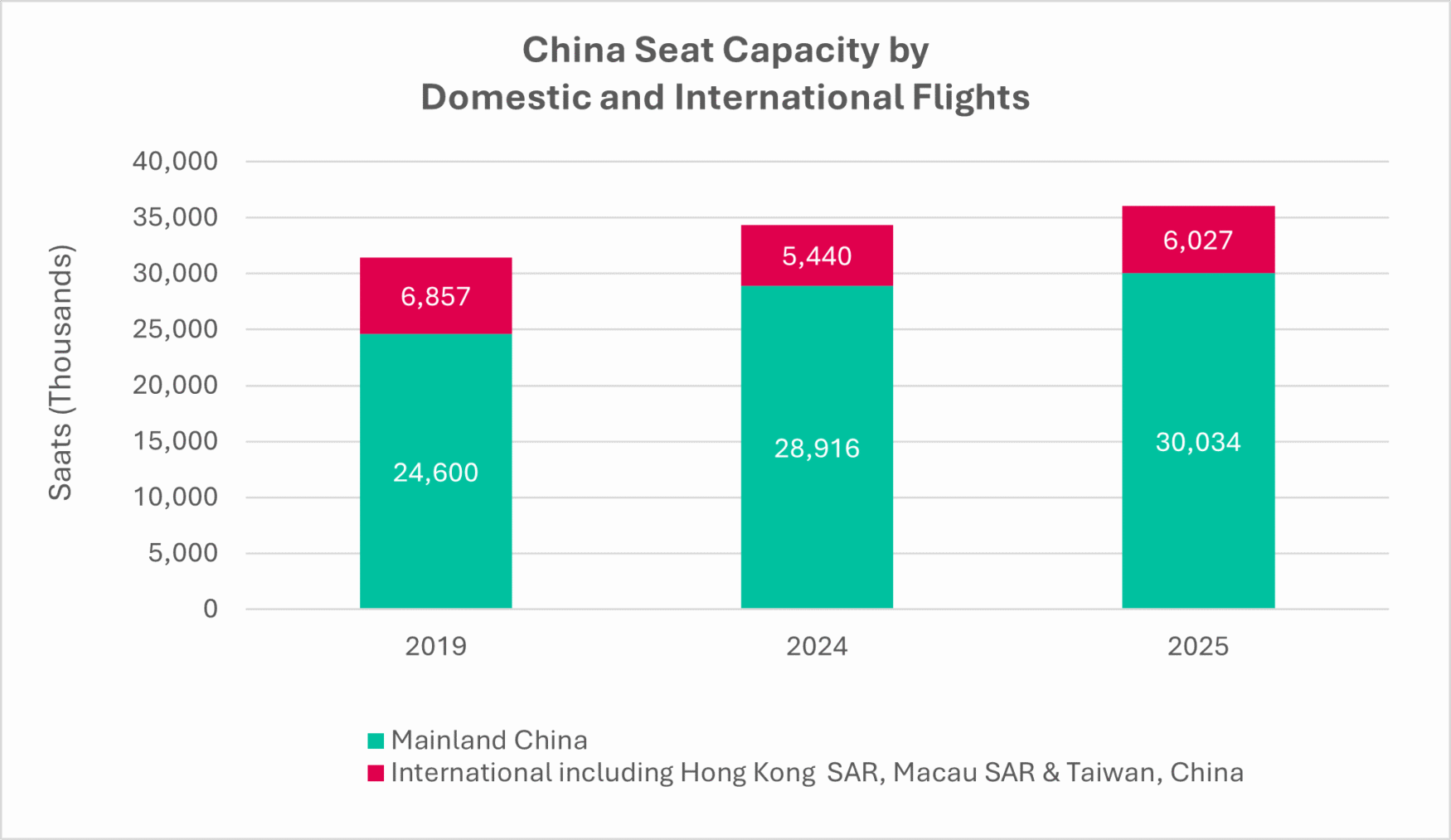

Domestic travel remains strong while international growth surges

Source: Cirium SRS Analyzer, scheduled seat capacity between 29 September to 10 October 2025.

In recent years, the National Day Golden Week holiday season has seen a consistent upward trend in overall seat capacity, propelled by the surge in domestic flight capacity. Since 2024, domestic flights have accounted for over 90% of the total capacity, marking a significant increase from the 87.7% in 2019. This reflects the growing preference for travel within Mainland China.

While domestic flights continue to take up the majority of market volume, international capacity is expanding at a rapid pace. Between 2024 and 2025, international seat capacity is projected to grow around 10%, outpacing the modest 4% growth seen in domestic capacity. This points to a renewed and growing appetite among Chinese travelers for overseas destinations, even as domestic travel remains dominant.

