Thomas Sweeney, Valuations Associate, Cirium Ascend Consultancy

As the summer winds down and we look ahead to a busy couple of months of conferences and events, I wanted to examine how risks to travel demand – which seemed unknowable six months ago – have been shaping up. In April when President Trump announced sweeping tariffs, the ensuing economic uncertainty was as large a risk to the aviation sector as the direct impacts of tariffs on aircraft trading. The latter continue to be defined and negotiated but the former have gained some clarity. The US market is naturally the most directly affected by recent events, though instability and contraction in the US economy will always have global ramifications. As the issuer of the world’s reserve currency and a major source of sovereign debt held globally, US economic instability quickly impacts global markets through shifts in dollar value, Treasury yields, and the productivity trends that underpin global growth expectations.

Economists have been asking if the US is in a recession. Shortly after the tariffs were announced many were predicting one, albeit mild. Government data suggests that the economy is growing, and recession has been avoided so far [1]. However, a common view among economists is that growth in the country is highly unevenly distributed between both sectors of the economy, socioeconomic groups and geographical regions[2]. Large investments into AI have resulted in strong growth for companies developing and utilising the technology. A second major driver of growth has been by the wealthiest segment of Americans. The top 10% of earners account for nearly 50% of consumption[3]. Has the demand for air travel been buoyed by wealthy spenders and AI investment or is there weakness indicative of a weaker economy outside these areas?

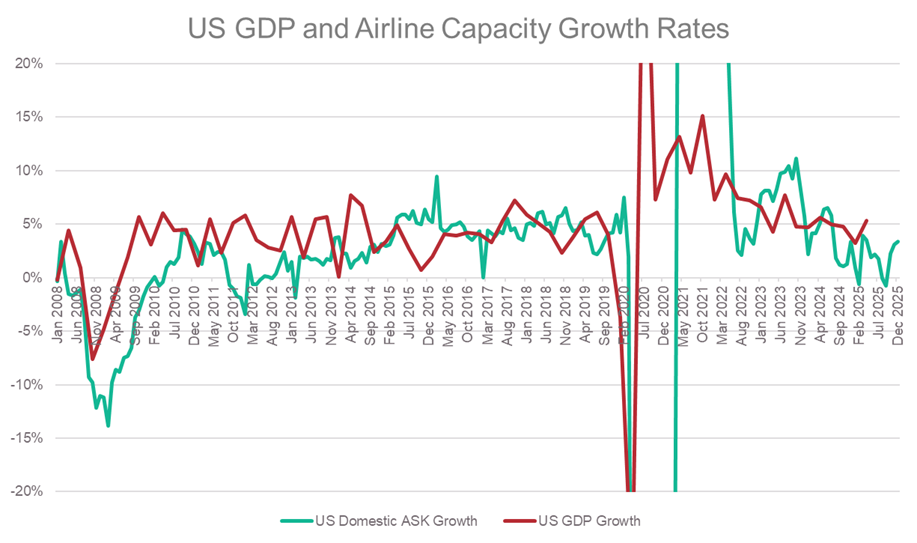

Growth in US capacity (ASKs) is correlated to overall GDP growth, amongst other factors. The correlation is not direct – there are specificities in the airline market distinct from the general economy – but the link is clear:

Source: Cirium Core and Federal Reserve Economic Data (FRED)

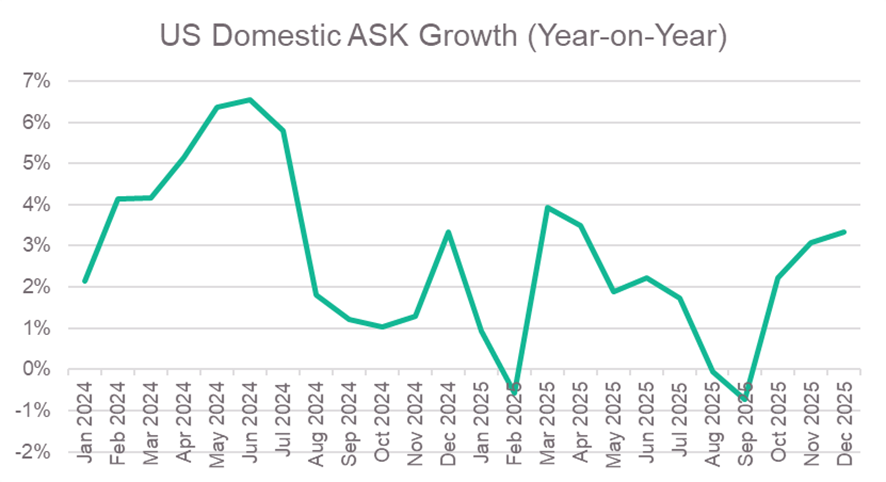

Zooming in to the most recent months, domestic capacity has been growing slower in 2025 than 2024 and, in some months, capacity has contracted.

