Aviation enters 2026 with momentum, experiencing resilient demand, persistent supply‑side constraints and an increasingly uncertain macroeconomic environment.

In The 2026 Aviation Market Outlook broadcast live on 4th February 2026, Stephen Burnside, Richard Evans and Daniel Hall explored the key factors shaping the sector to unpack what this means for airlines, lessors and the wider industry.

Mixed macro signals leave less room for error

From a macroeconomic perspective, the headline indicators point to an environment that supports air travel demand. Purchasing managers’ indices (PMIs) remain high, key economies are growing, and productivity metrics are rising sharply – all good news for the aviation industry. As Stephen Burnside noted, “PMIs are doing great… if it’s above 50%, we’re expanding,”

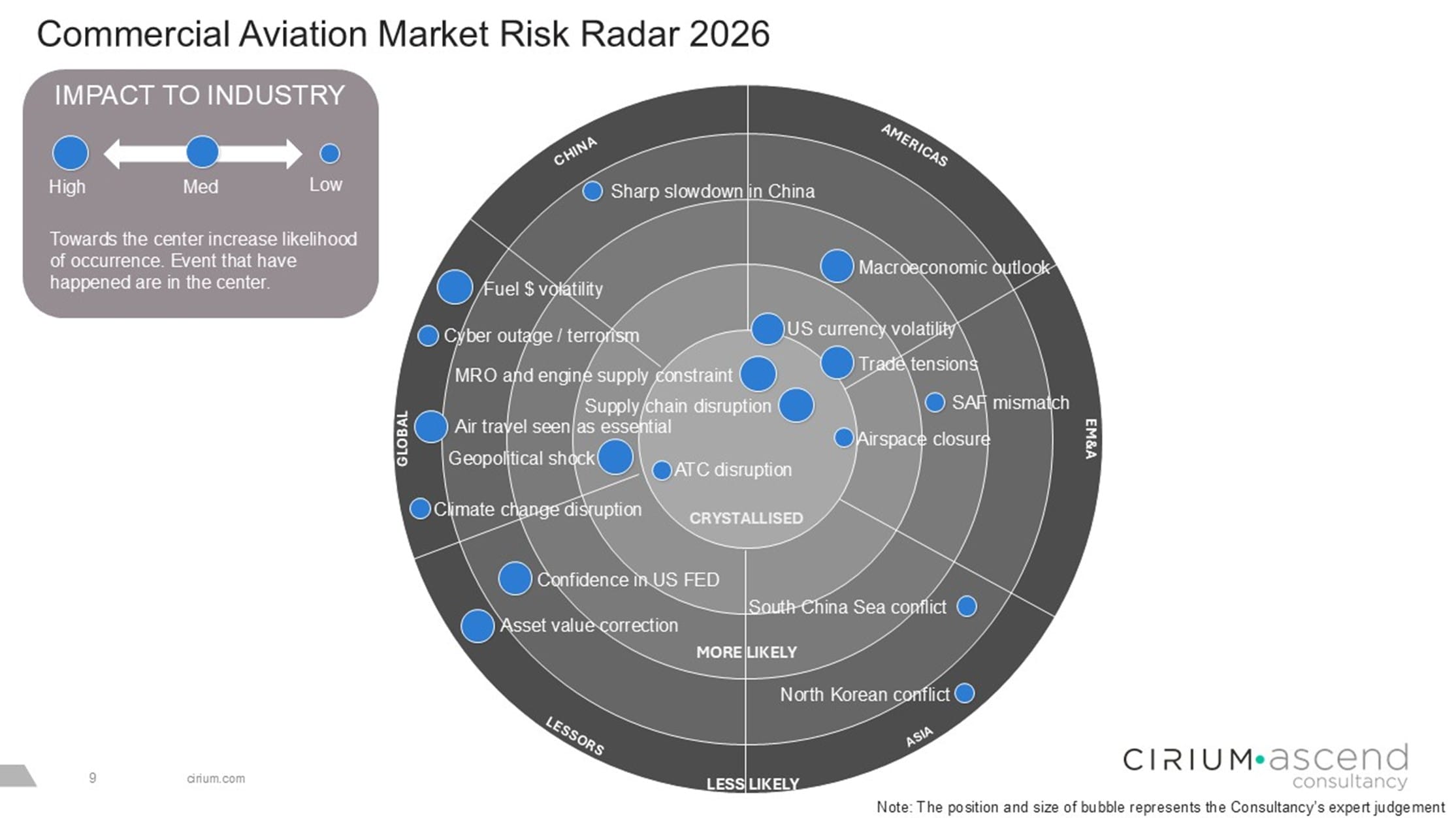

However, consumer sentiment is weakening, and external shocks threaten to create abrupt economic corrections. “The US is central to our 2026 outlook… we like to keep a very close eye on the US because it does really drive the entire world economy” Stephen explained, adding that the impact of a US policy error impacting trade and undermining economic growth was the “number one risk for our outlook for 2026”. While aviation enters 2026 with momentum, the industry has less margin for error. With debt‑to‑GDP ratios elevated and geopolitical tensions unresolved, any shock could have a faster and more pronounced impact than in previous cycles.