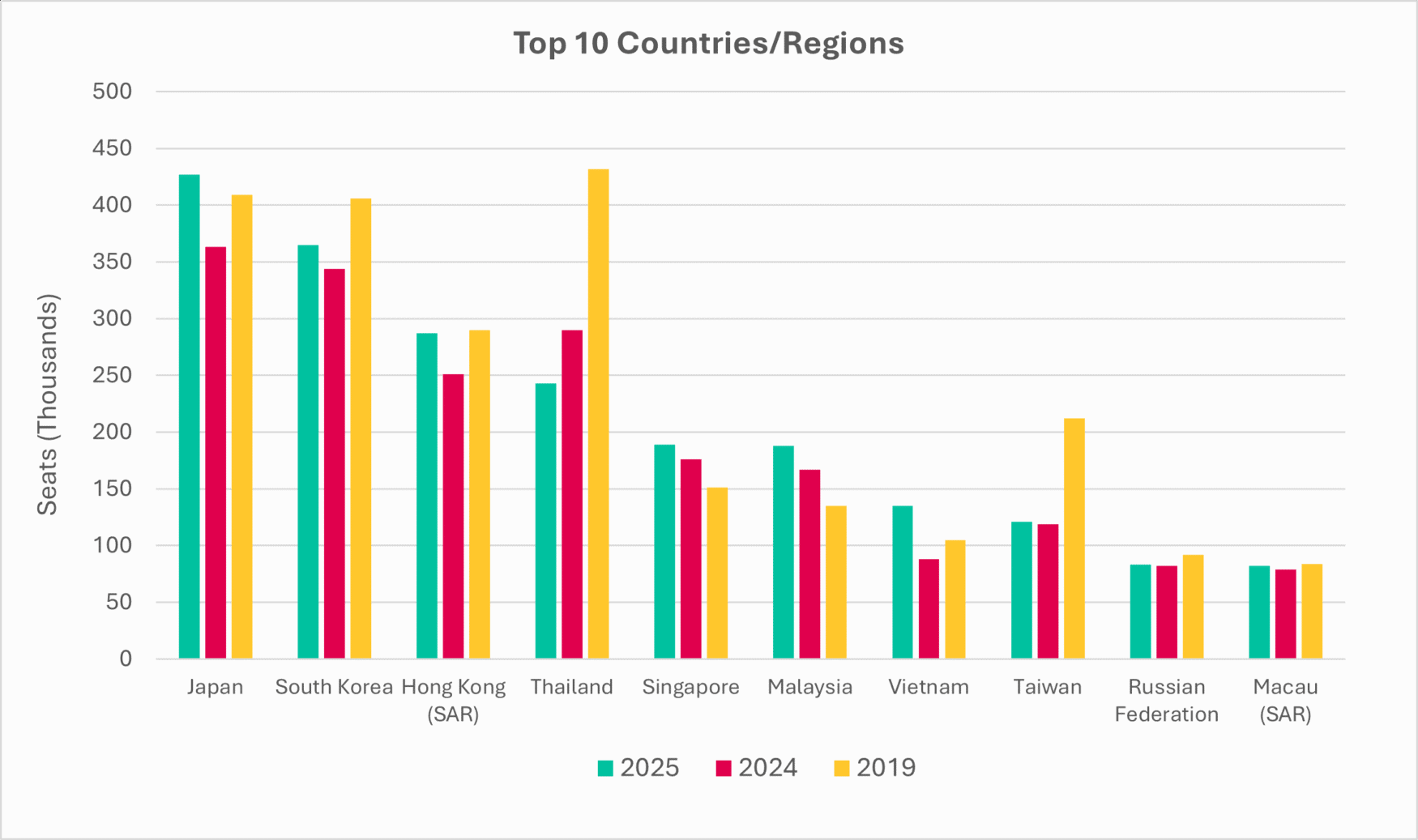

Shifting trends in international destinations

Source: Cirium SRS Analyzer, scheduled seat capacity between 29 September to 10 October 2025.

Interestingly, the top five countries/regions (Japan, South Korea, Hong Kong SAR, Thailand and Singapore) accounts for 50% of China’s total international seat capacity.

A detailed look at the top 10 international destinations shows a dynamic shift in traveler preferences. Japan leads as the most popular destination for Golden Week 2025, recording a 17.6% year-on-year increase in seat capacity. South Korea retains a strong second place, reinforcing East Asia’s continued appeal.