Source: Cirium Core

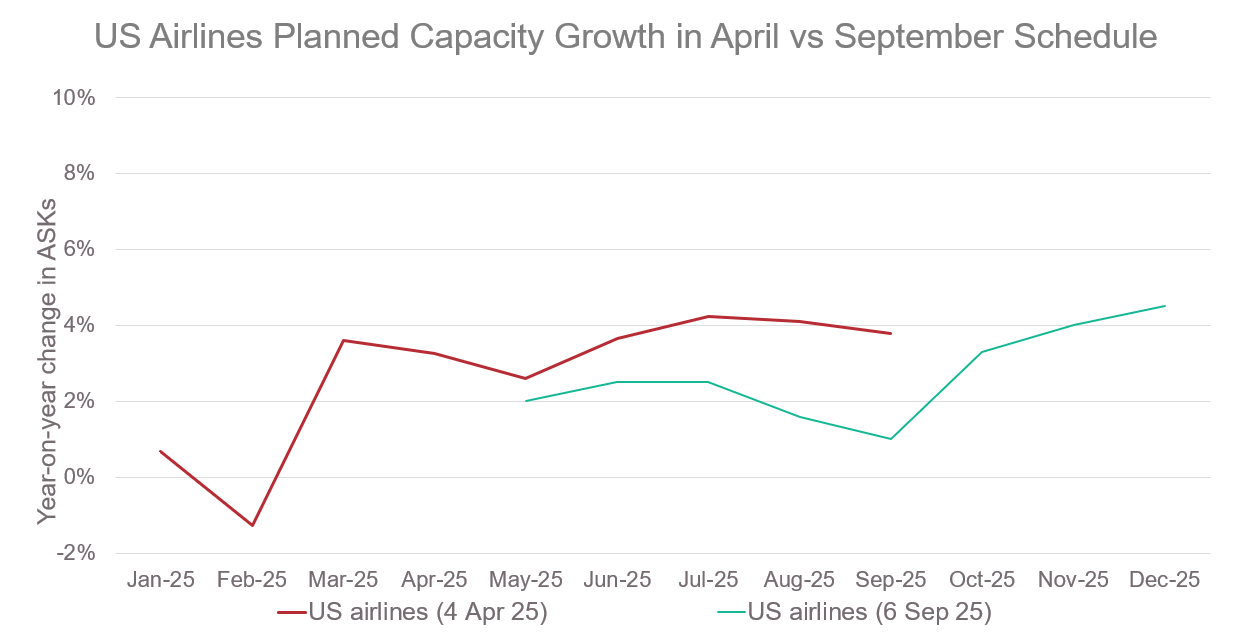

Several US airlines cut capacity from Q2 onwards in response to the economic uncertainty caused by tariffs. Planned domestic and international capacity has been cut by up to three percent by US airlines.

Source: Cirium Core

Capacity growth is recovering in the later part of the year, potentially as the uncertainty has waned in recent months. Nonetheless, apart from 2020 heavily influenced by the Covid-19 pandemic, 2025 appears to be the weakest year for capacity growth in a decade.

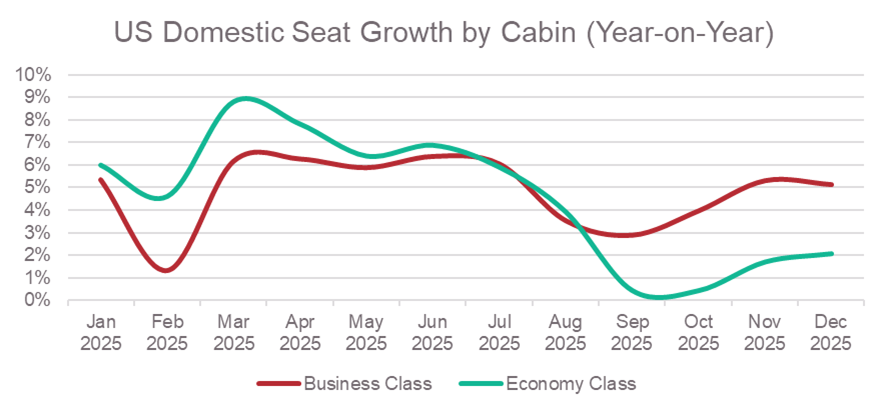

The picture is consistent with a growing economy for which there remains significant risk. Travel demand (and resulting capacity) within the US is exposed to the high-growth sectors of the economy, especially wealthy consumers who travel more frequently and in higher yielding cabins. Cutting capacity growth and focusing on premium travel can be a positive for airlines, allowing them to keep yields high. In the second half of 2025, capacity growth has been much slower in economy class seats, with business class seats remaining more robust.

Source: Cirium Core

Average US personal consumption expenditures have grown at their slowest level since 2020[4], which has been translating into the softening demand and capacity growth, even if it’s in lower-yielding cabins and sectors. Travel demand, like the US economy more generally, is likely to be highly sensitive to the consumption of the wealthiest segment of Americans. Any downturn which affects the spending habits of this group, such as a slump in AI confidence and investment, could impact air travel demand quickly. With risk concentrated in this way, close attention must be paid to economic signals for this group.

The US domestic market is markedly weaker than other regions. Despite the impact of tariffs on other countries, most do not show significantly weakened economies as compared to the beginning of the year. Global scheduled ASK growth is healthy, sitting between 4% and 6% for most of this year.

Source: Cirium Core

Global demand is remaining strong. However, the nature of the global economy and financial system is such that issues in the US have an outsized influence globally. US growth is currently resting on a few small groups. Softening there could have downstream effects on not just the US domestic airline market but passenger demand globally. Therefore, it is critical that we continue to monitor the health of this market for warning signs and proactively consider how we will navigate those challenges.

Meet the Cirium team at Airline Economics Growth Frontiers London 2025.

Hear from Thomas on the SAF Panel, Thursday 18th September 2025 at 14:00. Eleni Maragkou will join the Lease Rates & Valuations Panel, Wednesday 17th September 2025 at 11:40.

[1] https://fred.stlouisfed.org/series/GDPC1

[2] https://www.ft.com/content/e9be3e3f-2efe-42f7-b2d2-8ab3efea27a8

[3] https://www.wsj.com/economy/consumers/us-economy-strength-rich-spending-2c34a571

[4] https://fred.stlouisfed.org/series/PCECC96