Sara Dhariwal, Senior Aviation Analyst, Lead Appraiser – Helicopters & AAM, Cirium Ascend Consultancy

The past decade has for the helicopter industry been largely lived through a downturn. A prolonged period of significantly reduced oil prices affected production and exploration, which impacted the offshore support market. This turned relative undersupply to oversupply at a rapid speed leaving a substantial pool of excess helicopters, resulting in notable pressure on values. Growth slowed from a CAGR of around 2.5% prior to 2015, to 1.2% in the most recent decade.

In 2024 there was a fleet growth of 1.9% which is the strongest since 2015 signalling ongoing recovery.

The growth has been supported by stable deliveries, and lower attrition – with fewer retirements and total losses. In 2024, there were almost 100 fewer retirement/total loss events than in 2023. This means that existing fleet is being used longer supporting the long useful lives of helicopters, which helps strengthening investment cases. It also marks a welcome and long-term improvement in terms of safety.

Over the next 10-year period, the 2025 Cirium Helicopter Forecast anticipates a continued steady rebound at a pace of 1.3% year-on-year. The market is expected to welcome 7,500 new civil turbine helicopters, reaching a fleet of 27,700 by 2034. Key drivers will be the need for replacements and rising demand in emerging markets.

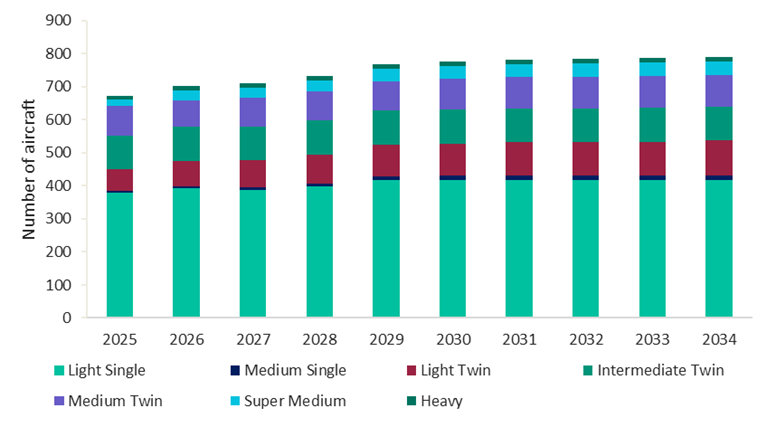

Helicopter delivery forecast (2025-2034)

Despite recovery from the oil and gas downturn and the Covid-19 pandemic, the 2025 forecast is 3% lower than 2024 due to ongoing supply chain constraints making lead times for new aircraft extensive. Annual deliveries dropped to 512 in 2020 but rebounded to nearly 700 in 2023, with no growth in 2024. A 5% decline is expected in 2025 compared to 2024, with gradual recovery projected and reaching 2014 levels (~790 units) by the early 2030s.

Overall, the forecast anticipates –

- 7,500 new civil turbine helicopters valued at $50 billion in 2025$ (based on a Base Full-Life Value for a typical utility machine) to be delivered over the next decade.

- 54% of demand is expected to be driven by replacement, and 46% by fleet growth.

Forecast annual civil helicopter deliveries 2025-2034

Source: 2025 Cirium Helicopter Forecast

Key factors stimulating future helicopter demand include:

- Aging fleets, especially in North America and Europe.

- Recovery in offshore oil support and growth in Asia-Pacific.

- Introduction of new models (e.g., H140, R88, Bell 525).

In 2024, there were 225 helicopters recorded as retired which was 100 fewer than 2023 and likely a result of a combination of high demand and constrained supply, as OEMs find challenges in despatching new helicopters due to ongoing supply chain issues. Subsequently and whilst deliveries are not predicted to increase significantly in the near term due to the challenges, it leads to longer use of the existing fleet.

Longer use underpins the asset class having strong residual values, supporting investment.

Helicopter replacement demand

Over the last 10 years, Cirium recorded approximately 2,200 permanent retirements, averaging around 1% of the fleet annually. This retirement rate is relatively low compared to commercial fixed-wing aircraft standards.

The average age of retirement in the past 10 years has been at 37.5 years.

Besides the physical retirements, there is also attrition from the fleet through accidents (total losses), which has to be factored into replacement demand and can be added to retirements.

Cirium Ascend monitors the total losses for helicopters and some 1,200 were recorded in the past 10 years. As helicopters operate in many different roles and environments, their loss rate can be comparatively high versus other commercial aviation sectors.

On a per year basis, some 1% of the fleet was being lost 20 years ago, but the trend has been declining and has been at just 0.5% in the most recent ten-year period. In 2024, the recorded rate was a record low of only 0.4%. This effectively means there is replacement demand for an average of 1.4% of the fleet annually, or 4,050 civil turbine helicopters in the next 10 years, which is 17% of the current total fleet.

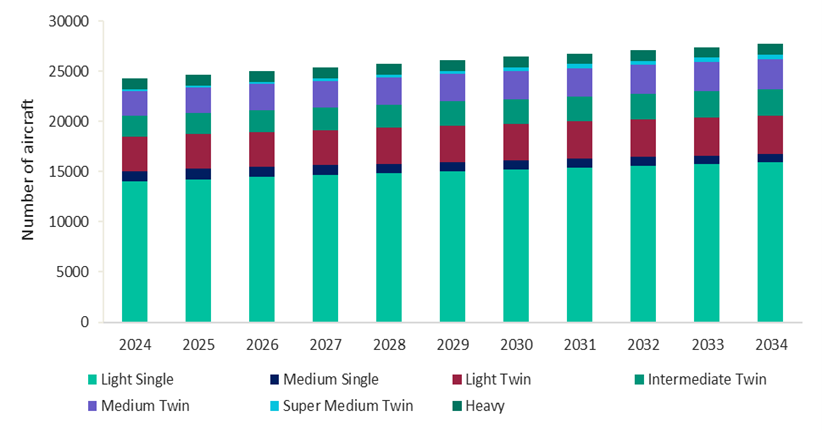

Helicopter fleet growth outlook

Forecast civil helicopter fleet to 2034

Source: 2025 Cirium Helicopter Forecast

By 2034, the global fleet is projected to reach 27,700 helicopters, growing at a slow but steady 1.3% annually, slightly higher than the previous decade’s rate.

North America is projected to remain the largest market, followed by Europe. The projection for Asia-Pacific has been revised in the 2025 forecast due to growth slowing down in recent years following restriction on airspace usage in China, impacting demand for helicopters.

Slow but steady seems a good pace for the helicopter market. The pre-2014 sprint approach to secure quick returns failed. Few held on to those returns as the oil and gas downturn led to financial hardship across the industry.

Some would argue that slow and steady is “boring” and implies that there isn’t anything of interest going on in the market. The stronger argument is possibly that slow and steady provides companies the time required to make better, more considered long-term strategic decisions.

The past decade suggests that discipline, and resilience alongside consistency, pacing, and the ability to learn from experience and adapt to unexpected situations is key. In other words, a Marathon Mindset, rather than that of a sprint.

REQUEST THE FULL 2025-2034 CIRIUM HELICOPTER FORECAST HERE