Southeast Asia has experienced the most notable change, showing an overall decline of approximately 8% compared to 2019. Thailand, once the top destination in 2019, has dropped to the fourth position, with seat capacity now nearly halved since its peak in 2019. In contrast, Vietnam has seen outstanding growth of more than 53% since 2024, highlighting its rising popularity. Singapore and Malaysia continue to gain momentum, posting gains of 7.3% and 12.6%, respectively.

One noteworthy shift in the top 10 list is the absence of the United States, which was ranked sixth in 2019. Current geopolitical developments and travel constraints may have shifted demand towards destinations closer to China.

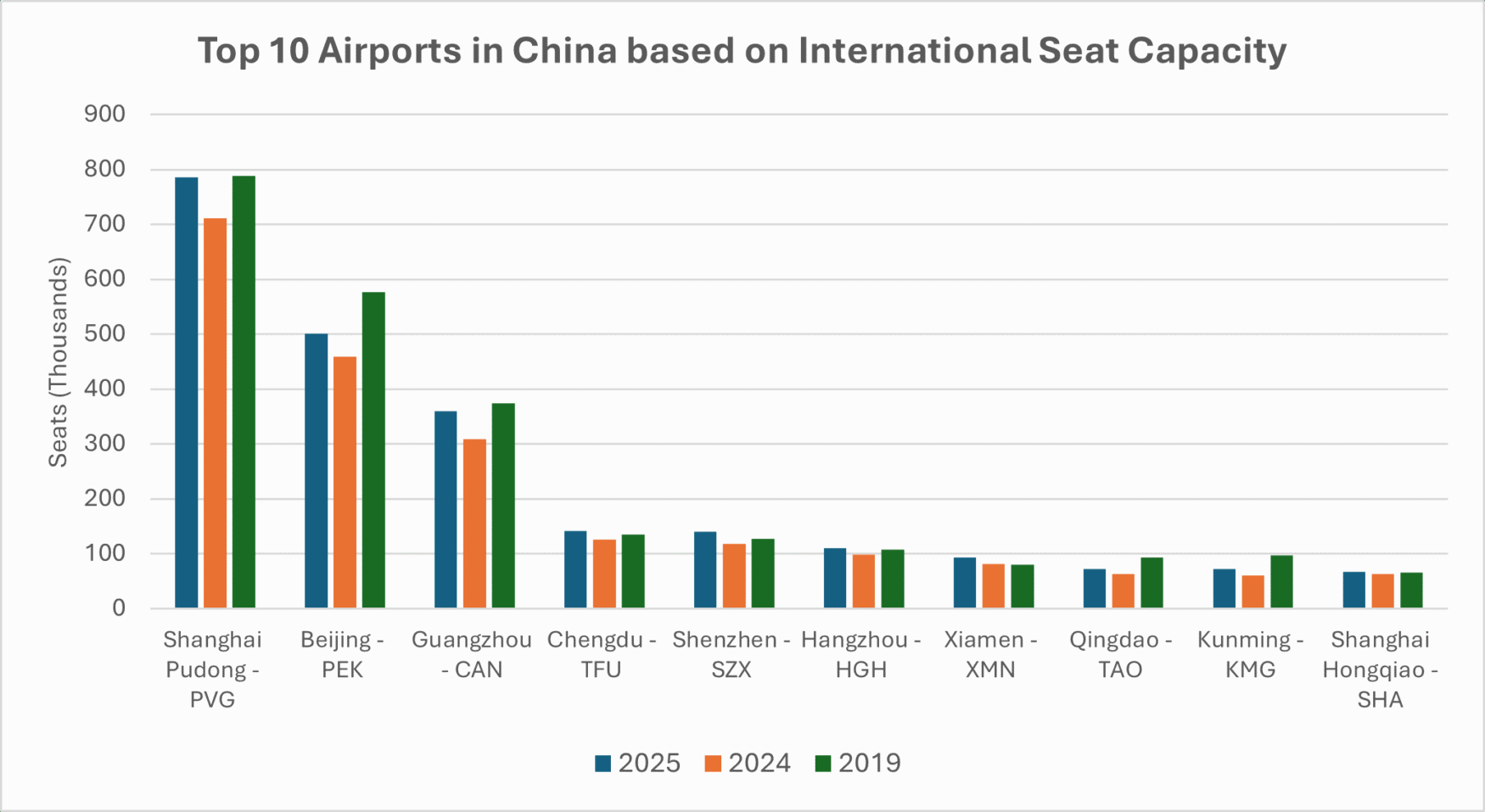

Key airports supporting Golden Week travel

Source: Cirium SRS Analyzer, scheduled seat capacity between 29 September to 10 October 2025.