Demand and capacity appear balanced – regional divergence tells a different story

After years of disruption and recovery, 2025 marked a return to more conventional aviation market dynamics. Globally, demand and capacity were closely aligned, with only marginal changes in load factors. “If you just stood above, if you didn’t know anything else, you’d say well demand and supply look fairly in balance,” observed Richard Evans, highlighting how far the industry has come since 2019.

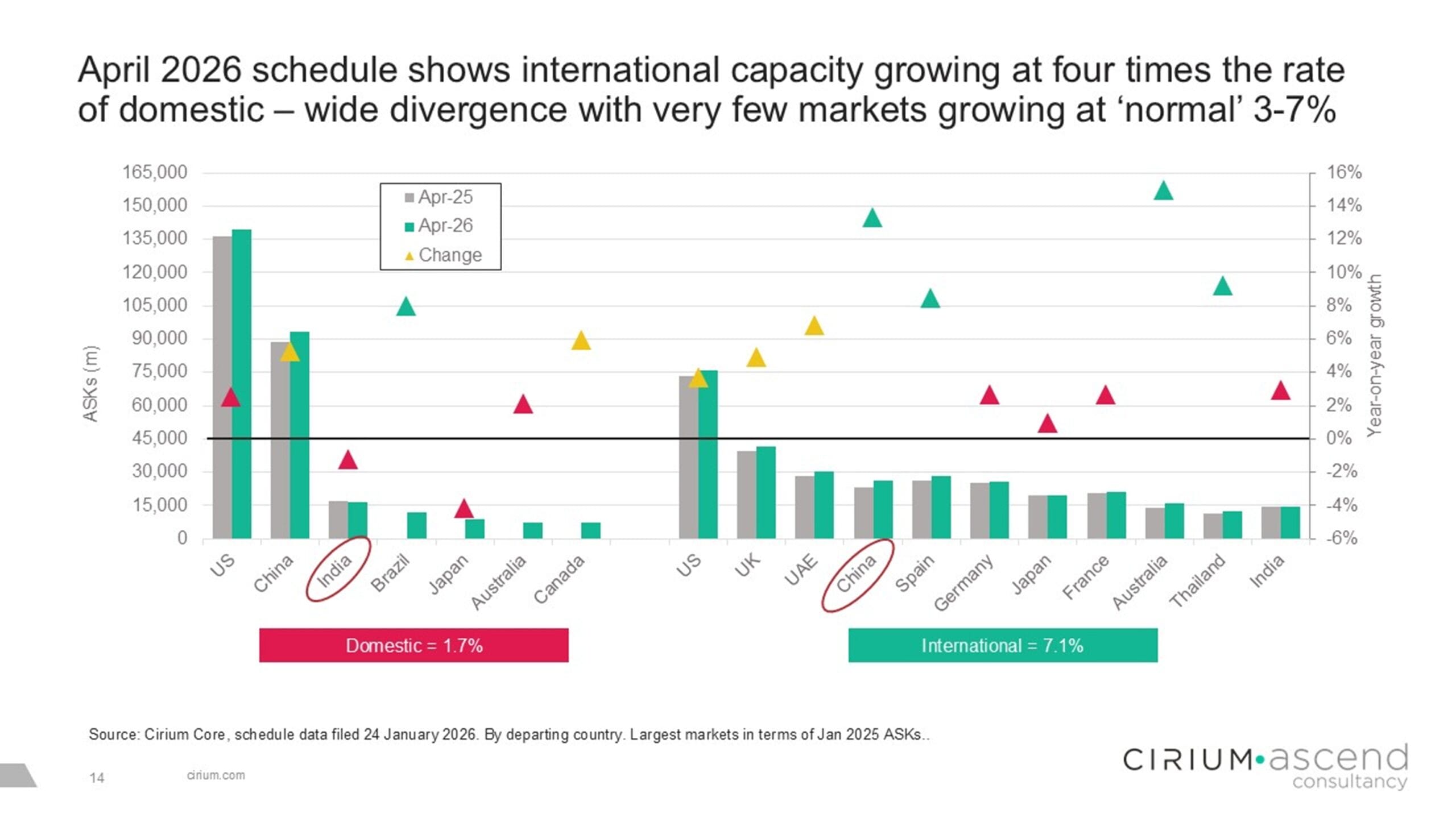

That balance, however, hides a widening gap between regions, markets and segments. Forward schedules show continued growth into 2026, but at a more measured pace, and with clear divergence by geography. Asia‑Pacific, the Middle East and Africa continue to see demand outpacing supply, while North America and Latin America experienced load factor declines earlier in the year.

This unevenness is set to persist in 2026. International capacity is growing far faster than domestic, while some major markets are barely expanding at all. Airline performance will depend on “whether the market is growing strongly or not, but within that what the balance of competition is and the opportunities for yield expansion on the international side.”