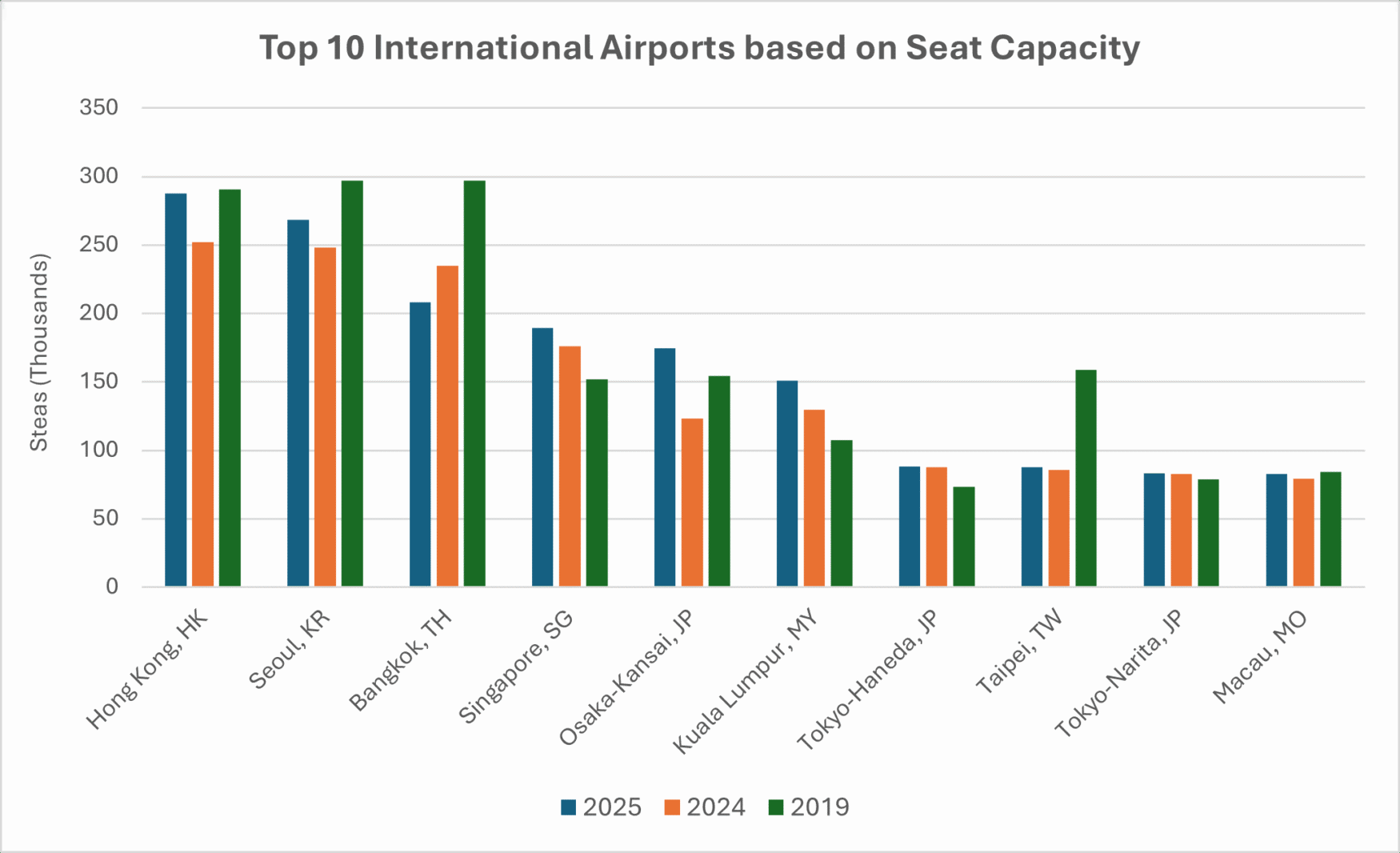

Source: Cirium SRS Analyzer, scheduled seat capacity between 29 September to 10 October 2025.

Shanghai Pudong Airport (PVG) continues to assert its dominance as a pivotal international hub in the country, with a 10.4% increase in seat capacity from 2024. Following closely behind is Beijing Capital Airport (PEK)and Guangzhou Baiyun Airport (CAN), reinforcing these hubs as crucial gateways for both domestic and international travelers.

Other than the obvious lead destination above, emerging destinations like Hanoi and Ho Chi Minh City have experienced significant growth in seat capacities over the past two years, increasing from rank 35 and 25 back in 2019, but now ranking at 11 and 13 respectively.

Source: Cirium SRS Analyzer, scheduled seat capacity between 29 September to 10 October 2025.

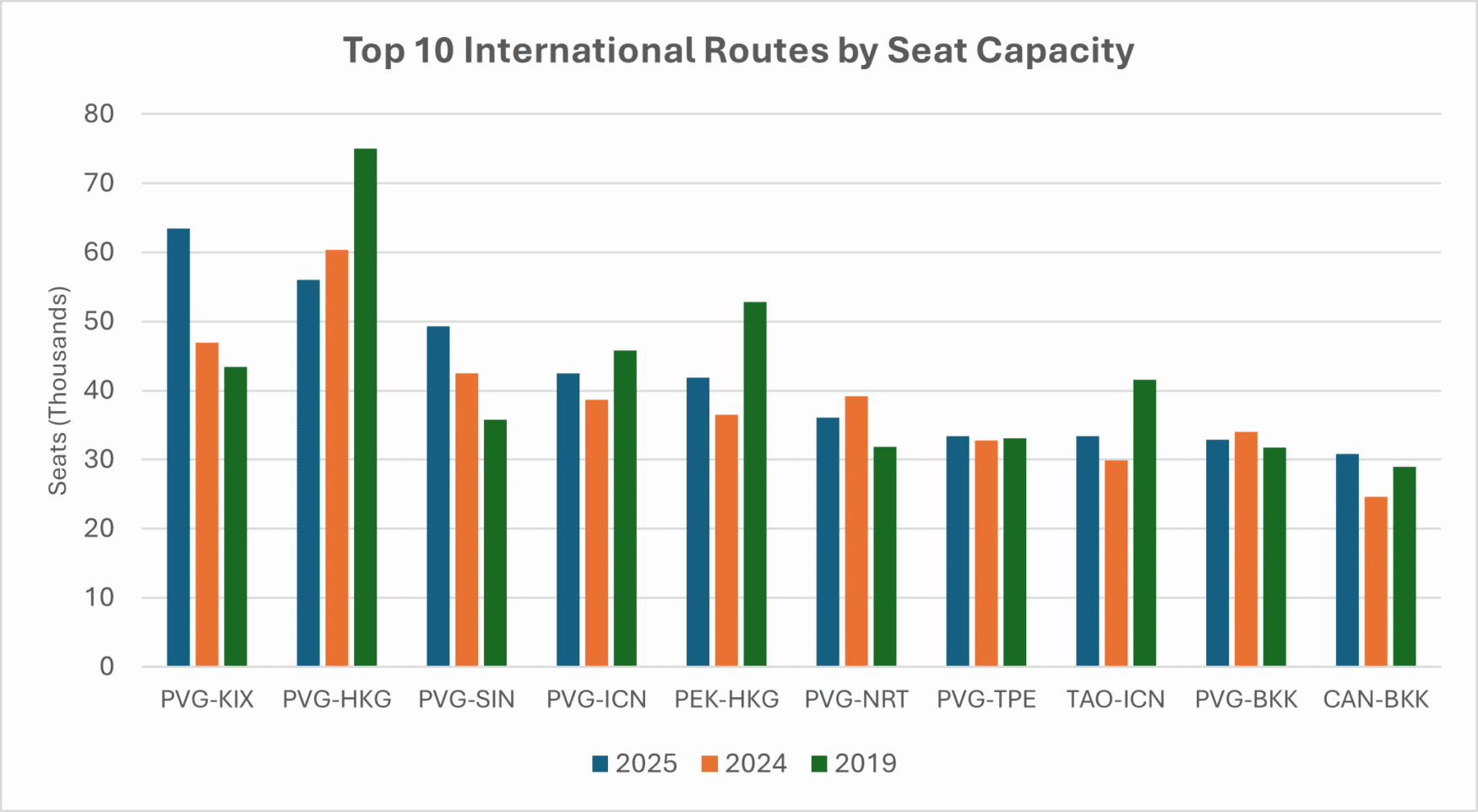

Seven of the ten busiest outbound international routes originated from PVG. China’s top international route is Shanghai Pudong to Osaka Kansai (PVG-KIX), which surged 35%, propelling it from fourth position in 2019 to first position in 2025. Similarly, Shanghai Pudong – Tokyo Narita (PVG-NRT) has also increased 14% compared to pre-covid days, noting an increasing attraction towards Japan.