Aircraft and engine values stay elevated with widebodies scarce

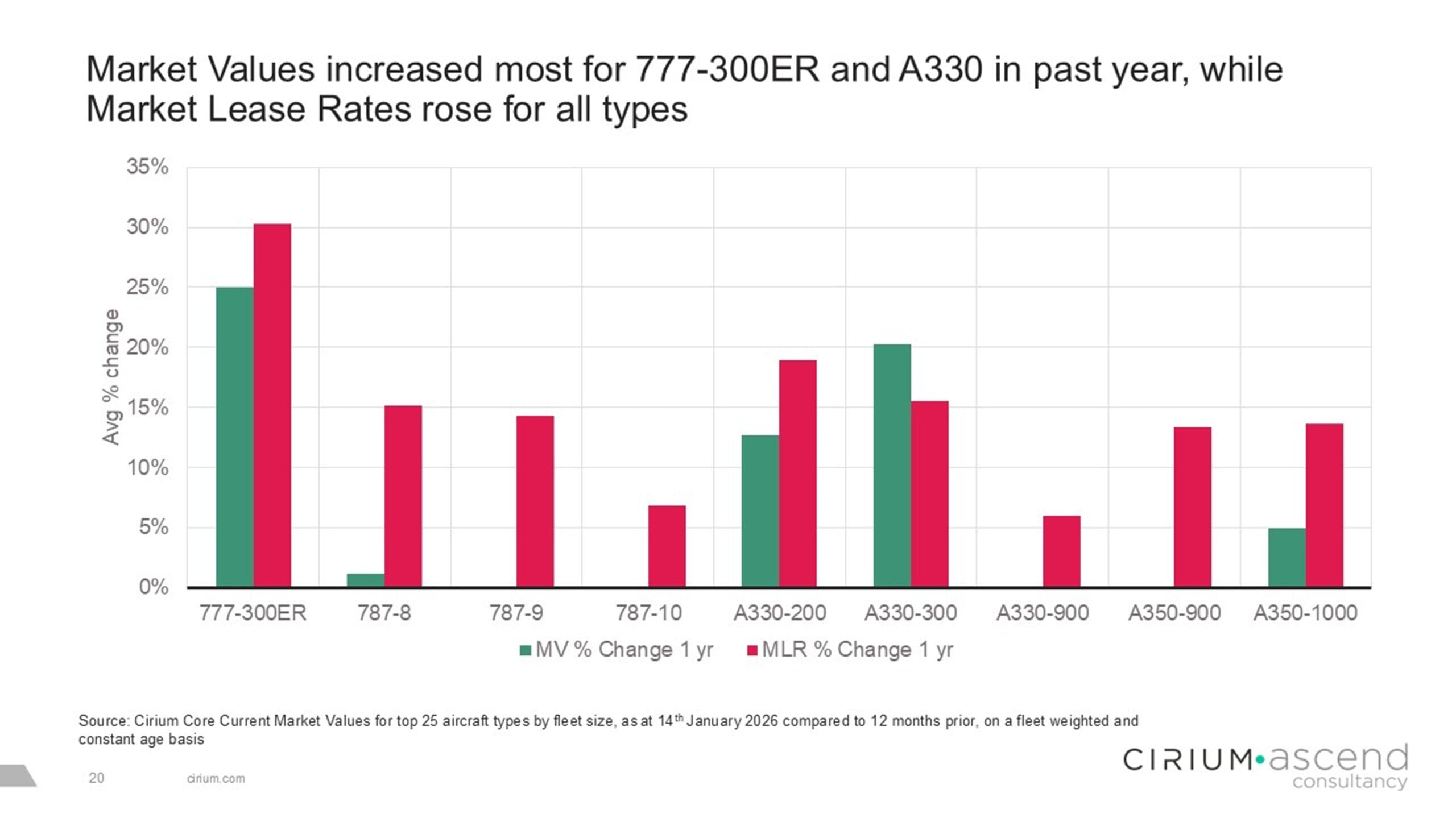

Tight supply conditions continued to support aircraft and engine values through 2025, with diverging dynamics between segments. After years of suppressed production, widebody availability is now extremely tight as international demand has fully recovered.

By contrast, the single‑aisle market has moved into a more stable phase, with market values rising only modestly over the past year and lease rates largely unchanged, reflecting improving production visibility and a highly competitive lessor landscape despite ongoing engine‑related constraints.

In the widebody market, Daniel Hall pointed to twelve months of growing market values, and lease rates rising by more than 14% on average last year. “If you speak to a lessor today and try and get your hands on a widebody under 15 or 20 years of age, I believe there are none available today.” This is pushing airlines to invest heavily in twin-aisle cabin refurbishments and sustaining pricing power for lessors and owners. While production rates are improving, they are not picking up fast enough to rebalance supply and demand in the next twelve months. “We expect similar this year, but maybe at a smaller magnitude; we have to look at the bigger picture” pointing to another year of lease rate growth.

Watch the webinar on-demand

To access the full presentation, including analysis of the impact of the GTF engine issues on single‑aisle capacity, fleet availability and lease‑rate dynamics, register to watch the webinar.